Earthquake microinsurance provides targeted financial protection against seismic risks, covering damages caused by sudden earth tremors and aftershocks, crucial for communities in high-risk fault zones. Drought microinsurance, on the other hand, offers coverage for losses resulting from prolonged dry periods, helping farmers and rural populations mitigate the economic impact of water scarcity and crop failures. Explore the differences in coverage, benefits, and application to determine which microinsurance suits your environmental risks.

Why it is important

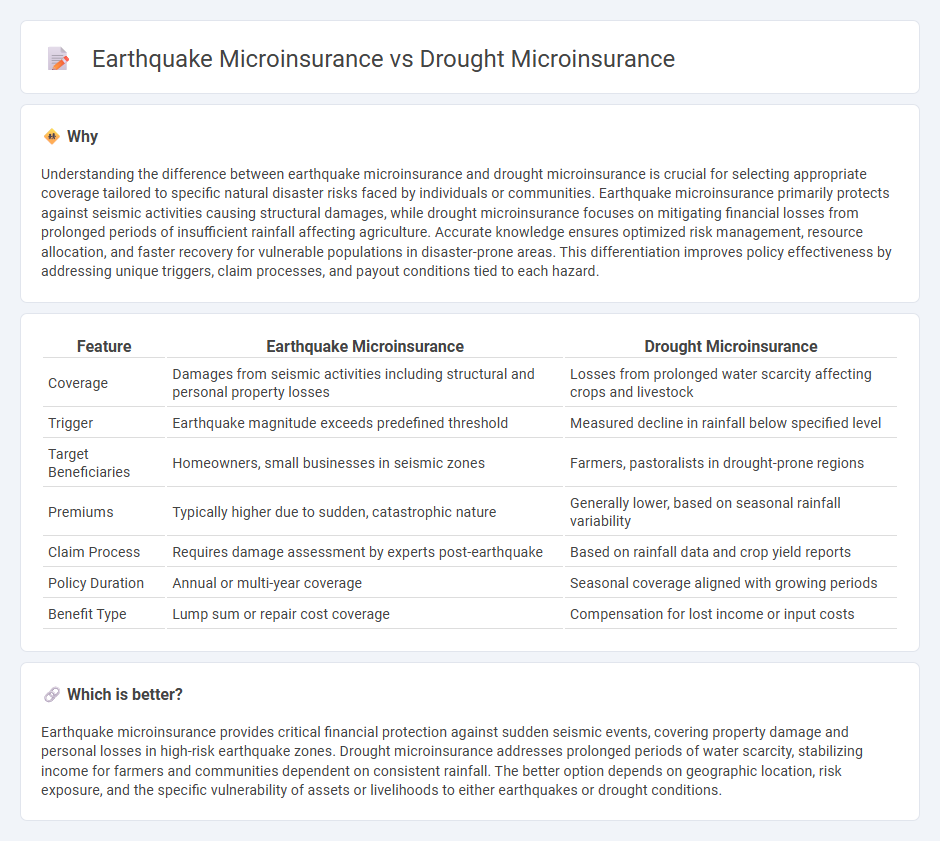

Understanding the difference between earthquake microinsurance and drought microinsurance is crucial for selecting appropriate coverage tailored to specific natural disaster risks faced by individuals or communities. Earthquake microinsurance primarily protects against seismic activities causing structural damages, while drought microinsurance focuses on mitigating financial losses from prolonged periods of insufficient rainfall affecting agriculture. Accurate knowledge ensures optimized risk management, resource allocation, and faster recovery for vulnerable populations in disaster-prone areas. This differentiation improves policy effectiveness by addressing unique triggers, claim processes, and payout conditions tied to each hazard.

Comparison Table

| Feature | Earthquake Microinsurance | Drought Microinsurance |

|---|---|---|

| Coverage | Damages from seismic activities including structural and personal property losses | Losses from prolonged water scarcity affecting crops and livestock |

| Trigger | Earthquake magnitude exceeds predefined threshold | Measured decline in rainfall below specified level |

| Target Beneficiaries | Homeowners, small businesses in seismic zones | Farmers, pastoralists in drought-prone regions |

| Premiums | Typically higher due to sudden, catastrophic nature | Generally lower, based on seasonal rainfall variability |

| Claim Process | Requires damage assessment by experts post-earthquake | Based on rainfall data and crop yield reports |

| Policy Duration | Annual or multi-year coverage | Seasonal coverage aligned with growing periods |

| Benefit Type | Lump sum or repair cost coverage | Compensation for lost income or input costs |

Which is better?

Earthquake microinsurance provides critical financial protection against sudden seismic events, covering property damage and personal losses in high-risk earthquake zones. Drought microinsurance addresses prolonged periods of water scarcity, stabilizing income for farmers and communities dependent on consistent rainfall. The better option depends on geographic location, risk exposure, and the specific vulnerability of assets or livelihoods to either earthquakes or drought conditions.

Connection

Earthquake microinsurance and drought microinsurance both provide targeted financial protection against natural disasters that disproportionately impact low-income communities. These microinsurance products use region-specific data and risk models to offer affordable coverage, enabling swift recovery and reducing economic vulnerability. By pooling risk and leveraging satellite and seismic technology, they improve resilience to climate-related and geological hazards in vulnerable populations.

Key Terms

**Drought Microinsurance:**

Drought microinsurance provides financial protection to small-scale farmers and rural communities against losses caused by prolonged dry spells, helping to stabilize income and maintain agricultural productivity. This type of insurance is tailored to monitor rainfall levels and yield reductions, offering payouts triggered by specific drought indices to ensure timely disaster response. Explore more about how drought microinsurance supports climate resilience and sustainable farming practices.

Rainfall Index

Drought microinsurance primarily uses the Rainfall Index to trigger payouts based on cumulative rainfall levels falling below a defined threshold, providing financial support to farmers affected by insufficient rainfall. Earthquake microinsurance, in contrast, relies on seismic data and ground-shaking measurements instead of rainfall indices to assess damage and compensation needs. Explore comprehensive comparisons to understand how index-based insurance models cater differently to natural disaster risks.

Payout Trigger

Drought microinsurance typically uses index-based triggers such as rainfall levels or soil moisture deficits to determine payouts, enabling quick compensation without on-site damage assessments. Earthquake microinsurance often relies on seismic intensity measurements and structural damage reports as payout triggers, requiring more detailed damage verification before claims are processed. Explore the nuances of payout triggers in microinsurance to understand their impact on timely risk mitigation.

Source and External Links

The Impact of Microinsurance on Consumption Smoothing and Asset Protection - This paper explores how microinsurance can help households in developing economies mitigate the impacts of drought by reducing costly coping strategies.

Can Microinsurance Protect Developing Nations Against the Risks of Climate Change? - Microinsurance uses climate-linked indices to provide automatic payouts during droughts, enhancing resilience and reducing verification costs.

Does Climate Insurance Work? Evidence from WFP-Supported Microinsurance Programmes - This factsheet summarizes how WFP-supported microinsurance programs protect smallholder farmers from climate-related risks like droughts, promoting resilient livelihoods.

dowidth.com

dowidth.com