Embedded insurance integrates coverage directly into product purchases, offering seamless protection without separate transactions. Platform-integrated insurance operates within digital ecosystems, enabling insurers to reach users through partnered platforms for streamlined policy management. Explore the distinctions and benefits of both models to optimize your insurance strategy.

Why it is important

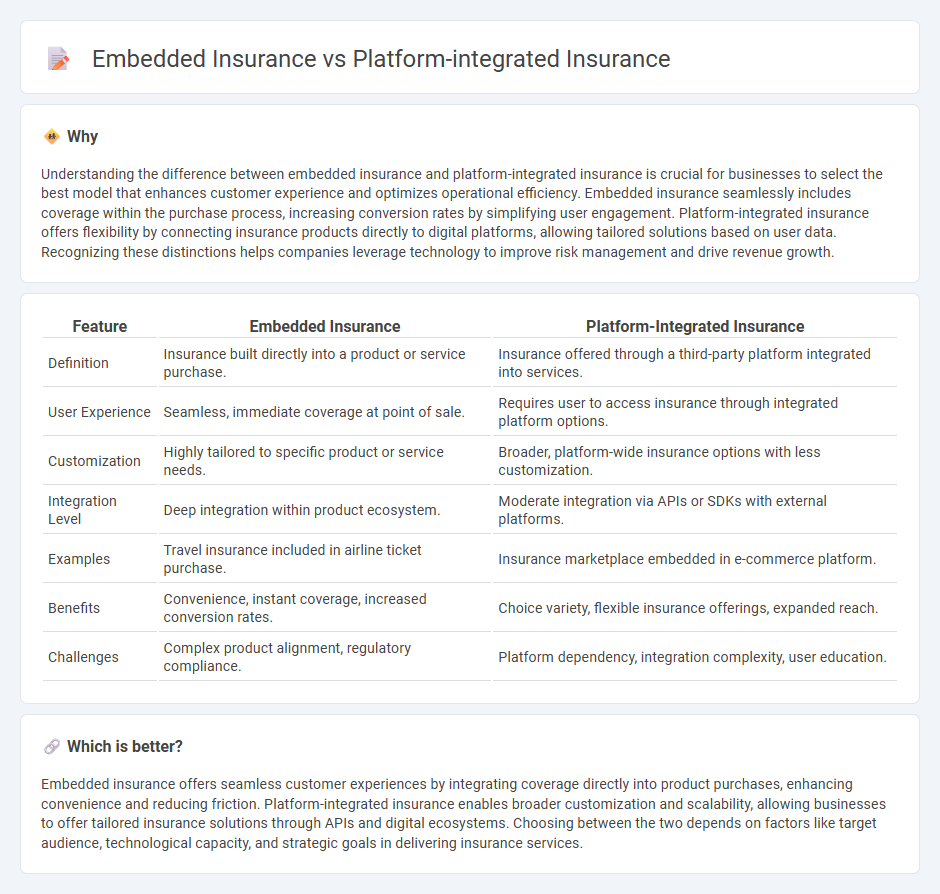

Understanding the difference between embedded insurance and platform-integrated insurance is crucial for businesses to select the best model that enhances customer experience and optimizes operational efficiency. Embedded insurance seamlessly includes coverage within the purchase process, increasing conversion rates by simplifying user engagement. Platform-integrated insurance offers flexibility by connecting insurance products directly to digital platforms, allowing tailored solutions based on user data. Recognizing these distinctions helps companies leverage technology to improve risk management and drive revenue growth.

Comparison Table

| Feature | Embedded Insurance | Platform-Integrated Insurance |

|---|---|---|

| Definition | Insurance built directly into a product or service purchase. | Insurance offered through a third-party platform integrated into services. |

| User Experience | Seamless, immediate coverage at point of sale. | Requires user to access insurance through integrated platform options. |

| Customization | Highly tailored to specific product or service needs. | Broader, platform-wide insurance options with less customization. |

| Integration Level | Deep integration within product ecosystem. | Moderate integration via APIs or SDKs with external platforms. |

| Examples | Travel insurance included in airline ticket purchase. | Insurance marketplace embedded in e-commerce platform. |

| Benefits | Convenience, instant coverage, increased conversion rates. | Choice variety, flexible insurance offerings, expanded reach. |

| Challenges | Complex product alignment, regulatory compliance. | Platform dependency, integration complexity, user education. |

Which is better?

Embedded insurance offers seamless customer experiences by integrating coverage directly into product purchases, enhancing convenience and reducing friction. Platform-integrated insurance enables broader customization and scalability, allowing businesses to offer tailored insurance solutions through APIs and digital ecosystems. Choosing between the two depends on factors like target audience, technological capacity, and strategic goals in delivering insurance services.

Connection

Embedded insurance seamlessly integrates coverage options directly within non-insurance platforms, enhancing customer experience by providing on-the-spot protection during transactions. Platform-integrated insurance leverages digital ecosystems such as e-commerce or ride-sharing apps to embed insurance products tailored to specific user activities. Both models rely on API-driven connectivity to deliver context-specific insurance solutions, streamlining the purchase process and increasing insurance adoption rates.

Key Terms

**Platform-integrated insurance:**

Platform-integrated insurance refers to insurance products seamlessly incorporated within a digital platform, allowing users to access coverage options directly during their online transactions or activities without needing to leave the platform. This approach enhances user experience by providing personalized, on-demand insurance solutions tied to the platform's services, such as ride-sharing or e-commerce. Explore how platform-integrated insurance transforms risk management and customer engagement in modern digital ecosystems.

API Connectivity

Platform-integrated insurance leverages API connectivity to seamlessly connect insurance products with digital platforms, enabling real-time data exchange and automated policy management. Embedded insurance, using similar API frameworks, integrates insurance offer directly within product purchase flows, enhancing user experience by reducing friction and boosting conversion rates. Explore our detailed analysis to understand how API connectivity differentiates these models and drives innovation in digital insurance.

Customization

Platform-integrated insurance offers a tailored approach by allowing businesses to configure insurance products that align with specific platform functionalities and user needs, enhancing user experience through customized policies. Embedded insurance seamlessly integrates insurance offerings directly within a product or service interface, providing pre-configured coverage options optimized for the typical use cases of the platform's audience. Discover more about how customization in platform-integrated and embedded insurance can transform risk management and customer engagement.

Source and External Links

Integrated Insurance Efficiency - Quick Silver Systems - Mercury Platform offers integrated insurance solutions that seamlessly combine policy administration, claims processing, and customer portals into one unified system, improving operational efficiency and customer self-service experience.

Today's Future-Proof Insurance PaaS - nexxbiz - Nexxbiz provides an Integrated Insurance Platform as a Service (iPaaS) featuring digitized actuarial modeling and reporting, scalable integration capabilities, and comprehensive process automation for life, pension, and disability insurers.

Top 5 Embedded Insurance Providers in 2025 - Openkoda - Embedded insurance platforms integrate insurance products directly into other business ecosystems like e-commerce or banking through APIs, workflow automation, and microinsurance, enabling seamless and tailored insurance offerings within non-insurance services.

dowidth.com

dowidth.com