Drone insurance provides coverage for potential damages or liabilities arising from drone operation, including property damage, bodily injury, and third-party claims. Event cancellation insurance protects organizers against financial losses caused by unforeseen interruptions, such as weather issues, vendor no-shows, or other disruptions. Explore the key differences and benefits of drone insurance versus event cancellation insurance to determine the best fit for your needs.

Why it is important

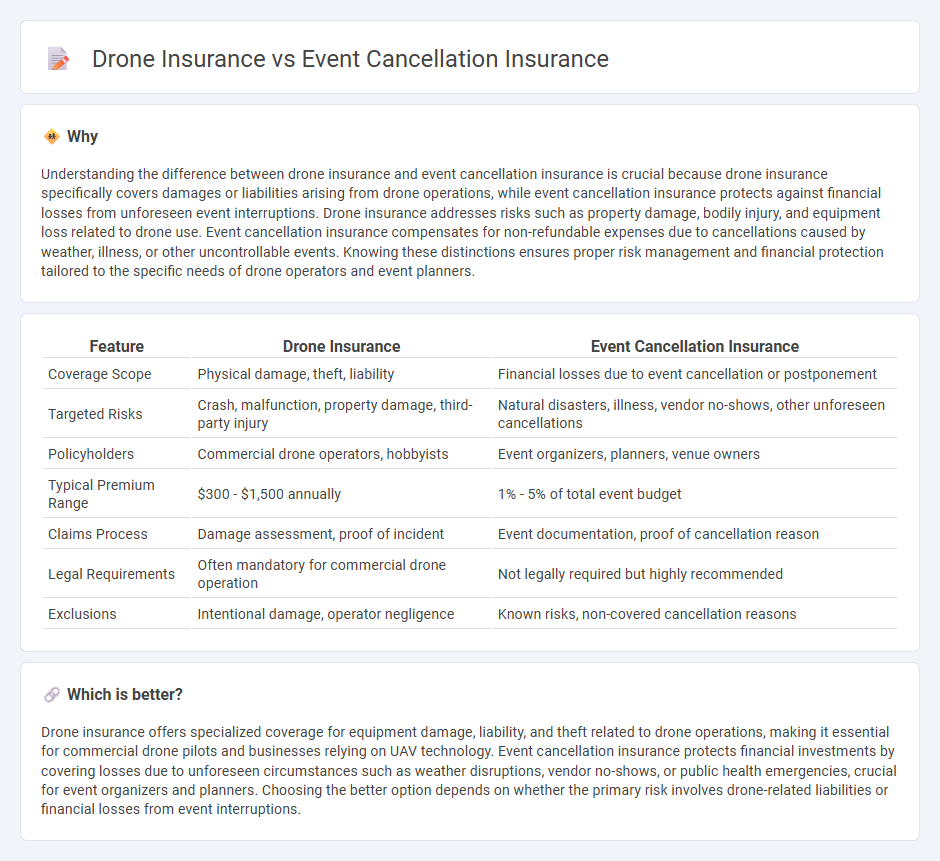

Understanding the difference between drone insurance and event cancellation insurance is crucial because drone insurance specifically covers damages or liabilities arising from drone operations, while event cancellation insurance protects against financial losses from unforeseen event interruptions. Drone insurance addresses risks such as property damage, bodily injury, and equipment loss related to drone use. Event cancellation insurance compensates for non-refundable expenses due to cancellations caused by weather, illness, or other uncontrollable events. Knowing these distinctions ensures proper risk management and financial protection tailored to the specific needs of drone operators and event planners.

Comparison Table

| Feature | Drone Insurance | Event Cancellation Insurance |

|---|---|---|

| Coverage Scope | Physical damage, theft, liability | Financial losses due to event cancellation or postponement |

| Targeted Risks | Crash, malfunction, property damage, third-party injury | Natural disasters, illness, vendor no-shows, other unforeseen cancellations |

| Policyholders | Commercial drone operators, hobbyists | Event organizers, planners, venue owners |

| Typical Premium Range | $300 - $1,500 annually | 1% - 5% of total event budget |

| Claims Process | Damage assessment, proof of incident | Event documentation, proof of cancellation reason |

| Legal Requirements | Often mandatory for commercial drone operation | Not legally required but highly recommended |

| Exclusions | Intentional damage, operator negligence | Known risks, non-covered cancellation reasons |

Which is better?

Drone insurance offers specialized coverage for equipment damage, liability, and theft related to drone operations, making it essential for commercial drone pilots and businesses relying on UAV technology. Event cancellation insurance protects financial investments by covering losses due to unforeseen circumstances such as weather disruptions, vendor no-shows, or public health emergencies, crucial for event organizers and planners. Choosing the better option depends on whether the primary risk involves drone-related liabilities or financial losses from event interruptions.

Connection

Drone insurance and event cancellation insurance intersect in scenarios where drones are deployed for event coverage, such as aerial photography or live broadcasting. Liability from drone malfunctions or accidents can directly impact event proceedings, potentially causing cancellations or delays. Insurance policies that cover drone-related risks thus help mitigate financial losses associated with event disruptions.

Key Terms

**Event Cancellation Insurance:**

Event cancellation insurance protects event organizers against financial losses resulting from unforeseen cancellations, postponements, or interruptions caused by factors such as extreme weather, vendor issues, or public safety concerns. Unlike drone insurance, which covers damages, liability, and operational risks related to drone use, event cancellation insurance specifically safeguards investments in venue bookings, ticket sales, and vendor contracts. Discover how event cancellation insurance can provide a reliable financial safety net for your next event.

Non-Appearance

Event cancellation insurance covers financial losses if a key participant fails to appear, protecting organizers against unforeseen no-shows. Drone insurance primarily addresses liabilities and damages related to drone operation, offering limited or no coverage for event participant non-appearance. Explore detailed comparisons to understand how non-appearance risks impact your coverage options.

Force Majeure

Event cancellation insurance covers losses due to unforeseen disruptions like Force Majeure events including natural disasters, government restrictions, or pandemics, protecting organizers' investments when events cannot proceed. Drone insurance primarily focuses on liability, physical damage, and theft related to drone operations, with Force Majeure typically excluded from standard policies unless specifically endorsed. Explore how tailored coverage options address Force Majeure risks in both insurance types to safeguard your assets effectively.

Source and External Links

Event Cancellation and Non-Appearance Insurance - Event cancellation insurance protects against financial loss if an event is canceled, postponed, or disrupted due to insured perils such as severe weather, venue issues, terrorism, or non-appearance of key participants, covering expenses and lost revenues for various event types.

Event Cancellation Insurance: Protect Your Event Revenues - Alliant EXPO Guard(tm) offers comprehensive event cancellation insurance designed for trade shows, conferences, and professional events, covering a broad range of perils including weather, terrorism, civil unrest, venue damage, and speaker non-appearance.

Wedding & Special Event Insurance - Event cancellation insurance from GEICO helps reimburse lost deposits and fees if an event must be canceled or postponed due to unforeseen circumstances like vendor no-shows or extreme weather, with policies starting at about $130 and coverage available close to the event date.

dowidth.com

dowidth.com