Drone insurance offers specialized coverage for risks associated with unmanned aerial vehicles, including liability for property damage and personal injury, which homeowners insurance typically excludes. Homeowners insurance primarily protects against damage to the home and personal property, along with liability for incidents occurring on the property, but rarely covers drone-related accidents. Explore the differences in coverage options and protection limits to determine which policy best suits your needs.

Why it is important

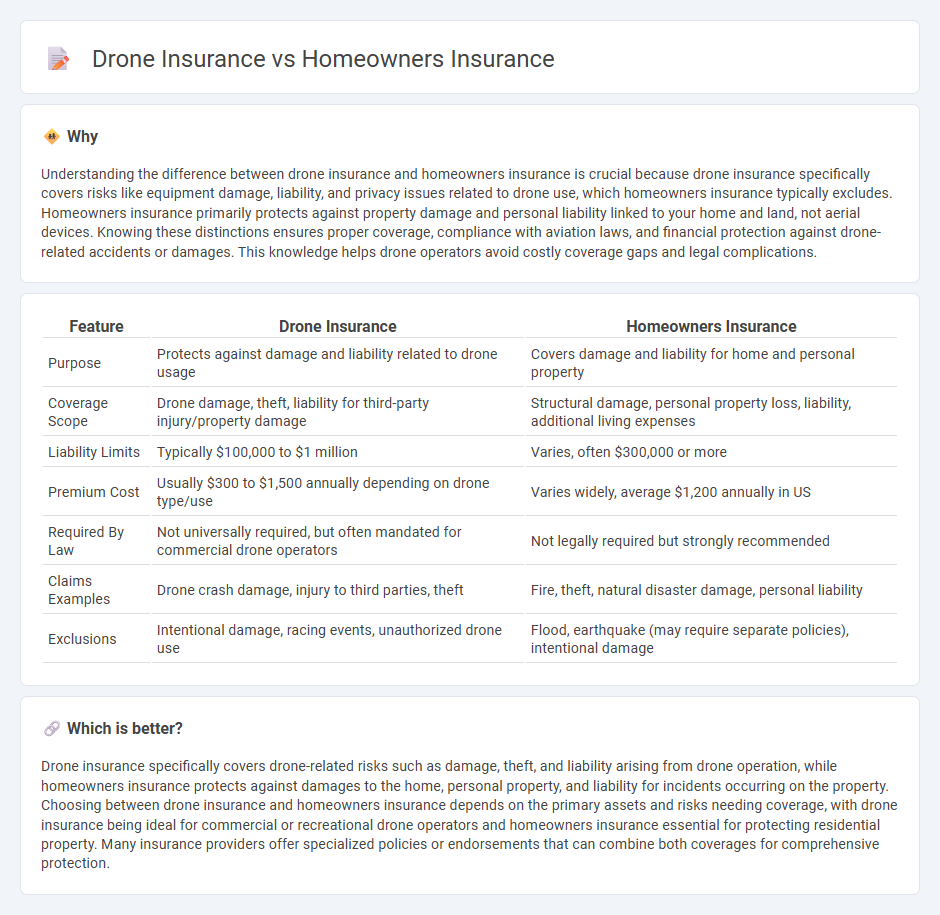

Understanding the difference between drone insurance and homeowners insurance is crucial because drone insurance specifically covers risks like equipment damage, liability, and privacy issues related to drone use, which homeowners insurance typically excludes. Homeowners insurance primarily protects against property damage and personal liability linked to your home and land, not aerial devices. Knowing these distinctions ensures proper coverage, compliance with aviation laws, and financial protection against drone-related accidents or damages. This knowledge helps drone operators avoid costly coverage gaps and legal complications.

Comparison Table

| Feature | Drone Insurance | Homeowners Insurance |

|---|---|---|

| Purpose | Protects against damage and liability related to drone usage | Covers damage and liability for home and personal property |

| Coverage Scope | Drone damage, theft, liability for third-party injury/property damage | Structural damage, personal property loss, liability, additional living expenses |

| Liability Limits | Typically $100,000 to $1 million | Varies, often $300,000 or more |

| Premium Cost | Usually $300 to $1,500 annually depending on drone type/use | Varies widely, average $1,200 annually in US |

| Required By Law | Not universally required, but often mandated for commercial drone operators | Not legally required but strongly recommended |

| Claims Examples | Drone crash damage, injury to third parties, theft | Fire, theft, natural disaster damage, personal liability |

| Exclusions | Intentional damage, racing events, unauthorized drone use | Flood, earthquake (may require separate policies), intentional damage |

Which is better?

Drone insurance specifically covers drone-related risks such as damage, theft, and liability arising from drone operation, while homeowners insurance protects against damages to the home, personal property, and liability for incidents occurring on the property. Choosing between drone insurance and homeowners insurance depends on the primary assets and risks needing coverage, with drone insurance being ideal for commercial or recreational drone operators and homeowners insurance essential for protecting residential property. Many insurance providers offer specialized policies or endorsements that can combine both coverages for comprehensive protection.

Connection

Drone insurance and homeowners insurance are connected through liability coverage that protects property owners from potential damages caused by drones on their premises. Both policies can complement each other by covering different aspects of risk, such as personal injury and property damage caused by drone accidents. Integrating drone insurance with homeowners insurance ensures comprehensive protection against emerging aerial drone risks while safeguarding the insured's residential property.

Key Terms

Property Coverage

Homeowners insurance typically covers damage to the physical structure of a home and personal property caused by risks such as fire, theft, or natural disasters; however, it rarely extends protection to drones or drone-related liabilities. Drone insurance specifically offers property coverage for the drone itself, including damages from crashes, theft, or mechanical failures, alongside liability coverage for potential injuries or property damage caused during drone operations. Explore the differences in detail to understand which insurance best safeguards your assets and responsibilities.

Liability Coverage

Homeowners insurance typically covers liability for accidents occurring on the property, offering protection against bodily injury or property damage claims. Drone insurance specifically addresses liability risks from aerial operations, including third-party injury and property damage caused by drone flights. Explore comprehensive coverage options to fully protect yourself from drone-related liabilities.

Exclusions

Homeowners insurance typically excludes coverage for drone-related damages and liabilities, leaving gaps for drone operators in case of accidents or property damage caused by drones. Drone insurance specifically addresses these exclusions, providing liability and physical damage coverage tailored to UAVs, including protection against third-party injuries and privacy violations. Explore detailed comparisons and policy options to fully understand how each insurance type protects your assets and responsibilities.

Source and External Links

Allstate homeowners insurance - Get a personalized quote, compare coverage options, and protect your house and family from unexpected losses.

Travelers homeowners insurance - Helps cover repairs or rebuilding, personal belongings, liability, and living expenses if your home is damaged, plus get a quote to customize coverage.

How home insurance works - Standard policies include dwelling coverage, protection for other structures, personal property, and potential for extra coverage for valuables and loss of use.

dowidth.com

dowidth.com