Buy now insurance offers immediate coverage tailored to specific needs, ensuring protection from the moment of purchase. Supplementary insurance provides additional benefits that complement primary policies, covering gaps such as dental, vision, or critical illness expenses. Explore the differences to determine which option best suits your coverage requirements.

Why it is important

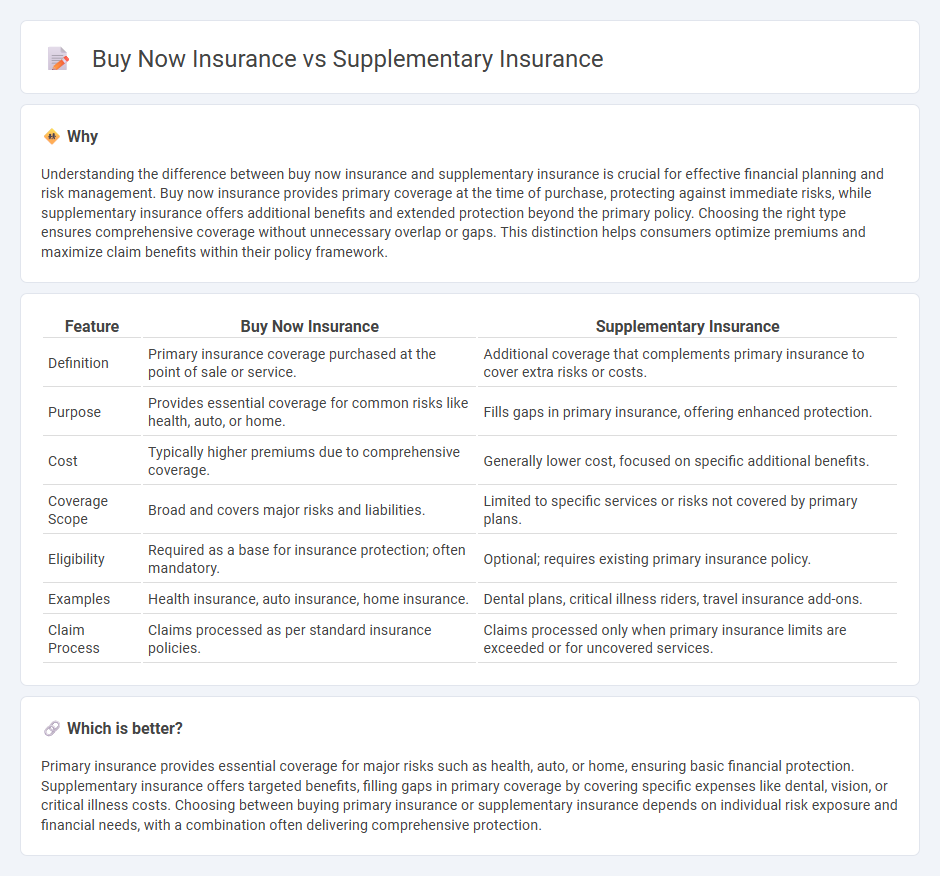

Understanding the difference between buy now insurance and supplementary insurance is crucial for effective financial planning and risk management. Buy now insurance provides primary coverage at the time of purchase, protecting against immediate risks, while supplementary insurance offers additional benefits and extended protection beyond the primary policy. Choosing the right type ensures comprehensive coverage without unnecessary overlap or gaps. This distinction helps consumers optimize premiums and maximize claim benefits within their policy framework.

Comparison Table

| Feature | Buy Now Insurance | Supplementary Insurance |

|---|---|---|

| Definition | Primary insurance coverage purchased at the point of sale or service. | Additional coverage that complements primary insurance to cover extra risks or costs. |

| Purpose | Provides essential coverage for common risks like health, auto, or home. | Fills gaps in primary insurance, offering enhanced protection. |

| Cost | Typically higher premiums due to comprehensive coverage. | Generally lower cost, focused on specific additional benefits. |

| Coverage Scope | Broad and covers major risks and liabilities. | Limited to specific services or risks not covered by primary plans. |

| Eligibility | Required as a base for insurance protection; often mandatory. | Optional; requires existing primary insurance policy. |

| Examples | Health insurance, auto insurance, home insurance. | Dental plans, critical illness riders, travel insurance add-ons. |

| Claim Process | Claims processed as per standard insurance policies. | Claims processed only when primary insurance limits are exceeded or for uncovered services. |

Which is better?

Primary insurance provides essential coverage for major risks such as health, auto, or home, ensuring basic financial protection. Supplementary insurance offers targeted benefits, filling gaps in primary coverage by covering specific expenses like dental, vision, or critical illness costs. Choosing between buying primary insurance or supplementary insurance depends on individual risk exposure and financial needs, with a combination often delivering comprehensive protection.

Connection

Buy now insurance offers immediate coverage for essential risks, while supplementary insurance enhances this protection by covering additional needs such as dental, vision, or critical illness. The integration of buy now insurance with supplementary plans ensures comprehensive risk management and fills coverage gaps that standard policies often overlook. This connection provides policyholders with customizable options to tailor insurance portfolios to their specific health and financial circumstances.

Key Terms

Coverage Scope

Supplementary insurance enhances existing health coverage by filling gaps such as copayments, deductibles, and services excluded from primary plans, whereas buy now insurance offers comprehensive, standalone protection typically encompassing health, life, or property coverage. Supplementary options are ideal for individuals seeking to minimize out-of-pocket expenses within specific areas, while buy now insurance provides broad financial security with upfront policy purchase. Explore detailed comparisons to determine the optimal coverage scope for your insurance needs.

Premium Cost

Supplementary insurance typically offers lower premium costs compared to buy now insurance due to its role in covering gaps left by primary policies, reducing overall out-of-pocket expenses. Buy now insurance often involves higher premiums as it provides comprehensive, standalone coverage without relying on existing plans. Explore detailed comparisons to determine which option best fits your financial and coverage needs.

Enrollment Timing

Supplementary insurance enrollment typically occurs during specific periods such as open enrollment or special enrollment windows, ensuring coverage aligns with existing primary insurance plans. Buy now insurance allows immediate purchase without waiting, providing flexible entry for those seeking instant protection. Explore our detailed guide to understand which enrollment timing suits your insurance needs best.

Source and External Links

Supplemental Health Insurance: What Is It & Do You Need it? - Supplemental health insurance covers treatments and services that standard health insurance plans may not cover, providing additional financial protection.

Dental, vision & more supplemental plans - UnitedHealthcare offers supplemental insurance plans for dental, vision, accident, critical illness, and hospital stays to complement primary health insurance.

Supplemental Insurance Plans - Anthem provides budget-friendly supplemental insurance for accident, critical illness, and hospital indemnity to enhance current medical coverage.

dowidth.com

dowidth.com