Buy now insurance offers immediate coverage tailored for short-term needs, providing flexibility and ease of access. Term insurance delivers financial protection over a specified period with fixed premiums and often higher coverage amounts. Explore the key differences to determine which insurance option best suits your financial goals.

Why it is important

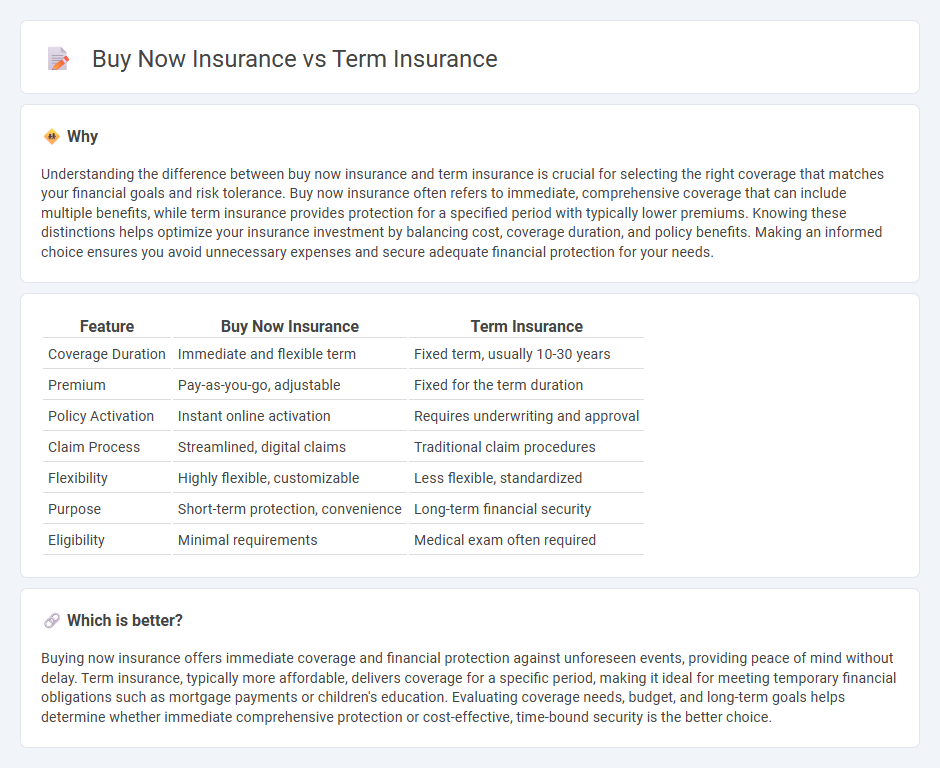

Understanding the difference between buy now insurance and term insurance is crucial for selecting the right coverage that matches your financial goals and risk tolerance. Buy now insurance often refers to immediate, comprehensive coverage that can include multiple benefits, while term insurance provides protection for a specified period with typically lower premiums. Knowing these distinctions helps optimize your insurance investment by balancing cost, coverage duration, and policy benefits. Making an informed choice ensures you avoid unnecessary expenses and secure adequate financial protection for your needs.

Comparison Table

| Feature | Buy Now Insurance | Term Insurance |

|---|---|---|

| Coverage Duration | Immediate and flexible term | Fixed term, usually 10-30 years |

| Premium | Pay-as-you-go, adjustable | Fixed for the term duration |

| Policy Activation | Instant online activation | Requires underwriting and approval |

| Claim Process | Streamlined, digital claims | Traditional claim procedures |

| Flexibility | Highly flexible, customizable | Less flexible, standardized |

| Purpose | Short-term protection, convenience | Long-term financial security |

| Eligibility | Minimal requirements | Medical exam often required |

Which is better?

Buying now insurance offers immediate coverage and financial protection against unforeseen events, providing peace of mind without delay. Term insurance, typically more affordable, delivers coverage for a specific period, making it ideal for meeting temporary financial obligations such as mortgage payments or children's education. Evaluating coverage needs, budget, and long-term goals helps determine whether immediate comprehensive protection or cost-effective, time-bound security is the better choice.

Connection

Buy now insurance platforms simplify the process of purchasing term insurance by offering instant quotes and seamless online transactions, making it easier for customers to secure coverage quickly. Term insurance provides temporary financial protection, typically covering death benefits for a specific period, which aligns perfectly with the fast and flexible nature of buy now insurance services. The integration enhances customer experience by combining accessibility with tailored term insurance policies based on individual risk profiles and coverage needs.

Key Terms

Coverage Period

Term insurance offers a fixed coverage period, typically ranging from 10 to 30 years, providing financial protection for a specific duration. Buy now insurance often refers to policies purchased at a younger age to lock in lower premiums for the entire coverage period, maximizing long-term cost-effectiveness. Explore the benefits of each to determine which coverage period best suits your financial goals and family needs.

Premium Cost

Term insurance offers fixed premium costs throughout the policy duration, making it a cost-effective choice for long-term coverage. Buy now insurance may involve dynamic premium rates, influenced by factors such as age, health, and market conditions, potentially leading to higher expenses. Explore detailed comparisons to understand which premium structure aligns best with your financial goals.

Cash Value

Term insurance offers coverage for a specific period without accumulating cash value, making it a cost-effective choice for temporary financial protection. Buy now insurance, often referring to whole or universal life policies, builds cash value over time, serving as both insurance and an investment vehicle. Explore the differences in cash value growth and flexibility to make an informed decision about your insurance needs.

Source and External Links

Term Life Insurance Policies - MetLife - Provides financial protection for a specified period, typically offering a lump sum to loved ones if the policyholder dies during the term.

Term Life Insurance -- Types and How it Works | Guardian - Offers a variety of term policies, including level premium and yearly renewable term, with benefits like cost-effectiveness and flexibility.

Term Life Insurance - Compare Quotes for Free - Progressive - Provides temporary life insurance coverage for a set period, such as 10, 15, 20, or 30 years, with benefits that include affordability and tax-free payouts.

dowidth.com

dowidth.com