Pet insurance platforms specialize in offering coverage tailored to veterinary care, accidents, and illnesses specific to domestic animals, ensuring comprehensive health protection for pets. Marine insurance platforms focus on safeguarding vessels, cargo, and maritime liabilities, addressing risks associated with sea transport and shipping activities. Explore the key differences and benefits of each insurance type to find the best solution for your needs.

Why it is important

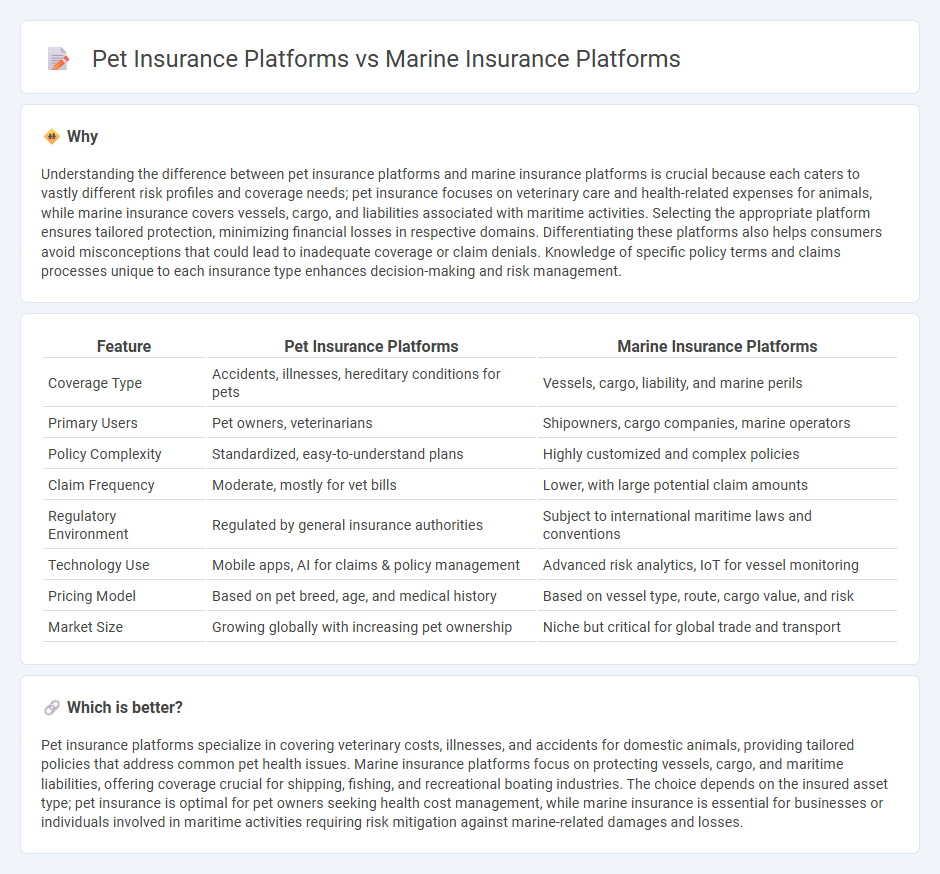

Understanding the difference between pet insurance platforms and marine insurance platforms is crucial because each caters to vastly different risk profiles and coverage needs; pet insurance focuses on veterinary care and health-related expenses for animals, while marine insurance covers vessels, cargo, and liabilities associated with maritime activities. Selecting the appropriate platform ensures tailored protection, minimizing financial losses in respective domains. Differentiating these platforms also helps consumers avoid misconceptions that could lead to inadequate coverage or claim denials. Knowledge of specific policy terms and claims processes unique to each insurance type enhances decision-making and risk management.

Comparison Table

| Feature | Pet Insurance Platforms | Marine Insurance Platforms |

|---|---|---|

| Coverage Type | Accidents, illnesses, hereditary conditions for pets | Vessels, cargo, liability, and marine perils |

| Primary Users | Pet owners, veterinarians | Shipowners, cargo companies, marine operators |

| Policy Complexity | Standardized, easy-to-understand plans | Highly customized and complex policies |

| Claim Frequency | Moderate, mostly for vet bills | Lower, with large potential claim amounts |

| Regulatory Environment | Regulated by general insurance authorities | Subject to international maritime laws and conventions |

| Technology Use | Mobile apps, AI for claims & policy management | Advanced risk analytics, IoT for vessel monitoring |

| Pricing Model | Based on pet breed, age, and medical history | Based on vessel type, route, cargo value, and risk |

| Market Size | Growing globally with increasing pet ownership | Niche but critical for global trade and transport |

Which is better?

Pet insurance platforms specialize in covering veterinary costs, illnesses, and accidents for domestic animals, providing tailored policies that address common pet health issues. Marine insurance platforms focus on protecting vessels, cargo, and maritime liabilities, offering coverage crucial for shipping, fishing, and recreational boating industries. The choice depends on the insured asset type; pet insurance is optimal for pet owners seeking health cost management, while marine insurance is essential for businesses or individuals involved in maritime activities requiring risk mitigation against marine-related damages and losses.

Connection

Pet insurance platforms and marine insurance platforms both leverage advanced risk assessment algorithms and data analytics to customize coverage and optimize premium pricing. These platforms utilize digital claims processing systems and customer engagement tools to enhance user experience and operational efficiency across diverse insurance sectors. Integration of IoT devices and telematics data in both platforms enables real-time monitoring and proactive risk management, facilitating more accurate underwriting and fraud detection.

Key Terms

**Marine Insurance Platforms:**

Marine insurance platforms specialize in coverage for cargo, vessels, and offshore risks, utilizing advanced risk assessment models tailored to maritime operations. These platforms integrate real-time tracking data and weather analytics to optimize policy management and claims processing for shipping companies, shipowners, and freight carriers. Discover how cutting-edge marine insurance platforms enhance maritime risk mitigation and operational efficiency.

Hull Coverage

Marine insurance platforms specializing in Hull Coverage provide tailored policies that protect the physical integrity of vessels against risks such as collision, weather damage, and piracy. Pet insurance platforms, by contrast, focus on medical coverage for pets and typically do not offer protection for physical damage like hull insurance. Explore the unique features and benefits of each platform to understand which best suits your insurance needs.

Cargo Insurance

Marine insurance platforms specialize in cargo insurance by providing comprehensive coverage for goods in transit over sea, addressing risks such as damage, theft, and loss during shipment. These platforms leverage real-time tracking, risk assessment algorithms, and tailored policies suited for global shipping logistics to minimize financial exposure for importers and exporters. Explore how advanced marine insurance platforms enhance cargo protection and streamline claims management for international trade.

Source and External Links

Marine Insurance Software - ScienceSoft - Offers automated underwriting, policy administration, claim resolution, and fraud detection capabilities for maritime insurers.

Comprehensive Marine Insurance Coverage | Alliant - Provides expert marine insurance broking services covering ships, cargo, terminals, and other marine properties.

Marine | Zurich Insurance - Offers tailored marine insurance solutions through platforms like Zurich Swift Marine Cargo for managing cargo insurance online.

dowidth.com

dowidth.com