Peer-to-peer insurance pools resources from individuals to share risk collectively, reducing reliance on traditional insurers and often lowering premiums. Self-insurance involves setting aside funds independently to cover potential losses, providing more control but requiring significant financial discipline. Explore the differences between these models to determine which suits your risk management strategy best.

Why it is important

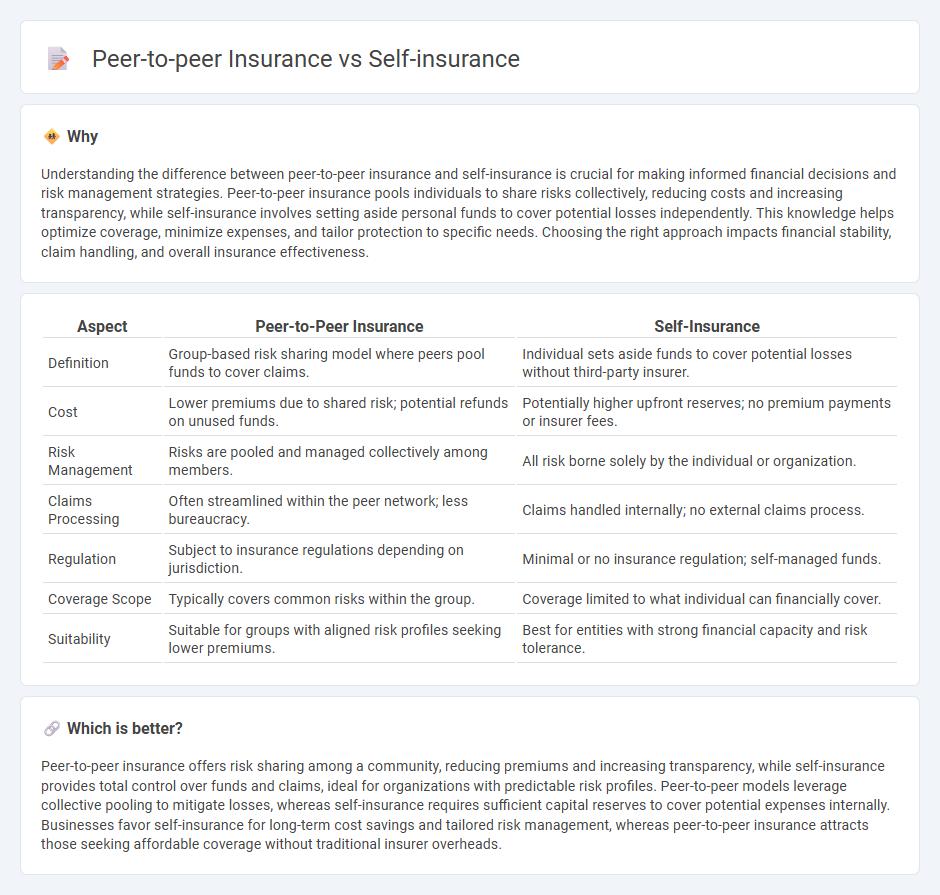

Understanding the difference between peer-to-peer insurance and self-insurance is crucial for making informed financial decisions and risk management strategies. Peer-to-peer insurance pools individuals to share risks collectively, reducing costs and increasing transparency, while self-insurance involves setting aside personal funds to cover potential losses independently. This knowledge helps optimize coverage, minimize expenses, and tailor protection to specific needs. Choosing the right approach impacts financial stability, claim handling, and overall insurance effectiveness.

Comparison Table

| Aspect | Peer-to-Peer Insurance | Self-Insurance |

|---|---|---|

| Definition | Group-based risk sharing model where peers pool funds to cover claims. | Individual sets aside funds to cover potential losses without third-party insurer. |

| Cost | Lower premiums due to shared risk; potential refunds on unused funds. | Potentially higher upfront reserves; no premium payments or insurer fees. |

| Risk Management | Risks are pooled and managed collectively among members. | All risk borne solely by the individual or organization. |

| Claims Processing | Often streamlined within the peer network; less bureaucracy. | Claims handled internally; no external claims process. |

| Regulation | Subject to insurance regulations depending on jurisdiction. | Minimal or no insurance regulation; self-managed funds. |

| Coverage Scope | Typically covers common risks within the group. | Coverage limited to what individual can financially cover. |

| Suitability | Suitable for groups with aligned risk profiles seeking lower premiums. | Best for entities with strong financial capacity and risk tolerance. |

Which is better?

Peer-to-peer insurance offers risk sharing among a community, reducing premiums and increasing transparency, while self-insurance provides total control over funds and claims, ideal for organizations with predictable risk profiles. Peer-to-peer models leverage collective pooling to mitigate losses, whereas self-insurance requires sufficient capital reserves to cover potential expenses internally. Businesses favor self-insurance for long-term cost savings and tailored risk management, whereas peer-to-peer insurance attracts those seeking affordable coverage without traditional insurer overheads.

Connection

Peer-to-peer insurance and self-insurance are connected through their shared focus on risk-sharing among individuals rather than traditional insurers. Both models empower policyholders to retain more control over their coverage and potential claims costs by pooling funds directly or setting aside reserves. This approach reduces dependence on conventional insurance companies, promoting transparency and potentially lowering premiums.

Key Terms

Risk Pooling

Self-insurance involves individuals or organizations setting aside funds to cover their own risks without transferring them to an insurer, leading to personal risk retention but greater control over risk pooling. Peer-to-peer insurance pools resources from members within a community to collectively cover losses, offering shared risk and potentially lower costs due to reduced administrative fees. Explore the nuances of risk pooling in both models to determine which aligns best with your risk management strategy.

Claims Management

Self-insurance allows organizations to retain risk internally, streamlining claims management by eliminating third-party insurers and enabling direct control over claims processing and settlement. Peer-to-peer insurance leverages group risk sharing, enhancing transparency and reducing fraud through collective oversight and decentralized claims assessment. Explore the nuances of claims management in these models to optimize risk handling strategies effectively.

Capital Requirements

Self-insurance requires significant capital reserves to cover potential claims, ensuring financial stability without relying on external insurers. Peer-to-peer insurance pools capital from members, distributing risk while typically maintaining lower individual capital requirements. Explore the detailed differences to understand which model suits your financial strategy best.

Source and External Links

Self-insurance - Wikipedia - A risk management method where an organization retains and manages risk internally instead of purchasing third-party insurance, setting aside its own funds to cover potential future losses.

What Is the Difference between Self-Insurance and Captive Insurance - Companies that self-insure use their own finances to pay for future claims, which can reduce costs compared to traditional insurance but carries the risk of insufficient funds for large or unexpected losses.

Self-Insurance - Florida Highway Safety and Motor Vehicles - Qualifying as a self-insured entity means you are directly financially responsible for covered losses, rather than having a traditional insurance policy, with specific financial and documentation requirements mandated by law.

dowidth.com

dowidth.com