Cyber insurance protects businesses from financial losses due to cyberattacks, data breaches, and other digital threats, covering expenses like legal fees and notification costs. Business interruption insurance compensates for lost income and operating expenses during periods when physical premises or operations are disrupted by events such as natural disasters or equipment failures. Explore the key differences and benefits of these insurance types to safeguard your business effectively.

Why it is important

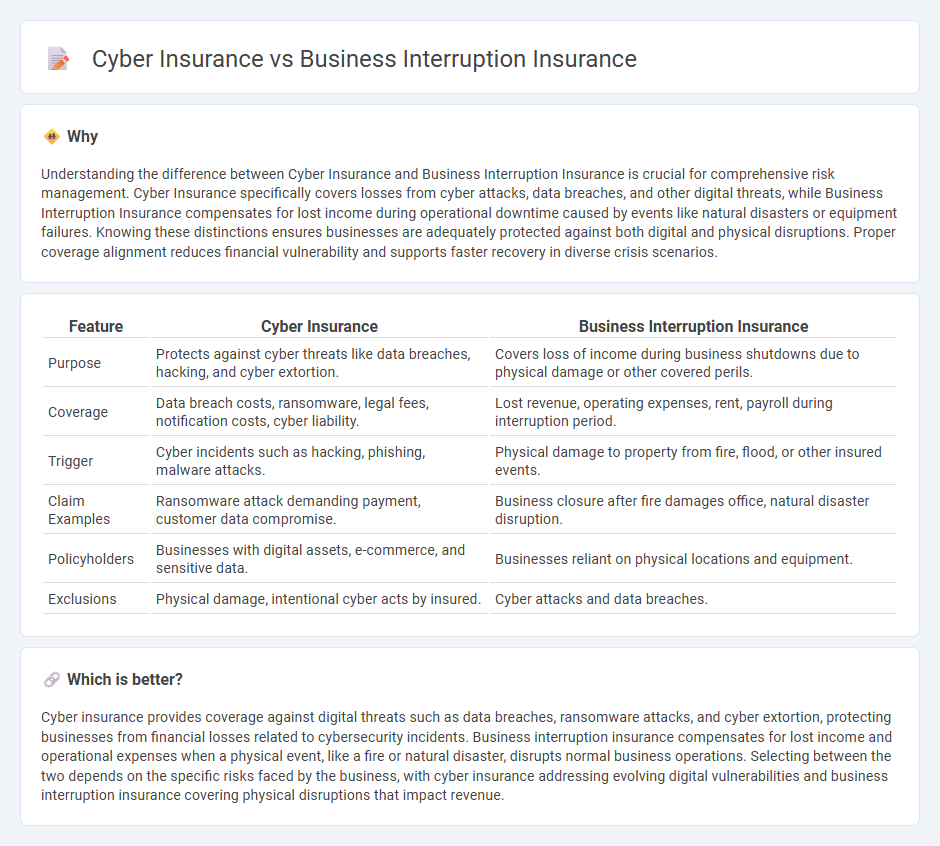

Understanding the difference between Cyber Insurance and Business Interruption Insurance is crucial for comprehensive risk management. Cyber Insurance specifically covers losses from cyber attacks, data breaches, and other digital threats, while Business Interruption Insurance compensates for lost income during operational downtime caused by events like natural disasters or equipment failures. Knowing these distinctions ensures businesses are adequately protected against both digital and physical disruptions. Proper coverage alignment reduces financial vulnerability and supports faster recovery in diverse crisis scenarios.

Comparison Table

| Feature | Cyber Insurance | Business Interruption Insurance |

|---|---|---|

| Purpose | Protects against cyber threats like data breaches, hacking, and cyber extortion. | Covers loss of income during business shutdowns due to physical damage or other covered perils. |

| Coverage | Data breach costs, ransomware, legal fees, notification costs, cyber liability. | Lost revenue, operating expenses, rent, payroll during interruption period. |

| Trigger | Cyber incidents such as hacking, phishing, malware attacks. | Physical damage to property from fire, flood, or other insured events. |

| Claim Examples | Ransomware attack demanding payment, customer data compromise. | Business closure after fire damages office, natural disaster disruption. |

| Policyholders | Businesses with digital assets, e-commerce, and sensitive data. | Businesses reliant on physical locations and equipment. |

| Exclusions | Physical damage, intentional cyber acts by insured. | Cyber attacks and data breaches. |

Which is better?

Cyber insurance provides coverage against digital threats such as data breaches, ransomware attacks, and cyber extortion, protecting businesses from financial losses related to cybersecurity incidents. Business interruption insurance compensates for lost income and operational expenses when a physical event, like a fire or natural disaster, disrupts normal business operations. Selecting between the two depends on the specific risks faced by the business, with cyber insurance addressing evolving digital vulnerabilities and business interruption insurance covering physical disruptions that impact revenue.

Connection

Cyber insurance and business interruption insurance are interconnected through their coverage of financial losses resulting from disruptions caused by cyberattacks. Cyber insurance specifically addresses risks like data breaches and ransomware, which can lead to operational downtime covered by business interruption insurance. This synergy ensures businesses are financially protected against revenue loss and extra expenses during cyber-related interruptions.

Key Terms

Coverage Scope

Business interruption insurance primarily covers financial losses due to physical damage or property destruction causing operational downtime, including lost income, ongoing expenses, and temporary relocation costs. Cyber insurance focuses on risks related to cyberattacks, data breaches, and network interruptions, offering coverage for data recovery, liability claims, and notification costs. Explore detailed comparisons to understand which policy best protects your business against specific operational and digital threats.

Trigger Events

Business interruption insurance primarily covers financial losses due to physical property damage or natural disasters disrupting operations, while cyber insurance addresses losses from data breaches, ransomware attacks, and other cyber incidents. Trigger events for business interruption include fire, flood, or equipment failure, whereas cyber insurance is activated by cybersecurity breaches, system failures, or cyber extortion. Explore detailed comparisons on coverage scope, claim processes, and risk mitigation strategies to understand which policy best suits your business needs.

Exclusions

Business interruption insurance typically excludes losses caused by cyberattacks such as data breaches, ransomware, and network failures, limiting coverage to physical damage-related disruptions. Cyber insurance specifically addresses these digital risks but often excludes incidents like physical damage or non-cyber-related business interruptions. Explore detailed policy comparisons to understand how exclusions impact your risk management strategy.

Source and External Links

Business Interruption Insurance: Coverage, Quotes & Policies - Business interruption insurance helps replace lost income and covers other expenses if a business must close temporarily due to a covered peril like fire, wind, or theft.

Insurance Topics | Business Interruption & Business Owner Policy - This coverage allows businesses to pay fixed expenses, including costs incurred while operating offsite, and offers optional riders for supply chain disruptions (contingent) or extended periods after property repair (extended).

What Is Business Interruption Insurance? - Business interruption insurance can cover lost revenue, rent, payroll, taxes, relocation, and extra expenses if a covered event forces a temporary shutdown.

dowidth.com

dowidth.com