Pet health insurance covers veterinary expenses for illnesses, injuries, and routine care, ensuring pets receive timely medical attention without financial strain. Liability insurance protects against claims arising from damages or injuries caused by the policyholder to third parties, offering financial security and legal defense. Explore the key differences and benefits of each insurance type to make informed coverage decisions.

Why it is important

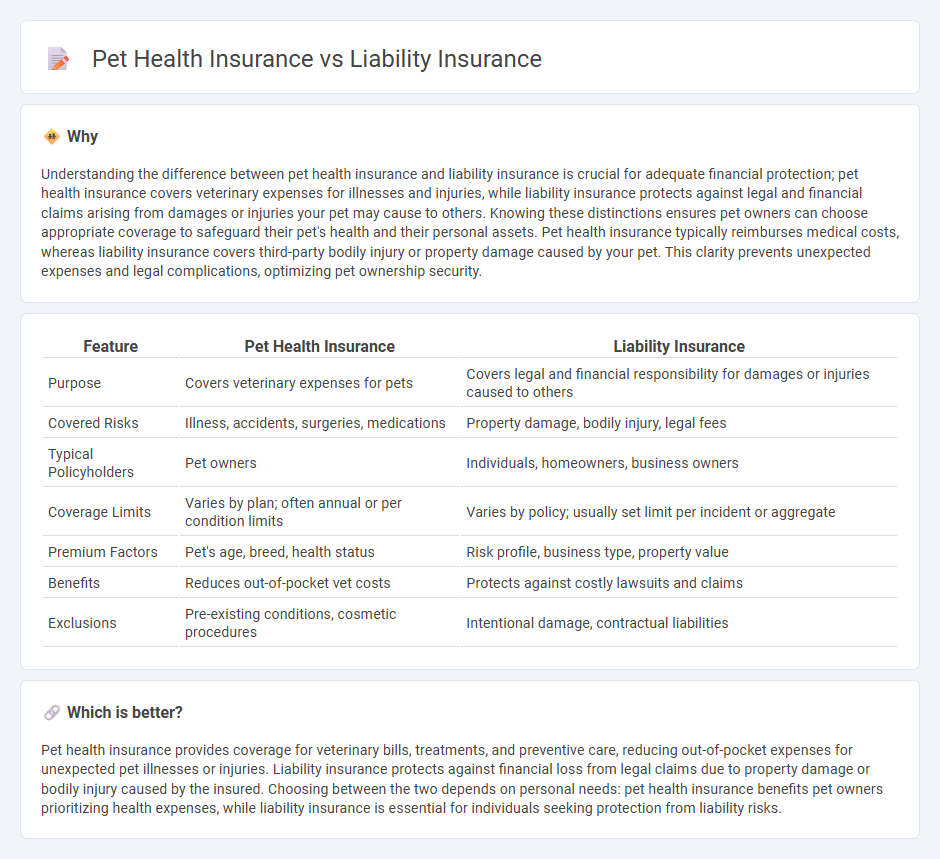

Understanding the difference between pet health insurance and liability insurance is crucial for adequate financial protection; pet health insurance covers veterinary expenses for illnesses and injuries, while liability insurance protects against legal and financial claims arising from damages or injuries your pet may cause to others. Knowing these distinctions ensures pet owners can choose appropriate coverage to safeguard their pet's health and their personal assets. Pet health insurance typically reimburses medical costs, whereas liability insurance covers third-party bodily injury or property damage caused by your pet. This clarity prevents unexpected expenses and legal complications, optimizing pet ownership security.

Comparison Table

| Feature | Pet Health Insurance | Liability Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Covers legal and financial responsibility for damages or injuries caused to others |

| Covered Risks | Illness, accidents, surgeries, medications | Property damage, bodily injury, legal fees |

| Typical Policyholders | Pet owners | Individuals, homeowners, business owners |

| Coverage Limits | Varies by plan; often annual or per condition limits | Varies by policy; usually set limit per incident or aggregate |

| Premium Factors | Pet's age, breed, health status | Risk profile, business type, property value |

| Benefits | Reduces out-of-pocket vet costs | Protects against costly lawsuits and claims |

| Exclusions | Pre-existing conditions, cosmetic procedures | Intentional damage, contractual liabilities |

Which is better?

Pet health insurance provides coverage for veterinary bills, treatments, and preventive care, reducing out-of-pocket expenses for unexpected pet illnesses or injuries. Liability insurance protects against financial loss from legal claims due to property damage or bodily injury caused by the insured. Choosing between the two depends on personal needs: pet health insurance benefits pet owners prioritizing health expenses, while liability insurance is essential for individuals seeking protection from liability risks.

Connection

Pet health insurance and liability insurance are connected through their shared goal of managing financial risks associated with pet ownership. While pet health insurance covers veterinary expenses for illness or injury, liability insurance protects owners from legal and financial responsibility if their pet causes injury or property damage. Together, these policies provide comprehensive protection, combining medical care security with coverage against potential legal claims related to pets.

Key Terms

Coverage

Liability insurance primarily covers damages or injuries you cause to others, protecting your financial assets in legal claims, while pet health insurance specifically covers veterinary costs and medical treatments for your pets. Liability insurance often includes coverage for bodily injury and property damage, whereas pet health insurance focuses on illness, accident, and preventive care for animals. Discover detailed comparisons and benefits to choose the right protection tailored to your needs.

Premium

Liability insurance premiums are typically influenced by coverage limits and risk factors such as property value and claim history, while pet health insurance premiums depend on factors like your pet's breed, age, and pre-existing conditions. Liability insurance generally involves fixed premium rates based on policy terms, whereas pet health insurance premiums may fluctuate with changing pet health profiles and coverage levels. Explore detailed comparisons to determine which insurance premium structure suits your needs best.

Exclusions

Liability insurance often excludes damages caused intentionally or due to negligence, while pet health insurance typically excludes pre-existing conditions and routine care such as vaccinations and grooming. Understanding these exclusions helps policyholders anticipate out-of-pocket expenses and tailor coverage to their specific needs. Explore the detailed differences in exclusions to choose the best insurance plan for your pet's protection.

Source and External Links

What is Liability Car Insurance Coverage? - Liability insurance protects you financially if you're responsible for someone else's injuries or property damage during a covered accident and is legally required in almost every state; it covers bodily injury and property damage but does not cover your own injuries or vehicle repairs.

Liability Insurance - General Coverage for Your Business - General liability insurance protects businesses from claims related to bodily injuries, property damage, advertising injuries, and legal defense costs arising from normal business operations.

General Liability Insurance: Get a Free Quote - General liability insurance covers small businesses against claims for bodily injury, property damage, and personal or advertising injuries, including medical costs and legal expenses, helping protect businesses from financial risk.

dowidth.com

dowidth.com