Embedded insurance integrates coverage directly within product purchases or services, streamlining the protection process for consumers at the point of sale. Subscription insurance offers ongoing coverage through regular payments, providing flexibility and continuous protection tailored to evolving needs. Explore more to understand which insurance model best suits your lifestyle and financial goals.

Why it is important

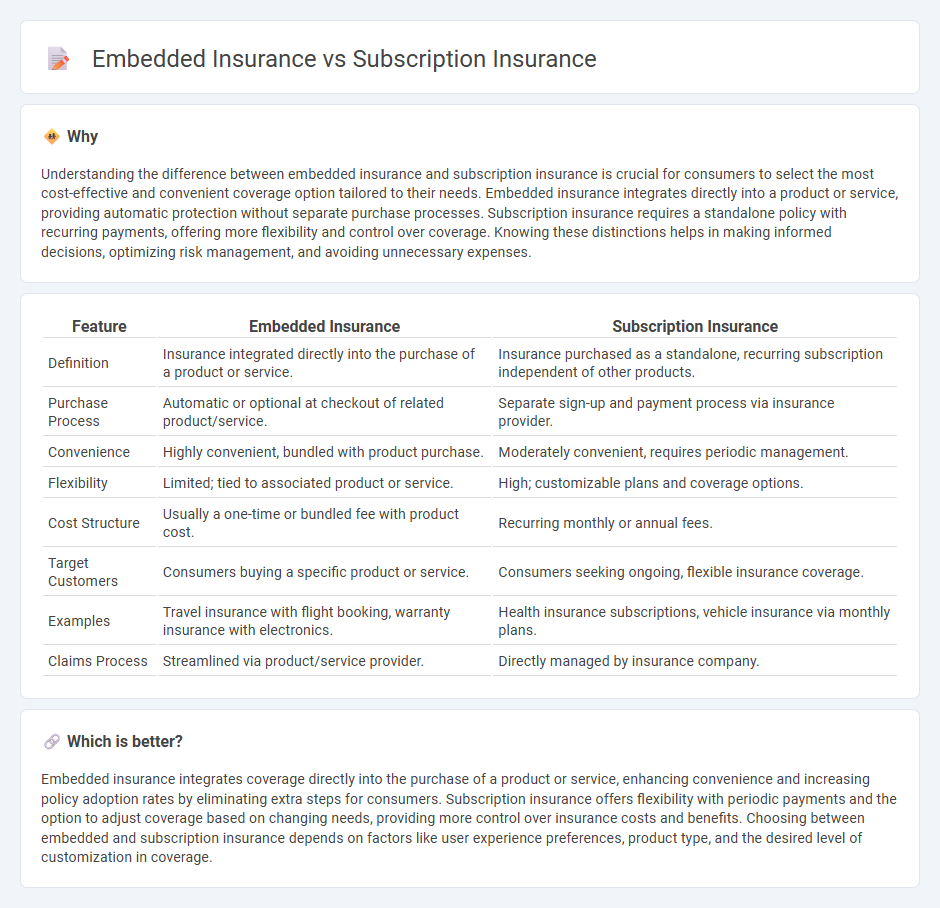

Understanding the difference between embedded insurance and subscription insurance is crucial for consumers to select the most cost-effective and convenient coverage option tailored to their needs. Embedded insurance integrates directly into a product or service, providing automatic protection without separate purchase processes. Subscription insurance requires a standalone policy with recurring payments, offering more flexibility and control over coverage. Knowing these distinctions helps in making informed decisions, optimizing risk management, and avoiding unnecessary expenses.

Comparison Table

| Feature | Embedded Insurance | Subscription Insurance |

|---|---|---|

| Definition | Insurance integrated directly into the purchase of a product or service. | Insurance purchased as a standalone, recurring subscription independent of other products. |

| Purchase Process | Automatic or optional at checkout of related product/service. | Separate sign-up and payment process via insurance provider. |

| Convenience | Highly convenient, bundled with product purchase. | Moderately convenient, requires periodic management. |

| Flexibility | Limited; tied to associated product or service. | High; customizable plans and coverage options. |

| Cost Structure | Usually a one-time or bundled fee with product cost. | Recurring monthly or annual fees. |

| Target Customers | Consumers buying a specific product or service. | Consumers seeking ongoing, flexible insurance coverage. |

| Examples | Travel insurance with flight booking, warranty insurance with electronics. | Health insurance subscriptions, vehicle insurance via monthly plans. |

| Claims Process | Streamlined via product/service provider. | Directly managed by insurance company. |

Which is better?

Embedded insurance integrates coverage directly into the purchase of a product or service, enhancing convenience and increasing policy adoption rates by eliminating extra steps for consumers. Subscription insurance offers flexibility with periodic payments and the option to adjust coverage based on changing needs, providing more control over insurance costs and benefits. Choosing between embedded and subscription insurance depends on factors like user experience preferences, product type, and the desired level of customization in coverage.

Connection

Embedded insurance integrates coverage options directly into the purchase of products or services, allowing seamless protection without separate insurance shopping. Subscription insurance offers continuous coverage through recurring payments, often enabling flexible, tailored protection plans. Both models enhance customer convenience and drive higher adoption rates by embedding insurance naturally within consumer transactions.

Key Terms

Risk Pooling

Subscription insurance pools risk among a defined group of subscribers who pay regular premiums to cover shared liabilities, optimizing risk distribution and minimizing individual exposure. Embedded insurance integrates coverage directly into the purchase of products or services, allowing the risk to be spread across a broader customer base, often leveraging real-time data for precise risk assessment. Explore further to understand how risk pooling models impact insurance efficiency and customer protection.

Distribution Channel

Subscription insurance leverages a direct-to-consumer distribution channel, often integrated within digital platforms or apps to offer seamless onboarding and policy management. Embedded insurance integrates coverage directly into the purchase of a product or service, distributed through partners like e-commerce sites, travel agencies, or automotive dealers, enhancing convenience and relevance at the point of sale. Explore the distinct advantages and growth opportunities of these distribution channels in modern insurance models to better understand their impact on customer engagement.

Policyholder Experience

Subscription insurance offers policyholders continuous coverage with flexible payment plans, enhancing convenience and real-time policy management through mobile apps. Embedded insurance integrates coverage seamlessly within a product or service purchase, providing instant protection without separate transactions, which improves user satisfaction by reducing friction. Explore more about how these models transform policyholder experience and streamline insurance access.

Source and External Links

What is a Subscription Policy? - Definition from Insuranceopedia - A subscription policy is an insurance policy in which multiple insurers share the risk of providing coverage, allowing each insurer to take on a portion of the risk based on their capacity.

Subscription Policy - Insurance Training Center - Subscription insurance involves two or more insurers accepting a percentage of the risk under one policy, with a lead insurer managing the arrangement, common when coverage exceeds what a single insurer is willing to carry.

Comparing Costs: Subscription Health Plans vs. Traditional Insurance - Subscription health plans are a form of insurance with flat monthly or annual fees offering transparency, affordability, and flexibility, differing from traditional insurance with complex billing and unexpected costs.

dowidth.com

dowidth.com