Digital health insurance leverages technology to offer personalized coverage, real-time claims processing, and seamless integration with telemedicine services, enhancing user convenience and reducing administrative costs. Point of Service (POS) insurance combines features of HMOs and PPOs, allowing policyholders to choose their healthcare providers while requiring referrals for specialist services and encouraging in-network care to control expenses. Explore the key differences and benefits of Digital health insurance versus POS insurance to determine the best fit for your healthcare needs.

Why it is important

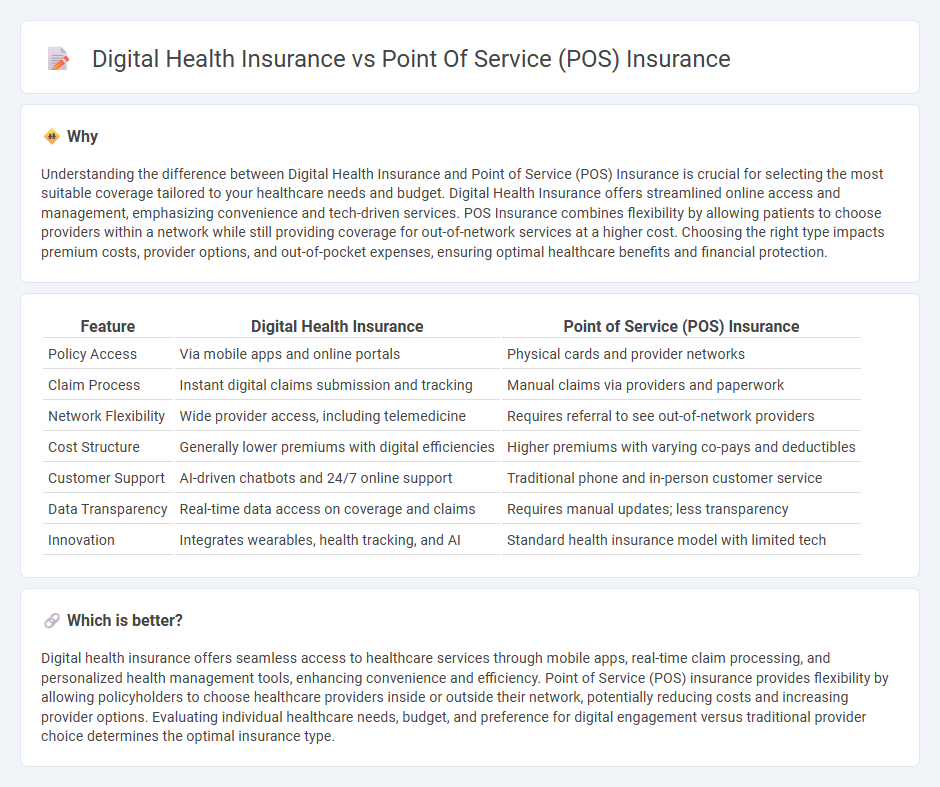

Understanding the difference between Digital Health Insurance and Point of Service (POS) Insurance is crucial for selecting the most suitable coverage tailored to your healthcare needs and budget. Digital Health Insurance offers streamlined online access and management, emphasizing convenience and tech-driven services. POS Insurance combines flexibility by allowing patients to choose providers within a network while still providing coverage for out-of-network services at a higher cost. Choosing the right type impacts premium costs, provider options, and out-of-pocket expenses, ensuring optimal healthcare benefits and financial protection.

Comparison Table

| Feature | Digital Health Insurance | Point of Service (POS) Insurance |

|---|---|---|

| Policy Access | Via mobile apps and online portals | Physical cards and provider networks |

| Claim Process | Instant digital claims submission and tracking | Manual claims via providers and paperwork |

| Network Flexibility | Wide provider access, including telemedicine | Requires referral to see out-of-network providers |

| Cost Structure | Generally lower premiums with digital efficiencies | Higher premiums with varying co-pays and deductibles |

| Customer Support | AI-driven chatbots and 24/7 online support | Traditional phone and in-person customer service |

| Data Transparency | Real-time data access on coverage and claims | Requires manual updates; less transparency |

| Innovation | Integrates wearables, health tracking, and AI | Standard health insurance model with limited tech |

Which is better?

Digital health insurance offers seamless access to healthcare services through mobile apps, real-time claim processing, and personalized health management tools, enhancing convenience and efficiency. Point of Service (POS) insurance provides flexibility by allowing policyholders to choose healthcare providers inside or outside their network, potentially reducing costs and increasing provider options. Evaluating individual healthcare needs, budget, and preference for digital engagement versus traditional provider choice determines the optimal insurance type.

Connection

Digital health insurance enhances Point of Service (POS) insurance by leveraging real-time data analytics and seamless mobile integration to streamline claims processing and improve patient access to in-network providers. POS insurance benefits from digital platforms that enable instant verification of coverage and copayments, reducing administrative burdens and accelerating service delivery. The integration of digital health tools with POS insurance systems optimizes customer experience through personalized plans and efficient resource management.

Key Terms

Network Flexibility

Point of service (POS) insurance offers moderate network flexibility, allowing insured individuals to choose between in-network and out-of-network providers but with higher costs for out-of-network services. Digital health insurance enhances network flexibility through telemedicine, AI-driven provider matching, and real-time access to an expanded range of healthcare professionals, reducing barriers to care. Explore the evolving advantages in network flexibility by learning more about how these insurance models meet diverse healthcare needs.

Claims Processing

Point of service (POS) insurance handles claims processing with a traditional, manual approach often involving paper forms and in-person submissions, leading to slower turnaround times. Digital health insurance leverages automated claims processing technology such as AI-driven adjudication and real-time data exchange, significantly accelerating approvals and reducing errors. Discover more about how digital innovations are transforming claims efficiency and customer experience in health insurance.

Telemedicine Access

Point of service (POS) insurance typically offers limited telemedicine access through network-affiliated providers, emphasizing in-person visits with some remote options. Digital health insurance prioritizes comprehensive telemedicine services, enabling 24/7 virtual consultations and seamless integration with mobile health apps. Explore how telemedicine access transforms patient care in both insurance models.

Source and External Links

What is Point of Service (POS) Health Insurance? - Cigna Healthcare - A POS health insurance plan combines features of HMO and PPO plans, requiring a primary care physician to coordinate care, offering lower costs for in-network services and the option to see out-of-network providers at a higher cost, often with referrals needed for specialists.

What is a POS Insurance Plan? Health Insurance 101 | eHealth - POS plans provide flexibility to choose between in-network and out-of-network providers, require a primary care physician for referrals, and cover out-of-network care at higher costs, distinct from EPO plans which only cover in-network services without referral requirements.

What Is An HMO POS | Blue Cross and Blue Shield of Texas - An HMO POS plan adds point of service benefits to a traditional HMO, allowing members to seek care outside the network or without referrals at higher out-of-pocket costs and with lower coverage compared to in-network services.

dowidth.com

dowidth.com