Microinsurance offers affordable risk protection tailored for low-income individuals, providing coverage for health, life, and property with minimal premiums. Group insurance extends benefits to employees or members of an organization, leveraging collective bargaining to enhance coverage and reduce costs. Explore detailed comparisons to understand which insurance solution best fits your needs.

Why it is important

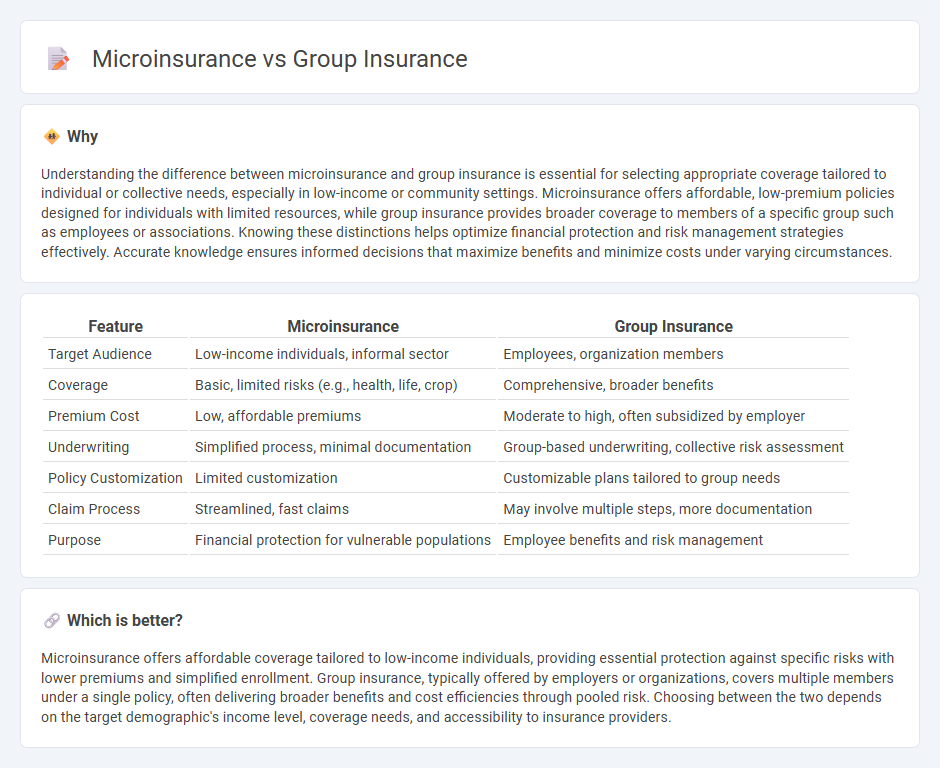

Understanding the difference between microinsurance and group insurance is essential for selecting appropriate coverage tailored to individual or collective needs, especially in low-income or community settings. Microinsurance offers affordable, low-premium policies designed for individuals with limited resources, while group insurance provides broader coverage to members of a specific group such as employees or associations. Knowing these distinctions helps optimize financial protection and risk management strategies effectively. Accurate knowledge ensures informed decisions that maximize benefits and minimize costs under varying circumstances.

Comparison Table

| Feature | Microinsurance | Group Insurance |

|---|---|---|

| Target Audience | Low-income individuals, informal sector | Employees, organization members |

| Coverage | Basic, limited risks (e.g., health, life, crop) | Comprehensive, broader benefits |

| Premium Cost | Low, affordable premiums | Moderate to high, often subsidized by employer |

| Underwriting | Simplified process, minimal documentation | Group-based underwriting, collective risk assessment |

| Policy Customization | Limited customization | Customizable plans tailored to group needs |

| Claim Process | Streamlined, fast claims | May involve multiple steps, more documentation |

| Purpose | Financial protection for vulnerable populations | Employee benefits and risk management |

Which is better?

Microinsurance offers affordable coverage tailored to low-income individuals, providing essential protection against specific risks with lower premiums and simplified enrollment. Group insurance, typically offered by employers or organizations, covers multiple members under a single policy, often delivering broader benefits and cost efficiencies through pooled risk. Choosing between the two depends on the target demographic's income level, coverage needs, and accessibility to insurance providers.

Connection

Microinsurance and group insurance both provide affordable risk protection by pooling resources among members to lower individual premiums. Microinsurance targets low-income populations with tailored coverage for health, life, and property, while group insurance offers benefits to members of an organization or community under a single policy. Their connection lies in leveraging collective risk management to increase accessibility and financial security for underserved groups.

Key Terms

Risk Pooling

Group insurance maximizes risk pooling by aggregating a large number of individuals under one policy, spreading risk evenly and reducing individual premiums. Microinsurance targets low-income populations with smaller risk pools but tailors coverage to specific risks, often using community-based models to enhance participation. Explore more insights into how these approaches impact coverage efficiency and affordability.

Premium Structure

Group insurance typically features a collective premium structure where costs are pooled among members, often resulting in lower individual premiums due to risk sharing. Microinsurance offers affordable, smaller premium payments tailored to low-income populations, with flexible payment schedules to accommodate irregular incomes. Explore the detailed differences in premium structures to choose the best insurance model for your needs.

Coverage Scope

Group insurance typically offers broad coverage designed for large employee groups, including health, life, and disability benefits, while microinsurance targets low-income populations with affordable, limited coverage often focused on specific risks such as health, agriculture, or property. The scope of group insurance covers extensive medical and financial protection, whereas microinsurance provides tailored, essential protection with streamlined claims processes to accommodate smaller premiums. Explore our detailed analysis to understand which insurance model best fits your organizational or personal needs.

Source and External Links

What is group insurance? Benefits and limitations [2025] - This article discusses how group insurance works, its benefits, and limitations compared to individual insurance.

What is Group Insurance & How Does It Work? - This webpage explains group insurance as a form of employee benefits, highlighting its cost advantages and enrollment process.

Group insurance - This Wikipedia page provides an overview of group insurance, including its international variations and types such as health and life insurance.

dowidth.com

dowidth.com