Digital nomad insurance offers comprehensive coverage tailored for individuals frequently traveling and working from various international locations, focusing on health, travel disruptions, and equipment protection. Remote worker insurance primarily addresses risks related to working from a fixed home office or a single location, emphasizing liability, cyber threats, and employer-related benefits. Discover the key differences and choose the best insurance plan suited to your work lifestyle.

Why it is important

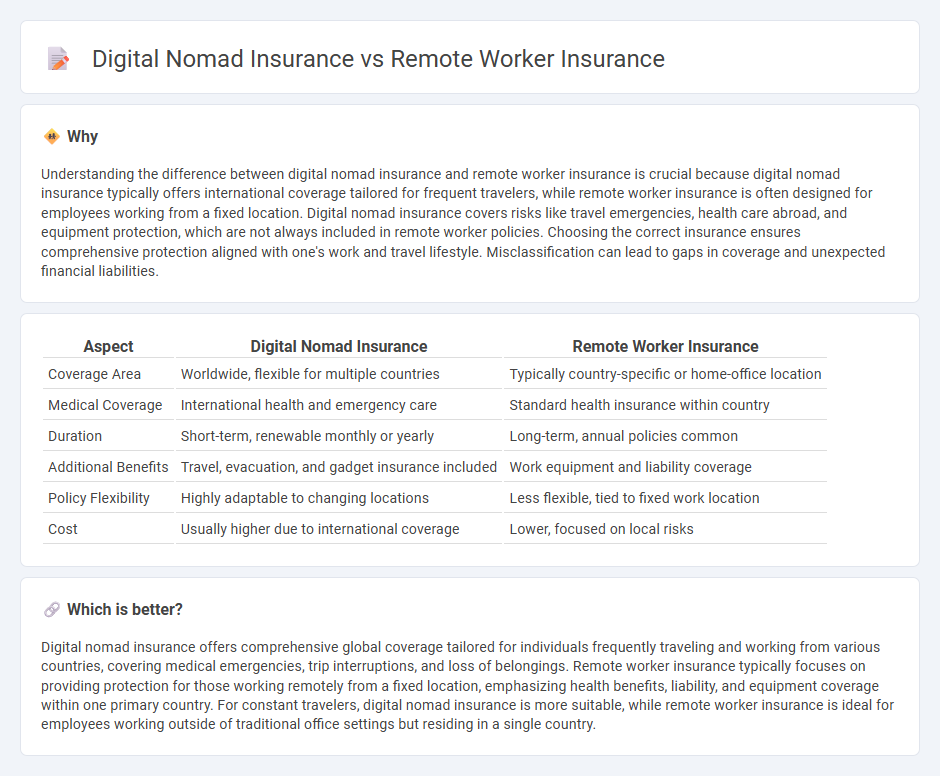

Understanding the difference between digital nomad insurance and remote worker insurance is crucial because digital nomad insurance typically offers international coverage tailored for frequent travelers, while remote worker insurance is often designed for employees working from a fixed location. Digital nomad insurance covers risks like travel emergencies, health care abroad, and equipment protection, which are not always included in remote worker policies. Choosing the correct insurance ensures comprehensive protection aligned with one's work and travel lifestyle. Misclassification can lead to gaps in coverage and unexpected financial liabilities.

Comparison Table

| Aspect | Digital Nomad Insurance | Remote Worker Insurance |

|---|---|---|

| Coverage Area | Worldwide, flexible for multiple countries | Typically country-specific or home-office location |

| Medical Coverage | International health and emergency care | Standard health insurance within country |

| Duration | Short-term, renewable monthly or yearly | Long-term, annual policies common |

| Additional Benefits | Travel, evacuation, and gadget insurance included | Work equipment and liability coverage |

| Policy Flexibility | Highly adaptable to changing locations | Less flexible, tied to fixed work location |

| Cost | Usually higher due to international coverage | Lower, focused on local risks |

Which is better?

Digital nomad insurance offers comprehensive global coverage tailored for individuals frequently traveling and working from various countries, covering medical emergencies, trip interruptions, and loss of belongings. Remote worker insurance typically focuses on providing protection for those working remotely from a fixed location, emphasizing health benefits, liability, and equipment coverage within one primary country. For constant travelers, digital nomad insurance is more suitable, while remote worker insurance is ideal for employees working outside of traditional office settings but residing in a single country.

Connection

Digital nomad insurance and remote worker insurance both address the unique risks faced by professionals working outside traditional office settings, providing coverage for health, travel, and liability. These specialized insurance policies often include global health insurance, equipment protection, and emergency evacuation services tailored to mobile lifestyles. By combining elements of travel and professional insurance, they ensure comprehensive risk management for individuals working remotely across different regions.

Key Terms

Coverage Scope

Remote worker insurance typically covers workplace injuries, equipment loss, and liability within a fixed location, emphasizing protection tied to a home or office environment. Digital nomad insurance offers broader global coverage, including health, travel disruptions, and gear protection across multiple countries and varied work settings. Explore the differences in coverage scope to select the insurance that best matches your remote or nomadic lifestyle needs.

Geographic Limitations

Remote worker insurance typically covers employees working from a fixed home location within their country, often imposing geographic restrictions tied to their registered address. Digital nomad insurance caters to highly mobile individuals, offering flexible coverage across multiple countries and continents without strict location limits. Explore detailed comparisons to find the best insurance suited to your geographic lifestyle.

Policy Duration

Remote worker insurance typically offers flexible policy durations tailored to longer-term employment spans, often ranging from six months to multiple years, providing stability and consistent coverage for individuals working remotely from a fixed location. Digital nomad insurance prioritizes short-term, customizable policies that can be extended or adjusted monthly to accommodate frequent travel and changing destinations, ensuring continuous protection across borders. Explore detailed comparisons to choose the policy duration that best suits your unique lifestyle and coverage needs.

Source and External Links

Workers' Comp for Remote Employees: Here's What You Need to Know - Remote workers are typically covered under workers' compensation policies if injury or illness occurs during work tasks, with employers responsible for ensuring a safe remote work environment despite not controlling the home setting.

How to Handle Health Benefits for Remote Workers - Employers can provide health benefits to remote workers through traditional insurance, health stipends, or by working with local partners and global Professional Employment Organizations (PEOs) for international coverage.

How to Offer Health Insurance to Multi-State Remote Workers - Health reimbursement arrangements (HRAs), especially Qualified Small Employer HRAs (QSEHRA), offer flexible, employer-funded solutions that reimburse remote workers tax-free for individual health insurance premiums and expenses.

dowidth.com

dowidth.com