Crop insurance provides financial protection to farmers against losses caused by natural disasters, pests, or adverse weather conditions, ensuring stability in agricultural income. Life insurance offers financial security to beneficiaries by providing a death benefit in the event of the policyholder's passing, supporting long-term financial planning and family protection. Explore more to understand how each insurance type safeguards different aspects of your livelihood.

Why it is important

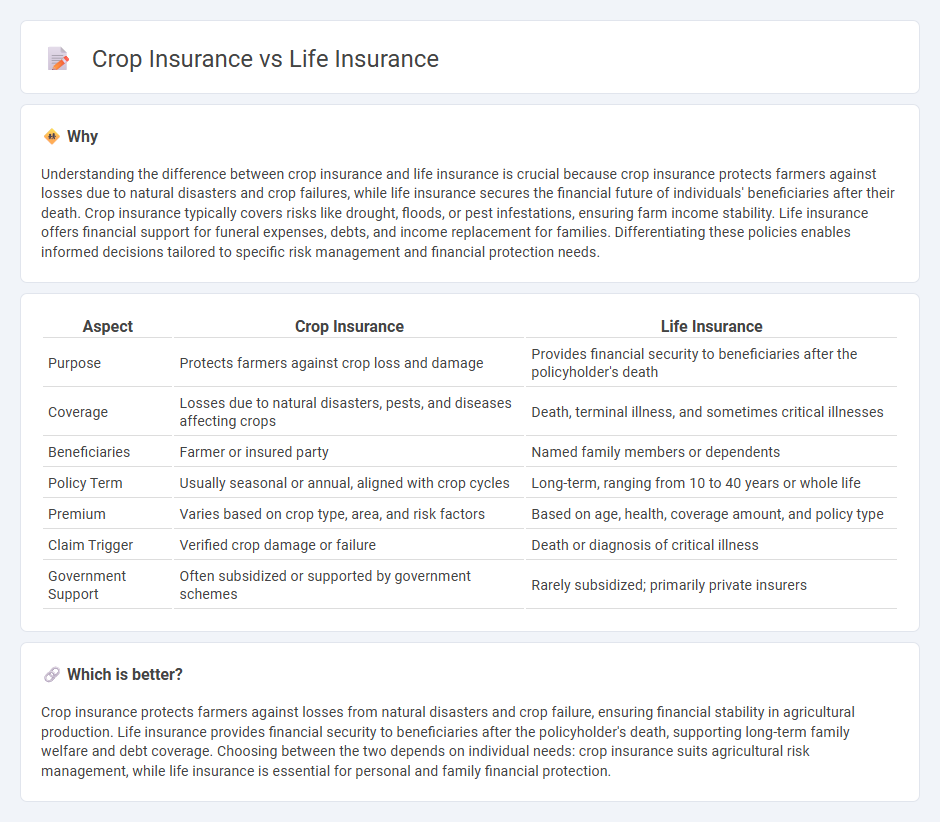

Understanding the difference between crop insurance and life insurance is crucial because crop insurance protects farmers against losses due to natural disasters and crop failures, while life insurance secures the financial future of individuals' beneficiaries after their death. Crop insurance typically covers risks like drought, floods, or pest infestations, ensuring farm income stability. Life insurance offers financial support for funeral expenses, debts, and income replacement for families. Differentiating these policies enables informed decisions tailored to specific risk management and financial protection needs.

Comparison Table

| Aspect | Crop Insurance | Life Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss and damage | Provides financial security to beneficiaries after the policyholder's death |

| Coverage | Losses due to natural disasters, pests, and diseases affecting crops | Death, terminal illness, and sometimes critical illnesses |

| Beneficiaries | Farmer or insured party | Named family members or dependents |

| Policy Term | Usually seasonal or annual, aligned with crop cycles | Long-term, ranging from 10 to 40 years or whole life |

| Premium | Varies based on crop type, area, and risk factors | Based on age, health, coverage amount, and policy type |

| Claim Trigger | Verified crop damage or failure | Death or diagnosis of critical illness |

| Government Support | Often subsidized or supported by government schemes | Rarely subsidized; primarily private insurers |

Which is better?

Crop insurance protects farmers against losses from natural disasters and crop failure, ensuring financial stability in agricultural production. Life insurance provides financial security to beneficiaries after the policyholder's death, supporting long-term family welfare and debt coverage. Choosing between the two depends on individual needs: crop insurance suits agricultural risk management, while life insurance is essential for personal and family financial protection.

Connection

Crop insurance and life insurance share the core principle of risk management by providing financial protection against unforeseen events that threaten income or livelihood. Both insurance types mitigate potential losses: crop insurance safeguards farmers against agricultural risks like drought or pests, while life insurance secures beneficiaries' financial stability after the policyholder's death. By transferring risk to insurers, these policies help individuals and families maintain economic resilience in uncertain circumstances.

Key Terms

Beneficiary

Life insurance designates a specific beneficiary, typically an individual or family member, who receives the payout upon the policyholder's death, providing financial security and support. Crop insurance benefits the policyholder, such as a farmer or agricultural business, by covering losses from crop damage or failure, ensuring stability in agricultural income. Explore more to understand how each insurance type protects its beneficiaries uniquely.

Sum Assured

Life insurance typically offers a fixed sum assured based on the insured individual's age, income, and policy type, ensuring financial security for beneficiaries. Crop insurance provides coverage based on the insured acreage, crop type, and potential yield loss, safeguarding farmers against unpredictable agricultural risks. Explore detailed comparisons to understand which insurance best protects your assets.

Indemnity

Life insurance provides financial protection to beneficiaries based on the insured's death or specified events, ensuring a predetermined sum is paid out. Crop insurance offers indemnity by compensating farmers for losses or damages to crops due to risks like weather, pests, or disease, typically based on actual loss assessments or predefined yields. Explore the key differences in indemnity mechanisms and benefits further to make an informed decision.

Source and External Links

Allstate Life Insurance - Offers various life insurance options, including term and permanent policies, to provide financial protection for loved ones.

Aflac Life Insurance - Provides term, whole, and final expense life insurance policies with flexible coverage options.

GEICO Life Insurance - Offers affordable life insurance policies with options for term, whole, and universal life insurance to suit different needs.

dowidth.com

dowidth.com