Telematics insurance uses real-time data from devices installed in vehicles to monitor driving behaviors, enabling personalized premiums based on actual usage and risk levels. Pay-how-you-drive insurance, a subset of telematics, specifically evaluates driving style, including speed, braking, and acceleration patterns, to adjust rates accordingly. Explore the differences and benefits of these innovative insurance models to find the best fit for your driving habits.

Why it is important

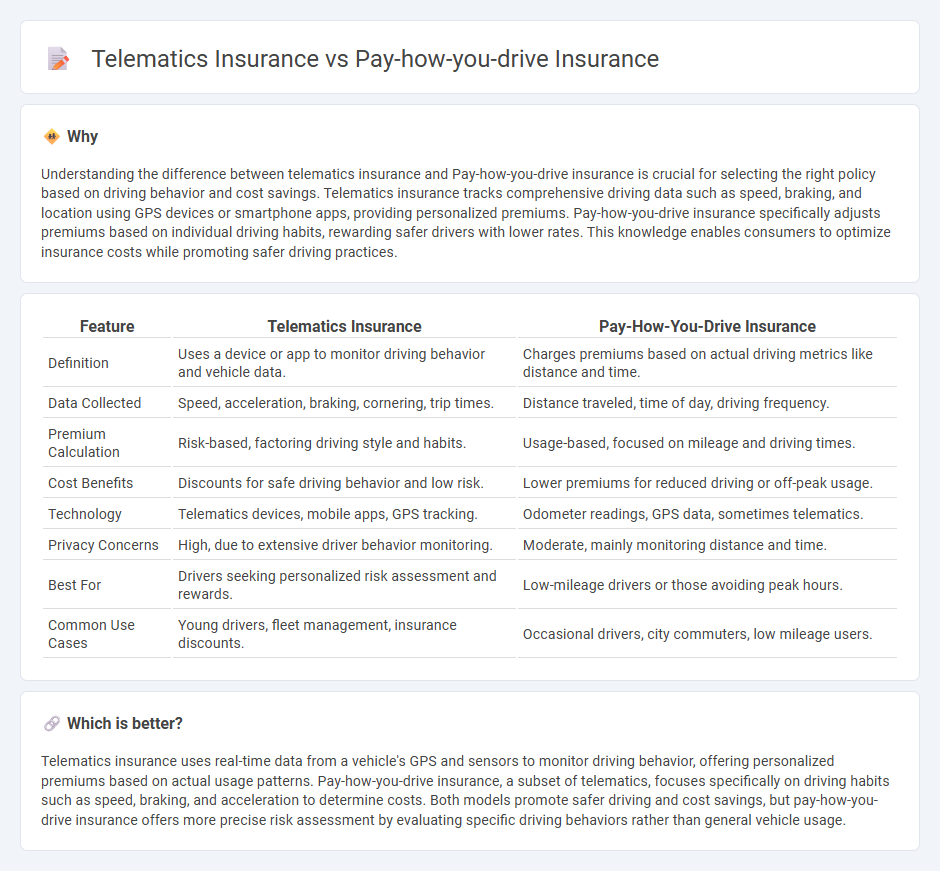

Understanding the difference between telematics insurance and Pay-how-you-drive insurance is crucial for selecting the right policy based on driving behavior and cost savings. Telematics insurance tracks comprehensive driving data such as speed, braking, and location using GPS devices or smartphone apps, providing personalized premiums. Pay-how-you-drive insurance specifically adjusts premiums based on individual driving habits, rewarding safer drivers with lower rates. This knowledge enables consumers to optimize insurance costs while promoting safer driving practices.

Comparison Table

| Feature | Telematics Insurance | Pay-How-You-Drive Insurance |

|---|---|---|

| Definition | Uses a device or app to monitor driving behavior and vehicle data. | Charges premiums based on actual driving metrics like distance and time. |

| Data Collected | Speed, acceleration, braking, cornering, trip times. | Distance traveled, time of day, driving frequency. |

| Premium Calculation | Risk-based, factoring driving style and habits. | Usage-based, focused on mileage and driving times. |

| Cost Benefits | Discounts for safe driving behavior and low risk. | Lower premiums for reduced driving or off-peak usage. |

| Technology | Telematics devices, mobile apps, GPS tracking. | Odometer readings, GPS data, sometimes telematics. |

| Privacy Concerns | High, due to extensive driver behavior monitoring. | Moderate, mainly monitoring distance and time. |

| Best For | Drivers seeking personalized risk assessment and rewards. | Low-mileage drivers or those avoiding peak hours. |

| Common Use Cases | Young drivers, fleet management, insurance discounts. | Occasional drivers, city commuters, low mileage users. |

Which is better?

Telematics insurance uses real-time data from a vehicle's GPS and sensors to monitor driving behavior, offering personalized premiums based on actual usage patterns. Pay-how-you-drive insurance, a subset of telematics, focuses specifically on driving habits such as speed, braking, and acceleration to determine costs. Both models promote safer driving and cost savings, but pay-how-you-drive insurance offers more precise risk assessment by evaluating specific driving behaviors rather than general vehicle usage.

Connection

Telematics insurance and Pay-how-you-drive insurance are connected through the use of real-time driving data collected via GPS and onboard sensors to assess individual driving behavior. This data-driven approach allows insurers to offer personalized premiums based on factors such as speed, braking patterns, and mileage, promoting safer driving habits. Both models leverage advanced telematics technology to enhance risk assessment accuracy and incentivize responsible driving.

Key Terms

Driving Behavior Monitoring

Driving behavior monitoring in pay-how-you-drive insurance involves analyzing real-time data such as speed, braking, and acceleration to tailor premiums based on actual road safety, whereas telematics insurance uses GPS and in-car devices to continuously track vehicle usage and driver habits comprehensively. Pay-how-you-drive prioritizes direct behavioral indicators to adjust rates dynamically, while telematics insurance integrates broader data points including location and distance traveled for risk assessment. Explore more about how these monitoring technologies influence insurance costs and driver safety.

Usage-Based Premiums

Pay-how-you-drive insurance calculates premiums based solely on driver behavior metrics like acceleration, braking, and speed, offering more personalized rates compared to traditional policies. Telematics insurance incorporates additional data such as mileage, time of day, and location to create a comprehensive profile that influences usage-based premiums more precisely. Explore the differences in detail to determine the best fit for your driving habits and savings potential.

Telematics Device

Telematics insurance relies on advanced devices installed in vehicles to collect real-time data on driving behavior such as speed, acceleration, braking, and mileage, providing insurers with precise usage patterns. Pay-how-you-drive insurance uses similar telematics technology but emphasizes dynamic pricing models that adjust premiums based on individual driving habits monitored through these devices. Explore how telematics devices transform auto insurance pricing and risk assessment by learning more about their integration and benefits.

Source and External Links

Usage-based insurance - Pay-how-you-drive insurance uses telematics and sensors to monitor driving behaviors--such as speed, braking, and acceleration--adjusting premiums based on actual driving habits, not just miles driven.

Telematics: 5 Reasons You Should Try Pay How You Drive Car Insurance - By opting into pay-how-you-drive programs, safe drivers may lower their car insurance premiums, while riskier drivers could see premium increases.

All You Need to Know About Pay-As-You-Drive Insurance - Pay-how-you-drive insurance is part of the broader usage-based insurance model, offering personalized pricing and additional services based on real-time driving data, encouraging safer driving and greater transparency.

dowidth.com

dowidth.com