Cyber risk insurance protects businesses from financial losses due to data breaches, cyberattacks, and digital threats, covering costs like legal fees and notification expenses. Workers' compensation insurance offers coverage for employees injured or ill on the job, providing medical benefits and wage replacement while mitigating employer liability. Explore our detailed comparison to understand which insurance best suits your organization's needs.

Why it is important

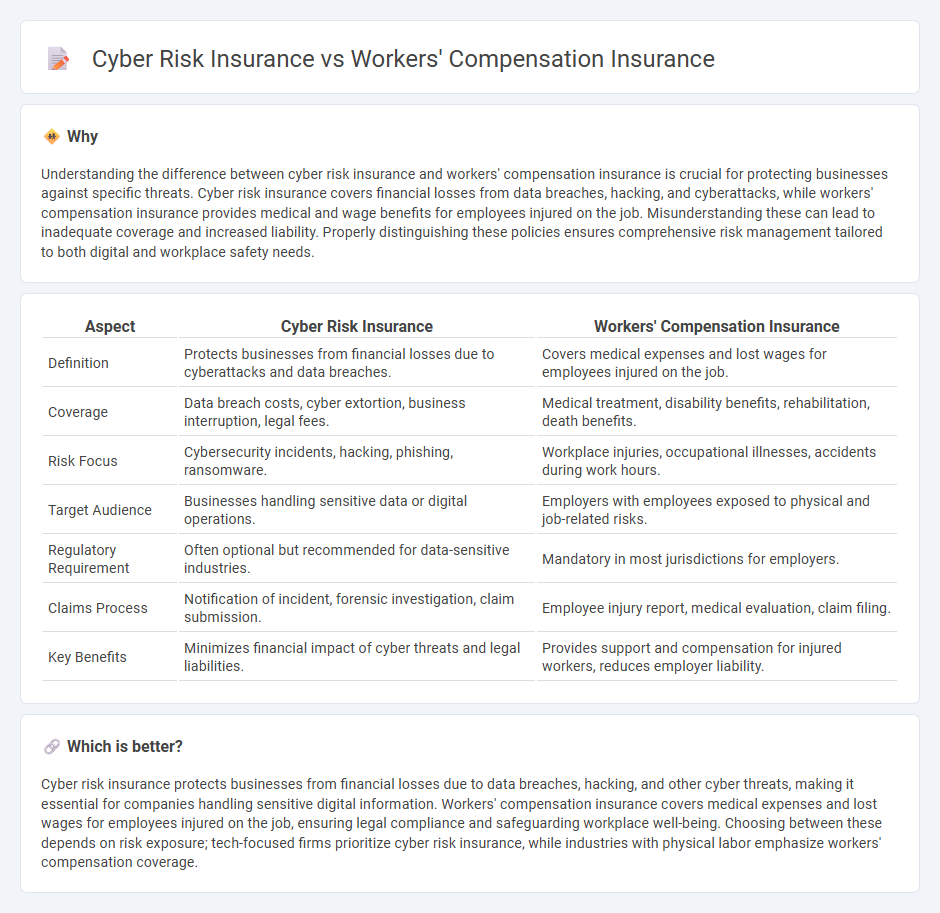

Understanding the difference between cyber risk insurance and workers' compensation insurance is crucial for protecting businesses against specific threats. Cyber risk insurance covers financial losses from data breaches, hacking, and cyberattacks, while workers' compensation insurance provides medical and wage benefits for employees injured on the job. Misunderstanding these can lead to inadequate coverage and increased liability. Properly distinguishing these policies ensures comprehensive risk management tailored to both digital and workplace safety needs.

Comparison Table

| Aspect | Cyber Risk Insurance | Workers' Compensation Insurance |

|---|---|---|

| Definition | Protects businesses from financial losses due to cyberattacks and data breaches. | Covers medical expenses and lost wages for employees injured on the job. |

| Coverage | Data breach costs, cyber extortion, business interruption, legal fees. | Medical treatment, disability benefits, rehabilitation, death benefits. |

| Risk Focus | Cybersecurity incidents, hacking, phishing, ransomware. | Workplace injuries, occupational illnesses, accidents during work hours. |

| Target Audience | Businesses handling sensitive data or digital operations. | Employers with employees exposed to physical and job-related risks. |

| Regulatory Requirement | Often optional but recommended for data-sensitive industries. | Mandatory in most jurisdictions for employers. |

| Claims Process | Notification of incident, forensic investigation, claim submission. | Employee injury report, medical evaluation, claim filing. |

| Key Benefits | Minimizes financial impact of cyber threats and legal liabilities. | Provides support and compensation for injured workers, reduces employer liability. |

Which is better?

Cyber risk insurance protects businesses from financial losses due to data breaches, hacking, and other cyber threats, making it essential for companies handling sensitive digital information. Workers' compensation insurance covers medical expenses and lost wages for employees injured on the job, ensuring legal compliance and safeguarding workplace well-being. Choosing between these depends on risk exposure; tech-focused firms prioritize cyber risk insurance, while industries with physical labor emphasize workers' compensation coverage.

Connection

Cyber risk insurance and workers' compensation insurance intersect through the increasing prevalence of cyber threats targeting employee data and workplace systems. Cyber risk insurance covers financial losses from data breaches affecting employee personal information, while workers' compensation insurance addresses medical and wage replacement costs for work-related injuries, including those caused by cyber incidents like ransomware attacks disrupting workplace safety. Integrating both types of insurance ensures comprehensive protection against the evolving risks associated with digital workplace environments.

Key Terms

**Workers' Compensation Insurance:**

Workers' compensation insurance provides essential coverage for employees injured or ill due to workplace conditions, ensuring medical expenses and wage replacement are handled efficiently. This insurance is mandatory in most states across the U.S., designed to protect both employees and employers from financial loss related to job-related accidents. Explore how workers' compensation insurance safeguards your workforce and business compliance by learning more today.

Medical Benefits

Workers' compensation insurance covers medical benefits for employees injured on the job, including hospital stays, surgeries, medications, and rehabilitation services. Cyber risk insurance typically excludes medical benefits since it focuses on data breaches, cyberattacks, and liability related to digital assets. Learn more about how these coverages protect your business in distinct ways.

Wage Replacement

Workers' compensation insurance primarily covers wage replacement and medical expenses for employees injured on the job, ensuring financial stability during recovery. Cyber risk insurance, however, does not provide wage replacement but focuses on mitigating financial losses due to data breaches, cyberattacks, and related liabilities. Explore the distinct benefits and limitations of these insurance types to safeguard your business comprehensively.

Source and External Links

What is Workers' Compensation Insurance - Workers' compensation insurance provides medical and wage benefits to people who are injured or become ill at work.

Workers' Compensation Requirements - California law requires employers to carry workers' compensation insurance, providing benefits for medical care, disability, and death.

Workers' Compensation Insurance - Workers' compensation insurance can help cover expenses for medical care and lost wages after a workplace injury.

dowidth.com

dowidth.com