Crop yield insurance guarantees compensation based on actual agricultural output, protecting farmers against losses in harvested crop volume due to weather, pests, or disease. Named peril insurance covers specific risks explicitly listed in the policy, such as hail, drought, or frost, leaving out any unmentioned hazards. Explore detailed comparisons and benefits of these insurance types to safeguard your farming investments effectively.

Why it is important

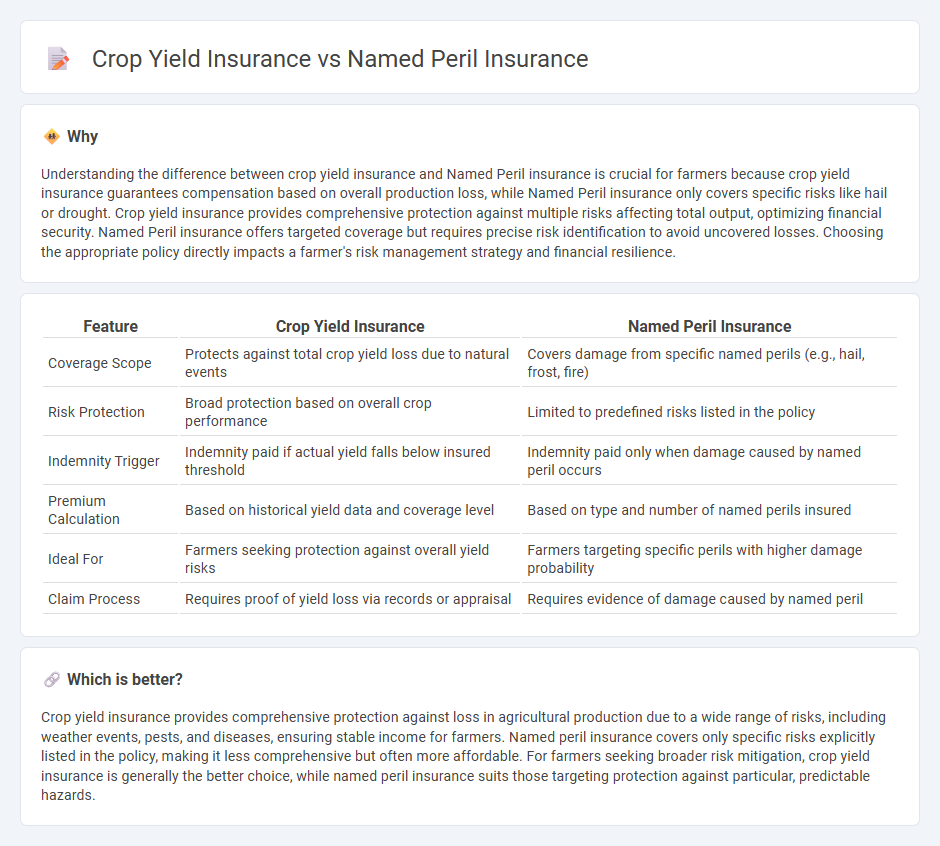

Understanding the difference between crop yield insurance and Named Peril insurance is crucial for farmers because crop yield insurance guarantees compensation based on overall production loss, while Named Peril insurance only covers specific risks like hail or drought. Crop yield insurance provides comprehensive protection against multiple risks affecting total output, optimizing financial security. Named Peril insurance offers targeted coverage but requires precise risk identification to avoid uncovered losses. Choosing the appropriate policy directly impacts a farmer's risk management strategy and financial resilience.

Comparison Table

| Feature | Crop Yield Insurance | Named Peril Insurance |

|---|---|---|

| Coverage Scope | Protects against total crop yield loss due to natural events | Covers damage from specific named perils (e.g., hail, frost, fire) |

| Risk Protection | Broad protection based on overall crop performance | Limited to predefined risks listed in the policy |

| Indemnity Trigger | Indemnity paid if actual yield falls below insured threshold | Indemnity paid only when damage caused by named peril occurs |

| Premium Calculation | Based on historical yield data and coverage level | Based on type and number of named perils insured |

| Ideal For | Farmers seeking protection against overall yield risks | Farmers targeting specific perils with higher damage probability |

| Claim Process | Requires proof of yield loss via records or appraisal | Requires evidence of damage caused by named peril |

Which is better?

Crop yield insurance provides comprehensive protection against loss in agricultural production due to a wide range of risks, including weather events, pests, and diseases, ensuring stable income for farmers. Named peril insurance covers only specific risks explicitly listed in the policy, making it less comprehensive but often more affordable. For farmers seeking broader risk mitigation, crop yield insurance is generally the better choice, while named peril insurance suits those targeting protection against particular, predictable hazards.

Connection

Crop yield insurance and named peril insurance are interconnected through their focus on protecting agricultural producers from specific risks that can damage crops and reduce harvest output. Named peril insurance offers coverage against distinct, listed hazards such as drought, hail, or frost, directly influencing the actual crop yield that crop yield insurance aims to safeguard. Together, these insurance types form a comprehensive risk management strategy, ensuring financial stability for farmers facing environmental uncertainties.

Key Terms

Covered Perils

Named peril insurance covers specific risks explicitly listed in the policy, such as hail, frost, or fire, providing protection only against those identified events. Crop yield insurance offers broader coverage based on actual production losses resulting from a variety of perils, often including weather conditions, pests, and diseases. Explore the detailed distinctions and coverage options to choose the best protection strategy for your agricultural operations.

Indemnity

Named peril insurance provides indemnity only when specific insured perils like drought, hail, or flood cause crop damage, limiting coverage to predefined risks. Crop yield insurance indemnifies based on actual yield loss compared to a guaranteed production level, offering a broader protection against various causes of yield reduction. Explore detailed comparisons to determine which indemnity type best suits your agricultural risk management needs.

Actual Production History (APH)

Actual Production History (APH) is crucial in crop yield insurance, providing a track record of a farmer's historical crop yields to establish expected production levels and calculate indemnity payments when yields fall below this benchmark. Named peril insurance covers specific risks like drought or hail but does not rely on APH data, instead focusing on damages caused by insured perils. To understand how APH influences crop yield insurance and its benefits over named peril coverage, explore the detailed comparisons and policy options.

Source and External Links

Named Perils vs. All Risks Explained in Plain English - Named peril insurance policies specifically list the perils covered, meaning coverage applies only for losses caused by those named perils, placing the burden on the insured to prove that the cause of loss matches a named peril in the policy.

Understanding Named Perils: What You Need to Know - Named peril coverage lists specific risks insured against, such as fire or theft, and covers losses from those events only, often at a lower premium than all-risk policies but without coverage for perils not explicitly named.

What Are Named Perils? - Lemonade Insurance - Named perils are specific damaging events listed in your insurance policy that, if they occur and cause loss to your property, trigger coverage for repair or replacement under the policy.

dowidth.com

dowidth.com