Pet health insurance covers veterinary expenses such as vaccinations, surgeries, and routine check-ups to ensure your pet's well-being, while long-term care insurance helps manage costs related to extended personal care services for chronic illnesses or disabilities. Both insurance types address specific health-related financial risks but cater to very different needs and beneficiaries. Explore the distinct benefits and coverage options of pet health insurance versus long-term care insurance to make an informed decision.

Why it is important

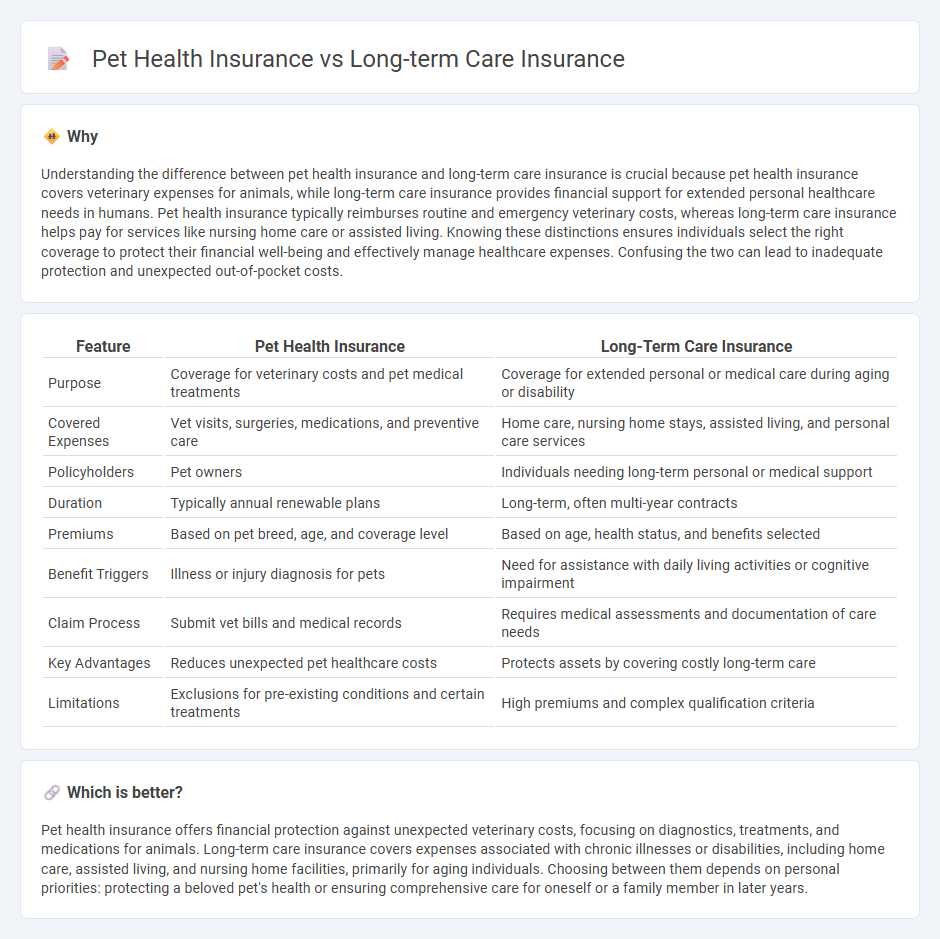

Understanding the difference between pet health insurance and long-term care insurance is crucial because pet health insurance covers veterinary expenses for animals, while long-term care insurance provides financial support for extended personal healthcare needs in humans. Pet health insurance typically reimburses routine and emergency veterinary costs, whereas long-term care insurance helps pay for services like nursing home care or assisted living. Knowing these distinctions ensures individuals select the right coverage to protect their financial well-being and effectively manage healthcare expenses. Confusing the two can lead to inadequate protection and unexpected out-of-pocket costs.

Comparison Table

| Feature | Pet Health Insurance | Long-Term Care Insurance |

|---|---|---|

| Purpose | Coverage for veterinary costs and pet medical treatments | Coverage for extended personal or medical care during aging or disability |

| Covered Expenses | Vet visits, surgeries, medications, and preventive care | Home care, nursing home stays, assisted living, and personal care services |

| Policyholders | Pet owners | Individuals needing long-term personal or medical support |

| Duration | Typically annual renewable plans | Long-term, often multi-year contracts |

| Premiums | Based on pet breed, age, and coverage level | Based on age, health status, and benefits selected |

| Benefit Triggers | Illness or injury diagnosis for pets | Need for assistance with daily living activities or cognitive impairment |

| Claim Process | Submit vet bills and medical records | Requires medical assessments and documentation of care needs |

| Key Advantages | Reduces unexpected pet healthcare costs | Protects assets by covering costly long-term care |

| Limitations | Exclusions for pre-existing conditions and certain treatments | High premiums and complex qualification criteria |

Which is better?

Pet health insurance offers financial protection against unexpected veterinary costs, focusing on diagnostics, treatments, and medications for animals. Long-term care insurance covers expenses associated with chronic illnesses or disabilities, including home care, assisted living, and nursing home facilities, primarily for aging individuals. Choosing between them depends on personal priorities: protecting a beloved pet's health or ensuring comprehensive care for oneself or a family member in later years.

Connection

Pet health insurance and long-term care insurance both address the financial challenges of ongoing medical needs, emphasizing risk management and cost control. They provide policyholders with coverage for extended care services, whether for chronic illnesses or aging-related conditions in pets and humans. These insurance types share the principle of promoting access to necessary healthcare without causing significant economic hardship.

Key Terms

Long-term care insurance:

Long-term care insurance provides financial coverage for services such as nursing home care, home health aides, and assisted living, which are essential for individuals with chronic illnesses or disabilities over an extended period. Unlike pet health insurance that covers veterinary expenses, long-term care insurance focuses on human healthcare needs related to aging and long-term disabilities. Explore how long-term care insurance can protect your future health and financial stability.

Benefit period

Long-term care insurance typically covers extended periods, often from several years up to a lifetime, providing financial support for chronic illness or disability-related care. Pet health insurance benefit periods vary widely, commonly offering annual or lifetime limits on veterinary expenses depending on the policy. Explore detailed comparisons to choose coverage tailored to your or your pet's specific health and care needs.

Elimination period

Long-term care insurance often features elimination periods ranging from 30 to 90 days, which require policyholders to cover care costs personally before benefits begin, emphasizing a waiting period tailored to human healthcare needs. Pet health insurance typically has shorter elimination periods, sometimes just a few days to a few weeks, allowing for quicker access to coverage after policy activation, reflecting the urgency in veterinary care. Explore detailed comparisons of elimination periods to choose the right insurance based on your care requirements and timing preferences.

Source and External Links

Long-Term Care Insurance Explained - This webpage provides an overview of how long-term care insurance works, including eligibility criteria and coverage details.

Long-term care costs & options - This article discusses various options for paying for long-term care, including government assistance and different types of insurance.

What is Long-term Care Insurance? - This webpage explains what long-term care insurance is and how it covers long-term services and supports in various settings.

dowidth.com

dowidth.com