Cyber insurance protects businesses from financial losses due to data breaches, cyberattacks, and other digital threats, emphasizing coverage for intangible assets and liability. Property insurance covers physical assets like buildings, equipment, and inventory against risks such as fire, theft, and natural disasters, focusing on tangible property damage. Explore the distinct benefits and coverage options of cyber insurance versus property insurance to safeguard your organization effectively.

Why it is important

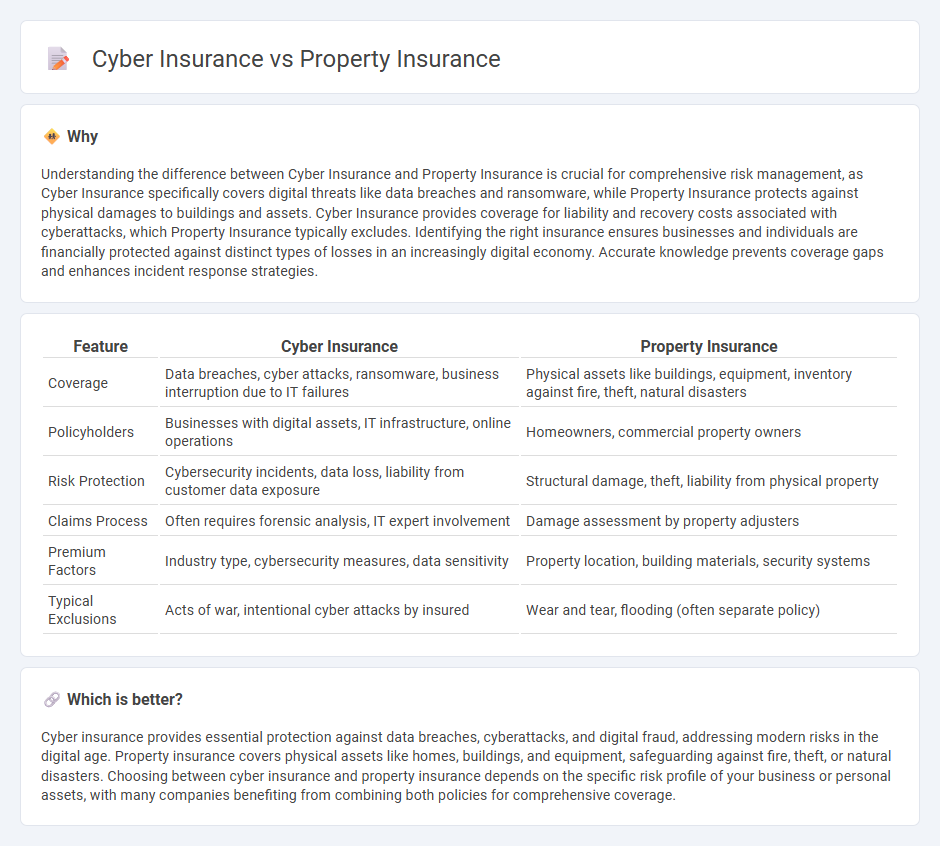

Understanding the difference between Cyber Insurance and Property Insurance is crucial for comprehensive risk management, as Cyber Insurance specifically covers digital threats like data breaches and ransomware, while Property Insurance protects against physical damages to buildings and assets. Cyber Insurance provides coverage for liability and recovery costs associated with cyberattacks, which Property Insurance typically excludes. Identifying the right insurance ensures businesses and individuals are financially protected against distinct types of losses in an increasingly digital economy. Accurate knowledge prevents coverage gaps and enhances incident response strategies.

Comparison Table

| Feature | Cyber Insurance | Property Insurance |

|---|---|---|

| Coverage | Data breaches, cyber attacks, ransomware, business interruption due to IT failures | Physical assets like buildings, equipment, inventory against fire, theft, natural disasters |

| Policyholders | Businesses with digital assets, IT infrastructure, online operations | Homeowners, commercial property owners |

| Risk Protection | Cybersecurity incidents, data loss, liability from customer data exposure | Structural damage, theft, liability from physical property |

| Claims Process | Often requires forensic analysis, IT expert involvement | Damage assessment by property adjusters |

| Premium Factors | Industry type, cybersecurity measures, data sensitivity | Property location, building materials, security systems |

| Typical Exclusions | Acts of war, intentional cyber attacks by insured | Wear and tear, flooding (often separate policy) |

Which is better?

Cyber insurance provides essential protection against data breaches, cyberattacks, and digital fraud, addressing modern risks in the digital age. Property insurance covers physical assets like homes, buildings, and equipment, safeguarding against fire, theft, or natural disasters. Choosing between cyber insurance and property insurance depends on the specific risk profile of your business or personal assets, with many companies benefiting from combining both policies for comprehensive coverage.

Connection

Cyber insurance and property insurance intersect in covering risks related to physical assets and digital infrastructures, protecting businesses from financial losses due to cyber-attacks that damage or disrupt property operations. Property insurance safeguards tangible assets such as buildings and equipment, while cyber insurance addresses data breaches, ransomware, and network downtime that can also affect physical property functionality. Integrating both policies enables comprehensive risk management, mitigating potential losses linked to cyber threats impacting physical property and operational continuity.

Key Terms

**Property insurance:**

Property insurance covers physical assets such as buildings, equipment, and inventory against risks like fire, theft, natural disasters, and vandalism. It provides financial compensation for damages or losses to tangible property, ensuring business continuity and safeguarding investments. Explore comprehensive coverage options to protect your physical assets effectively.

Replacement Cost

Property insurance covers physical assets by providing replacement cost coverage, compensating for the actual expense to repair or replace damaged property without depreciation deductions. Cyber insurance, however, addresses intangible digital assets and covers costs related to data breaches, cyber extortion, and business interruption, with replacement costs focusing on restoring systems and data integrity. Explore how understanding replacement cost nuances in both policies can optimize your risk management strategy.

Physical Damage

Property insurance primarily covers physical damage to buildings, equipment, and inventory caused by events like fire, theft, or natural disasters. Cyber insurance, however, addresses losses from data breaches, cyberattacks, and digital system failures, not tangible property damage. Explore the key distinctions and coverage benefits between property and cyber insurance to protect your assets effectively.

Source and External Links

Homeowners Insurance - Online Quotes - Provides protection against unexpected events such as damage to your home, theft of personal belongings, and legal liabilities.

Homeowners Insurance - Get a Home Insurance Quote - Offers customized home insurance policies to fit individual needs, including coverage for personal property and liability.

Homeowners Insurance: Get a Free Quote - Progressive - Provides affordable insurance that protects your home's structure, belongings, and personal assets with personalized coverage options.

dowidth.com

dowidth.com