Pre-existing condition coverage protects policyholders by ensuring medical conditions diagnosed before obtaining insurance are covered, preventing denials or higher premiums. Continuous coverage requires maintaining an unbroken insurance policy to avoid losing these benefits, emphasizing the need for timely renewals or switching plans without gaps. Explore the differences and importance of these coverages to safeguard your health and finances effectively.

Why it is important

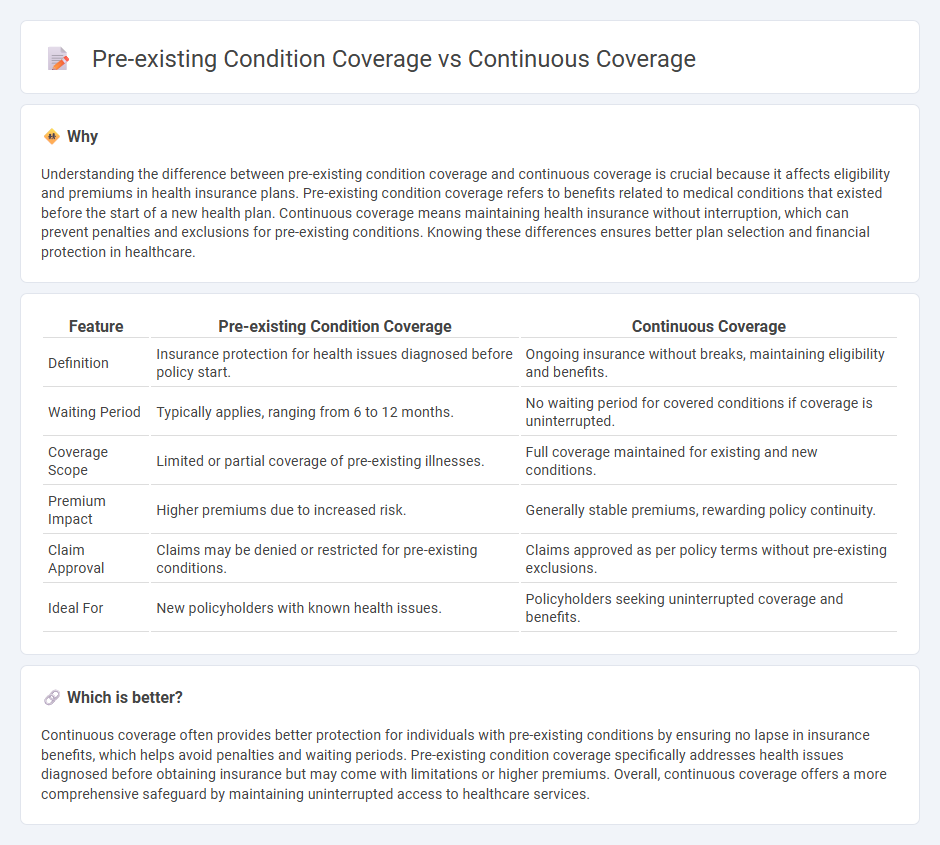

Understanding the difference between pre-existing condition coverage and continuous coverage is crucial because it affects eligibility and premiums in health insurance plans. Pre-existing condition coverage refers to benefits related to medical conditions that existed before the start of a new health plan. Continuous coverage means maintaining health insurance without interruption, which can prevent penalties and exclusions for pre-existing conditions. Knowing these differences ensures better plan selection and financial protection in healthcare.

Comparison Table

| Feature | Pre-existing Condition Coverage | Continuous Coverage |

|---|---|---|

| Definition | Insurance protection for health issues diagnosed before policy start. | Ongoing insurance without breaks, maintaining eligibility and benefits. |

| Waiting Period | Typically applies, ranging from 6 to 12 months. | No waiting period for covered conditions if coverage is uninterrupted. |

| Coverage Scope | Limited or partial coverage of pre-existing illnesses. | Full coverage maintained for existing and new conditions. |

| Premium Impact | Higher premiums due to increased risk. | Generally stable premiums, rewarding policy continuity. |

| Claim Approval | Claims may be denied or restricted for pre-existing conditions. | Claims approved as per policy terms without pre-existing exclusions. |

| Ideal For | New policyholders with known health issues. | Policyholders seeking uninterrupted coverage and benefits. |

Which is better?

Continuous coverage often provides better protection for individuals with pre-existing conditions by ensuring no lapse in insurance benefits, which helps avoid penalties and waiting periods. Pre-existing condition coverage specifically addresses health issues diagnosed before obtaining insurance but may come with limitations or higher premiums. Overall, continuous coverage offers a more comprehensive safeguard by maintaining uninterrupted access to healthcare services.

Connection

Pre-existing condition coverage in insurance ensures that individuals with prior medical conditions receive protection without waiting periods or exclusions. Continuous coverage plays a critical role by maintaining unbroken insurance, allowing policyholders to avoid penalties or increased risk classification when transitioning between plans. Insurers often require proof of continuous coverage to guarantee seamless access to benefits related to pre-existing conditions, facilitating comprehensive healthcare support.

Key Terms

Eligibility

Continuous coverage ensures eligibility for certain health benefits by preventing gaps in insurance, thereby protecting against denial of claims related to pre-existing conditions. Pre-existing condition coverage mandates insurers to cover medical conditions diagnosed before policy enrollment, subject to regulatory eligibility criteria. Explore detailed guidelines to understand how eligibility impacts your health insurance choices effectively.

Waiting period

Continuous coverage minimizes or eliminates the waiting period for pre-existing condition coverage by maintaining uninterrupted health insurance, ensuring immediate access to benefits. In contrast, policies without continuous coverage often impose a waiting period ranging from 6 to 12 months before pre-existing conditions are covered. Explore detailed comparisons to understand how waiting periods impact your healthcare expenses and plan choices.

Underwriting

Continuous coverage ensures uninterrupted health insurance protection, reducing the risk of denied claims due to pre-existing conditions during underwriting. Underwriting evaluates an applicant's medical history, and continuous coverage demonstrates stability, minimizing gaps that might trigger higher premiums or exclusions. Explore how continuous coverage impacts underwriting decisions and benefits policyholders.

Source and External Links

Why Continuous Coverage is Important - ISO Insurance - Continuous coverage means maintaining insurance without any lapses, which helps avoid resetting deductibles and out-of-pocket maximums, reducing long-term medical costs.

What is Continuous Coverage? - Definition from Insuranceopedia - Continuous coverage refers to uninterrupted insurance, crucial for avoiding legal issues, financial risk, and higher premiums, and in health insurance, it helps protect against pre-existing condition exclusions.

Continuous Eligibility for Medicaid and CHIP Coverage - Starting January 1, 2024, states must provide 12 months of continuous eligibility for children under 19 in Medicaid and CHIP, ensuring stable access to health care and reducing administrative burdens.

dowidth.com

dowidth.com