Crop yield insurance protects farmers against losses from reduced agricultural production due to pests, drought, or adverse weather conditions, ensuring financial stability throughout the growing season. Hail insurance specifically covers damages caused by hailstorms, which can severely impact crops in a short period. Explore the differences between these policies to find the best coverage for your farming needs.

Why it is important

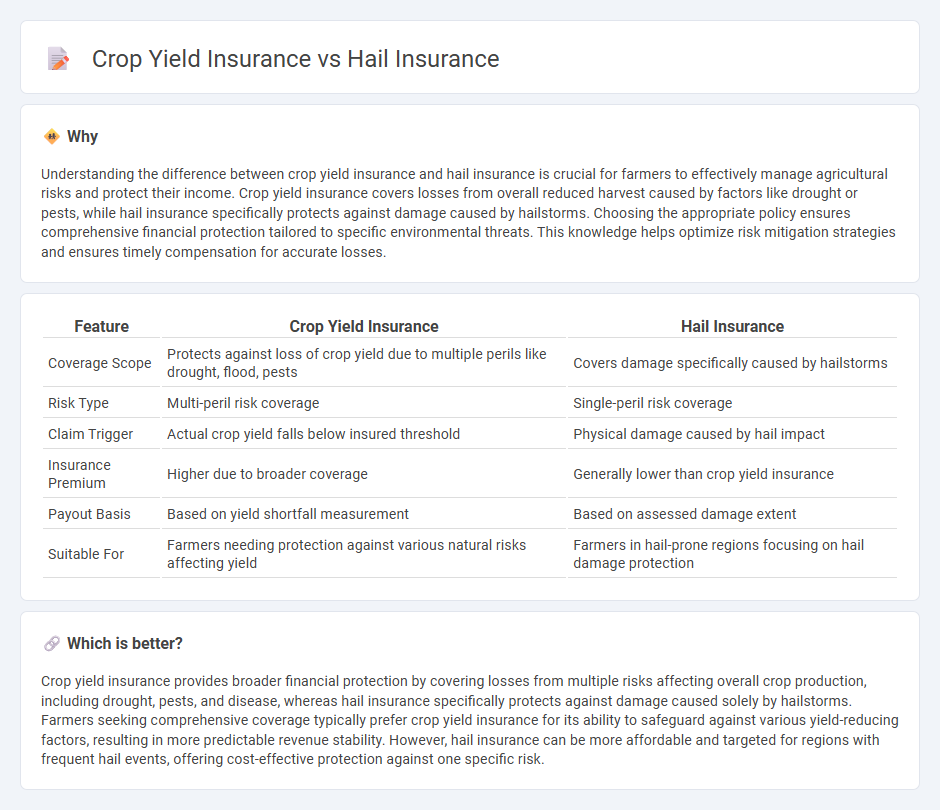

Understanding the difference between crop yield insurance and hail insurance is crucial for farmers to effectively manage agricultural risks and protect their income. Crop yield insurance covers losses from overall reduced harvest caused by factors like drought or pests, while hail insurance specifically protects against damage caused by hailstorms. Choosing the appropriate policy ensures comprehensive financial protection tailored to specific environmental threats. This knowledge helps optimize risk mitigation strategies and ensures timely compensation for accurate losses.

Comparison Table

| Feature | Crop Yield Insurance | Hail Insurance |

|---|---|---|

| Coverage Scope | Protects against loss of crop yield due to multiple perils like drought, flood, pests | Covers damage specifically caused by hailstorms |

| Risk Type | Multi-peril risk coverage | Single-peril risk coverage |

| Claim Trigger | Actual crop yield falls below insured threshold | Physical damage caused by hail impact |

| Insurance Premium | Higher due to broader coverage | Generally lower than crop yield insurance |

| Payout Basis | Based on yield shortfall measurement | Based on assessed damage extent |

| Suitable For | Farmers needing protection against various natural risks affecting yield | Farmers in hail-prone regions focusing on hail damage protection |

Which is better?

Crop yield insurance provides broader financial protection by covering losses from multiple risks affecting overall crop production, including drought, pests, and disease, whereas hail insurance specifically protects against damage caused solely by hailstorms. Farmers seeking comprehensive coverage typically prefer crop yield insurance for its ability to safeguard against various yield-reducing factors, resulting in more predictable revenue stability. However, hail insurance can be more affordable and targeted for regions with frequent hail events, offering cost-effective protection against one specific risk.

Connection

Crop yield insurance and hail insurance both serve as risk management tools protecting farmers from financial losses due to adverse weather conditions. Crop yield insurance compensates for low overall harvests caused by factors including drought, pests, and hail damage, while hail insurance specifically covers losses due to hailstorms impacting crops. Their connection lies in providing complementary coverage that safeguards agricultural income against variable weather-related risks.

Key Terms

Hail insurance:

Hail insurance specifically protects farmers against crop damage caused by hailstorms, covering losses from severe weather events that can devastate plant health and reduce harvest quality. This type of insurance typically offers faster claims processing and payouts tailored to hail-related damages, differing from crop yield insurance that covers broader yield losses due to multiple factors like drought or pests. Explore detailed coverage options and benefits of hail insurance to safeguard your agricultural investments effectively.

Named-peril coverage

Hail insurance specifically covers damages caused by hailstorms, providing farmers with targeted protection against this high-risk weather event, whereas crop yield insurance offers broader protection against multiple perils affecting overall crop performance. Named-peril coverage under hail insurance limits claims to only the hazards explicitly listed in the policy, often resulting in lower premiums but narrower protection compared to multi-peril yield insurance. Explore detailed differences and benefits to determine which insurance best suits your agricultural risk management needs.

Damage assessment

Hail insurance primarily covers damage caused by hailstorms, with damage assessment focusing on physical injury to crops, such as bruising, defoliation, and broken stems, which directly impact marketable produce. Crop yield insurance assesses losses in overall production due to a variety of perils, including drought, pests, or floods, using field inspections, satellite imagery, and yield data analysis to estimate financial indemnity. Explore more about how precise damage assessment methods influence insurance accuracy and farmer compensation strategies.

Source and External Links

Does car insurance cover hail damage? - Liberty Mutual - Comprehensive auto insurance generally covers hail damage, while liability-only policies do not, and filing a hail damage claim usually does not increase premiums.

Hail Insurance: Protection Before the Storm | AgCountry - Hail insurance for crops allows farmers to insure specific acres, customize coverage, and often includes protection against additional risks like fire and lightning, with carry-over coverage options between crop years.

How to Protect Your Car From Hail - Progressive - Comprehensive auto insurance typically covers hail damage, and securing your car in a garage or using a car cover can help prevent costly repairs.

dowidth.com

dowidth.com