Pet health insurance offers coverage for veterinary expenses, illnesses, and accidents, ensuring your furry friend's well-being without unexpected financial burdens. Auto insurance protects against vehicle damages, liability claims, and theft, safeguarding your car investment and providing peace of mind on the road. Discover the key differences and benefits of each insurance type to make an informed decision.

Why it is important

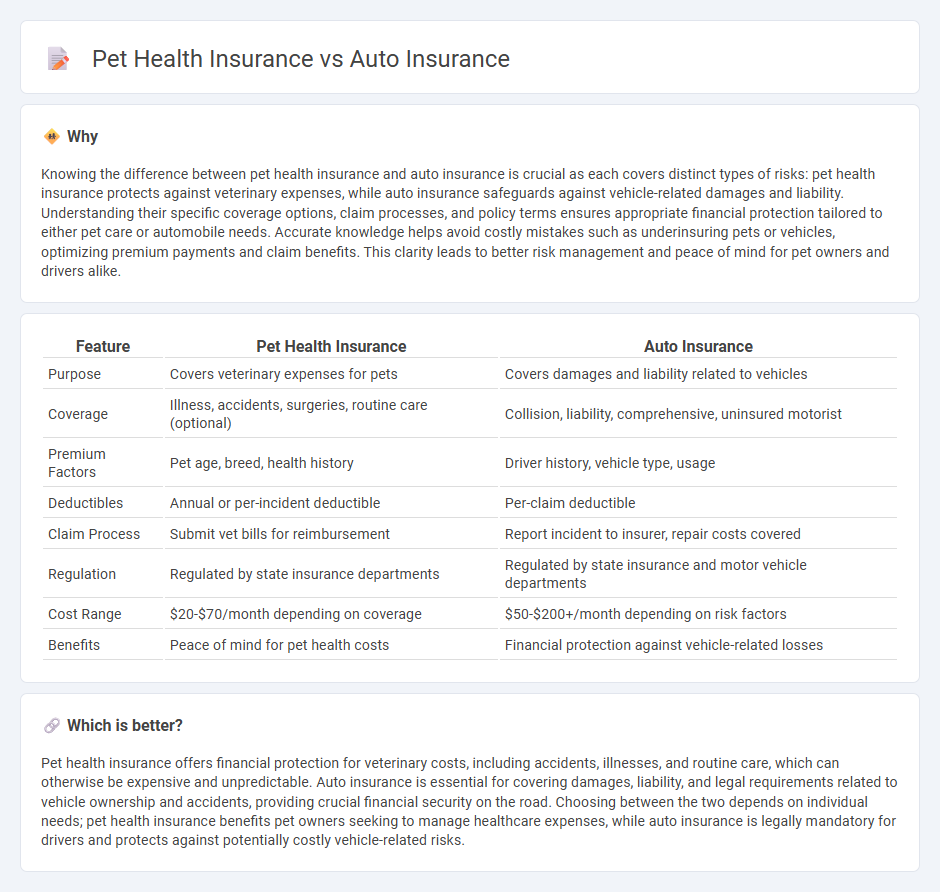

Knowing the difference between pet health insurance and auto insurance is crucial as each covers distinct types of risks: pet health insurance protects against veterinary expenses, while auto insurance safeguards against vehicle-related damages and liability. Understanding their specific coverage options, claim processes, and policy terms ensures appropriate financial protection tailored to either pet care or automobile needs. Accurate knowledge helps avoid costly mistakes such as underinsuring pets or vehicles, optimizing premium payments and claim benefits. This clarity leads to better risk management and peace of mind for pet owners and drivers alike.

Comparison Table

| Feature | Pet Health Insurance | Auto Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Covers damages and liability related to vehicles |

| Coverage | Illness, accidents, surgeries, routine care (optional) | Collision, liability, comprehensive, uninsured motorist |

| Premium Factors | Pet age, breed, health history | Driver history, vehicle type, usage |

| Deductibles | Annual or per-incident deductible | Per-claim deductible |

| Claim Process | Submit vet bills for reimbursement | Report incident to insurer, repair costs covered |

| Regulation | Regulated by state insurance departments | Regulated by state insurance and motor vehicle departments |

| Cost Range | $20-$70/month depending on coverage | $50-$200+/month depending on risk factors |

| Benefits | Peace of mind for pet health costs | Financial protection against vehicle-related losses |

Which is better?

Pet health insurance offers financial protection for veterinary costs, including accidents, illnesses, and routine care, which can otherwise be expensive and unpredictable. Auto insurance is essential for covering damages, liability, and legal requirements related to vehicle ownership and accidents, providing crucial financial security on the road. Choosing between the two depends on individual needs; pet health insurance benefits pet owners seeking to manage healthcare expenses, while auto insurance is legally mandatory for drivers and protects against potentially costly vehicle-related risks.

Connection

Pet health insurance and auto insurance are connected through the concept of risk management and financial protection against unexpected expenses. Both types of insurance help policyholders mitigate costs related to accidents, injuries, or damages, enhancing overall peace of mind. Insurers may offer bundled policies or discounts for customers who purchase multiple insurance products, linking pet and auto coverage.

Key Terms

Auto Insurance:

Auto insurance provides financial protection against vehicle-related damages, liability, and theft, covering expenses from accidents, collisions, and natural disasters. Comprehensive, collision, liability, and uninsured motorist coverage options address various risk scenarios, making it essential for legal compliance and financial security. Discover more about how auto insurance policies safeguard your investment and ensure peace of mind on the road.

Collision Coverage

Collision coverage is a critical component of auto insurance, providing financial protection for damages to your vehicle after an accident, regardless of fault. Pet health insurance, in contrast, focuses on veterinary bills for illnesses, injuries, and routine care but does not cover accidents involving vehicles. Explore the differences further to understand which coverage best meets your needs.

Liability Coverage

Auto insurance liability coverage protects policyholders from financial responsibility due to bodily injury or property damage caused to others in a car accident, often covering legal fees and medical expenses. In contrast, pet health insurance typically does not include liability coverage for injuries or damages caused by pets to third parties, focusing instead on veterinary costs related to pet illnesses and injuries. Explore our detailed comparison to understand how liability coverage differentiates these insurance types and why it matters for your protection needs.

Source and External Links

Car Insurance | Travelers Insurance - Provides liability, collision, and comprehensive coverages, plus options for rental reimbursement and loan/lease gap protection, with customizable premiums and deductibles to suit different needs.

Car Insurance - Get A Free Auto Insurance Quote Online - Offers liability, comprehensive, and collision coverage with real-world examples of protection scenarios, including damage from weather, accidents, and theft.

The General(r) Car Insurance | Get a Quote to Insure Your Car - Specializes in flexible payment plans and coverage for drivers with less-than-perfect records, including liability, collision, comprehensive, and full coverage options.

dowidth.com

dowidth.com