Pay-as-you-drive insurance calculates premiums based on actual miles driven, offering cost savings for low-mileage drivers and promoting fuel-efficient trips. Black box insurance uses a telematics device to monitor driving behavior such as speed, braking patterns, and acceleration, enabling insurers to tailor rates based on driving safety and habits. Discover how these innovative insurance models can personalize your coverage and reduce costs.

Why it is important

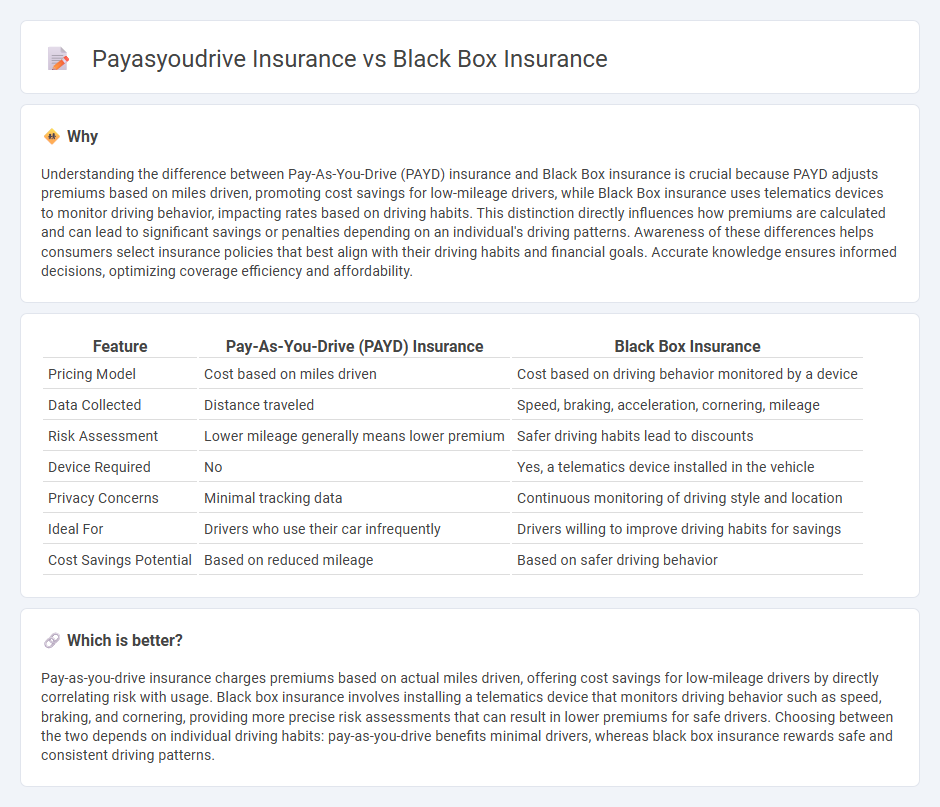

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and Black Box insurance is crucial because PAYD adjusts premiums based on miles driven, promoting cost savings for low-mileage drivers, while Black Box insurance uses telematics devices to monitor driving behavior, impacting rates based on driving habits. This distinction directly influences how premiums are calculated and can lead to significant savings or penalties depending on an individual's driving patterns. Awareness of these differences helps consumers select insurance policies that best align with their driving habits and financial goals. Accurate knowledge ensures informed decisions, optimizing coverage efficiency and affordability.

Comparison Table

| Feature | Pay-As-You-Drive (PAYD) Insurance | Black Box Insurance |

|---|---|---|

| Pricing Model | Cost based on miles driven | Cost based on driving behavior monitored by a device |

| Data Collected | Distance traveled | Speed, braking, acceleration, cornering, mileage |

| Risk Assessment | Lower mileage generally means lower premium | Safer driving habits lead to discounts |

| Device Required | No | Yes, a telematics device installed in the vehicle |

| Privacy Concerns | Minimal tracking data | Continuous monitoring of driving style and location |

| Ideal For | Drivers who use their car infrequently | Drivers willing to improve driving habits for savings |

| Cost Savings Potential | Based on reduced mileage | Based on safer driving behavior |

Which is better?

Pay-as-you-drive insurance charges premiums based on actual miles driven, offering cost savings for low-mileage drivers by directly correlating risk with usage. Black box insurance involves installing a telematics device that monitors driving behavior such as speed, braking, and cornering, providing more precise risk assessments that can result in lower premiums for safe drivers. Choosing between the two depends on individual driving habits: pay-as-you-drive benefits minimal drivers, whereas black box insurance rewards safe and consistent driving patterns.

Connection

Pay-as-you-drive insurance and black box insurance are connected through their reliance on telematics technology, which uses a device installed in the vehicle to monitor driving behavior, mileage, and speed. Both insurance models offer personalized premiums based on actual driving data, encouraging safer driving habits and potentially lowering costs for policyholders. This data-driven approach enhances risk assessment accuracy and allows insurers to tailor policies more effectively.

Key Terms

Telematics Device

Black box insurance utilizes a telematics device installed in the vehicle to monitor driving behavior, including speed, acceleration, and braking patterns, enabling insurers to tailor premiums based on actual risk. Pay-as-you-drive insurance also leverages telematics technology but emphasizes charging customers according to the number of miles driven, rewarding low mileage with lower costs. Discover how telematics devices are transforming auto insurance models and offering personalized savings.

Driving Behavior Monitoring

Black box insurance utilizes telematics devices to continuously monitor driving behavior such as speed, braking patterns, and cornering, enabling precise assessment of risk and personalized premium adjustments. Pay-as-you-drive insurance charges consumers based on actual miles driven combined with behavior data, rewarding safer and less frequent drivers with lower costs. Explore how these innovative models can optimize your insurance payments by learning more about driving behavior monitoring technologies.

Mileage-Based Premiums

Black box insurance uses telematics devices to monitor driving behavior, offering personalized premiums based on factors like speed, braking, and mileage, while pay-as-you-drive insurance primarily calculates premiums solely on miles driven. Mileage-based premiums in pay-as-you-drive insurance provide direct cost savings by charging policyholders only for the distance they drive, making it ideal for low-mileage drivers. Explore further to understand which mileage-focused insurance model best suits your driving habits and saving goals.

Source and External Links

Black Boxes in Cars: A Complete Guide - This guide explains how black box insurance works, including its ability to tailor premiums based on driving behavior and safety.

What is Black Box Car Insurance & How Does it Work? - This article explores the mechanics of black box insurance, focusing on how it tracks driving habits to provide discounts for safe drivers.

Telematics Car Insurance | Black Box Insurance - AIG's telematics insurance uses a black box to monitor driving, offering rewards for safe driving and additional safety features.

dowidth.com

dowidth.com