On-demand insurance offers flexible, pay-as-you-go coverage tailored to immediate needs, whereas subscription insurance provides continuous protection through regular, fixed payments. On-demand plans are ideal for occasional use, while subscription models suit consistent, long-term insurance requirements. Explore the key differences to determine which insurance type best aligns with your lifestyle.

Why it is important

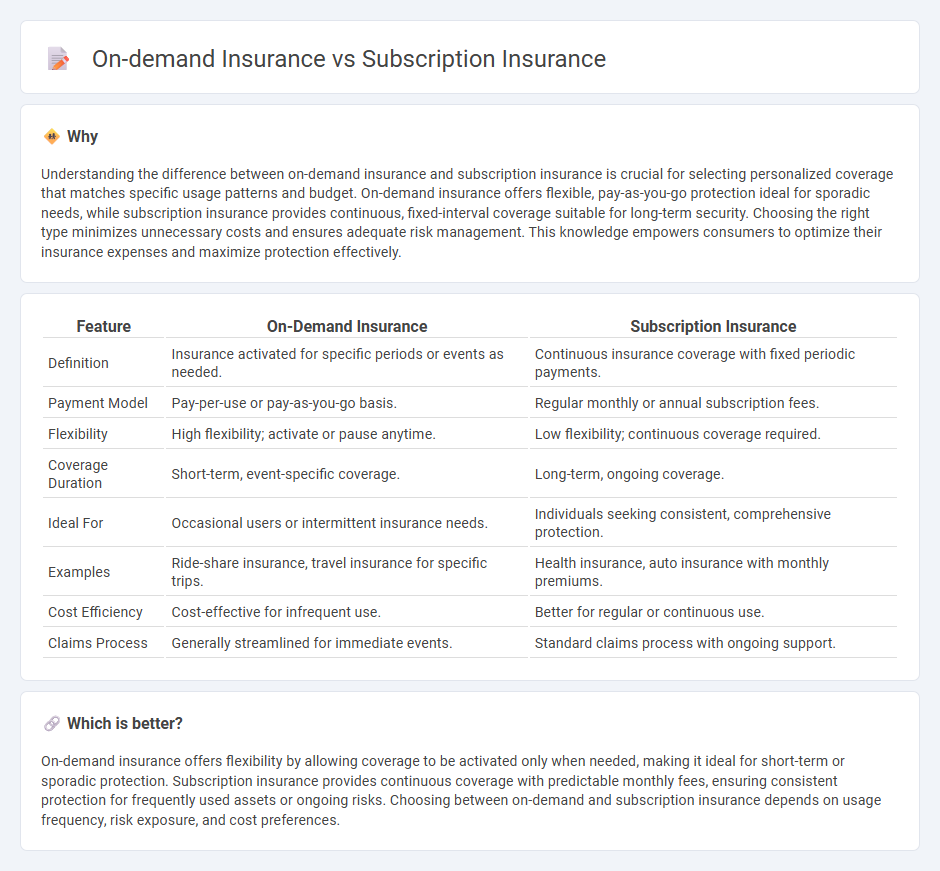

Understanding the difference between on-demand insurance and subscription insurance is crucial for selecting personalized coverage that matches specific usage patterns and budget. On-demand insurance offers flexible, pay-as-you-go protection ideal for sporadic needs, while subscription insurance provides continuous, fixed-interval coverage suitable for long-term security. Choosing the right type minimizes unnecessary costs and ensures adequate risk management. This knowledge empowers consumers to optimize their insurance expenses and maximize protection effectively.

Comparison Table

| Feature | On-Demand Insurance | Subscription Insurance |

|---|---|---|

| Definition | Insurance activated for specific periods or events as needed. | Continuous insurance coverage with fixed periodic payments. |

| Payment Model | Pay-per-use or pay-as-you-go basis. | Regular monthly or annual subscription fees. |

| Flexibility | High flexibility; activate or pause anytime. | Low flexibility; continuous coverage required. |

| Coverage Duration | Short-term, event-specific coverage. | Long-term, ongoing coverage. |

| Ideal For | Occasional users or intermittent insurance needs. | Individuals seeking consistent, comprehensive protection. |

| Examples | Ride-share insurance, travel insurance for specific trips. | Health insurance, auto insurance with monthly premiums. |

| Cost Efficiency | Cost-effective for infrequent use. | Better for regular or continuous use. |

| Claims Process | Generally streamlined for immediate events. | Standard claims process with ongoing support. |

Which is better?

On-demand insurance offers flexibility by allowing coverage to be activated only when needed, making it ideal for short-term or sporadic protection. Subscription insurance provides continuous coverage with predictable monthly fees, ensuring consistent protection for frequently used assets or ongoing risks. Choosing between on-demand and subscription insurance depends on usage frequency, risk exposure, and cost preferences.

Connection

On-demand insurance and subscription insurance both offer flexible, customer-focused coverage models driven by digital technology and real-time data analytics. On-demand insurance provides coverage for specific events or short periods, allowing users to activate policies instantly, while subscription insurance delivers continuous, recurring coverage for broader protection through regular payments. Both models leverage mobile apps and AI to enhance user experience, reduce costs, and adapt insurance policies to evolving customer needs.

Key Terms

Premium Structure

Subscription insurance features a fixed monthly or annual premium, offering predictable costs and continuous coverage without interruptions. On-demand insurance charges premiums based on actual usage or the specific time frame of coverage, providing flexibility and cost efficiency for sporadic needs. Explore more to determine which premium structure aligns best with your insurance requirements.

Coverage Period

Subscription insurance offers continuous, month-to-month coverage ideal for ongoing protection with predictable payments, while on-demand insurance provides flexible, short-term coverage activated only when needed, often by the hour or day. Subscription plans typically cover a wide array of incidents throughout the entire billing cycle, whereas on-demand insurance limits coverage to specific time frames tailored to precise usage. Discover which insurance model aligns best with your lifestyle and risk management needs.

Flexibility

Subscription insurance offers continuous, predictable coverage with regular payments, ideal for long-term protection needs and budget planning. On-demand insurance provides high flexibility by allowing users to activate and deactivate coverage instantly based on specific time frames or events, perfect for occasional or short-term use. Explore detailed comparisons to determine which insurance model best suits your flexibility requirements.

Source and External Links

What is a Subscription Policy? - Definition from Insuranceopedia - A subscription policy is an insurance arrangement where multiple insurers share the risk of coverage, with each insurer subscribing to a portion of the risk and premium according to their capacity and strategy.

Subscription Policy - Insurance Training Center - Subscription insurance involves two or more insurers sharing the risk by agreeing on assigned percentages, with one acting as the lead insurer managing the policy and claim payouts proportional to coverage.

Comparing Costs: Subscription Health Plans vs. Traditional Insurance - Subscription insurance health plans offer affordable, transparent flat fees and more flexible, direct access to care compared to traditional insurance, providing an alternative model with no hidden fees.

dowidth.com

dowidth.com