Pet health insurance provides coverage for veterinary expenses related to accidents, illnesses, and routine care, ensuring timely medical attention for your furry companions. Critical illness insurance offers financial protection by covering major medical conditions such as cancer, heart attack, or stroke, helping policyholders manage expensive treatments and recovery costs. Explore our comprehensive guide to understand which insurance best suits your needs and secures your loved ones' well-being.

Why it is important

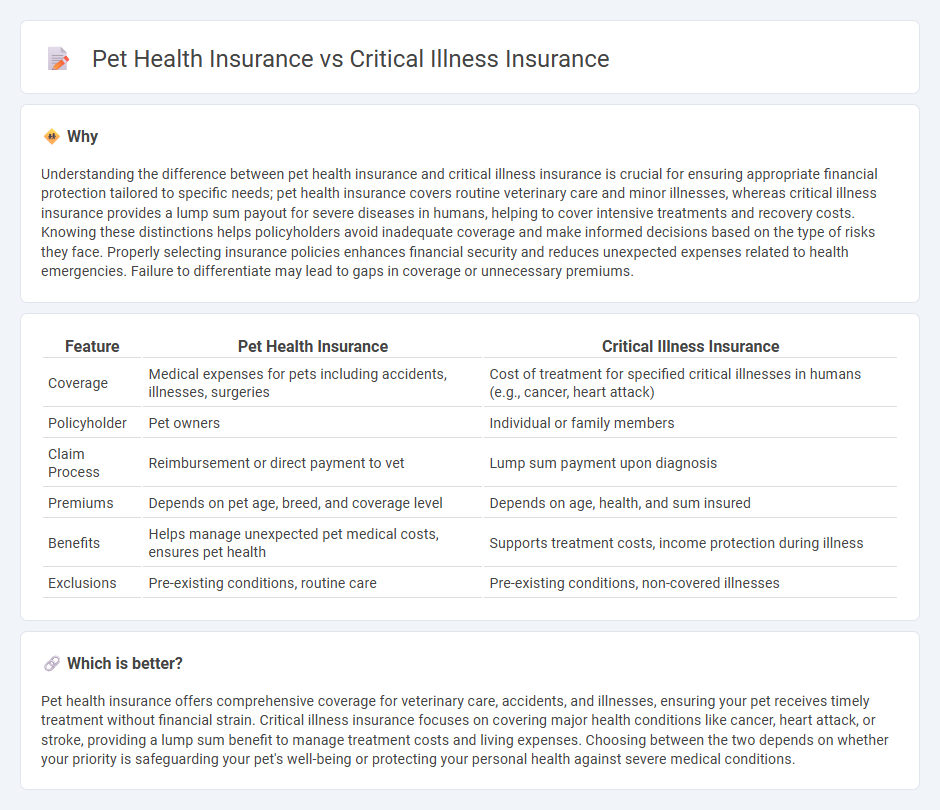

Understanding the difference between pet health insurance and critical illness insurance is crucial for ensuring appropriate financial protection tailored to specific needs; pet health insurance covers routine veterinary care and minor illnesses, whereas critical illness insurance provides a lump sum payout for severe diseases in humans, helping to cover intensive treatments and recovery costs. Knowing these distinctions helps policyholders avoid inadequate coverage and make informed decisions based on the type of risks they face. Properly selecting insurance policies enhances financial security and reduces unexpected expenses related to health emergencies. Failure to differentiate may lead to gaps in coverage or unnecessary premiums.

Comparison Table

| Feature | Pet Health Insurance | Critical Illness Insurance |

|---|---|---|

| Coverage | Medical expenses for pets including accidents, illnesses, surgeries | Cost of treatment for specified critical illnesses in humans (e.g., cancer, heart attack) |

| Policyholder | Pet owners | Individual or family members |

| Claim Process | Reimbursement or direct payment to vet | Lump sum payment upon diagnosis |

| Premiums | Depends on pet age, breed, and coverage level | Depends on age, health, and sum insured |

| Benefits | Helps manage unexpected pet medical costs, ensures pet health | Supports treatment costs, income protection during illness |

| Exclusions | Pre-existing conditions, routine care | Pre-existing conditions, non-covered illnesses |

Which is better?

Pet health insurance offers comprehensive coverage for veterinary care, accidents, and illnesses, ensuring your pet receives timely treatment without financial strain. Critical illness insurance focuses on covering major health conditions like cancer, heart attack, or stroke, providing a lump sum benefit to manage treatment costs and living expenses. Choosing between the two depends on whether your priority is safeguarding your pet's well-being or protecting your personal health against severe medical conditions.

Connection

Pet health insurance and critical illness insurance share a common focus on mitigating financial risk associated with unexpected medical conditions. Both types of insurance provide coverage for high-cost treatments, reducing out-of-pocket expenses for policyholders when pets or individuals face serious health challenges. Insurers often use similar underwriting criteria and risk assessment models to determine premiums based on health history and potential illness severity.

Key Terms

Critical Illness Insurance:

Critical illness insurance provides financial protection by covering significant medical expenses associated with severe health conditions such as heart attacks, strokes, or cancer. Unlike pet health insurance, which focuses on veterinary care for animals, critical illness insurance is designed to support individuals during major health crises by easing the burden of costly treatments and recovery costs. Explore the benefits and coverage options of critical illness insurance to better safeguard your financial future.

Lump Sum Benefit

Critical illness insurance provides a lump sum benefit upon diagnosis of specified serious medical conditions such as cancer, heart attack, or stroke, intended to cover medical expenses and loss of income. Pet health insurance, however, typically reimburses veterinary bills either partially or fully but rarely offers a lump sum payment, focusing instead on ongoing treatment costs and preventive care for pets. Explore more details to understand which insurance product best meets your financial protection needs.

Covered Conditions

Critical illness insurance typically covers serious human health conditions such as cancer, heart attack, and stroke, providing financial support for treatment and recovery costs. Pet health insurance focuses on veterinary care for illnesses and injuries in animals, including conditions like hip dysplasia, cancer, and infections. Explore detailed coverage differences to choose the best plan for your needs.

Source and External Links

Critical Illness Insurance - What Is It - Critical illness insurance provides supplemental coverage that pays a lump sum or monthly payments if diagnosed with major illnesses like heart attack, stroke, cancer, or organ transplant, helping with extra costs beyond health insurance.

Critical illness insurance - This insurance pays a lump sum or income upon diagnosis of specific diseases on a set list, often requiring survival beyond a minimum period; definitions of covered illnesses may be standardized for clarity and comparability.

Critical Illness Insurance Plans - MetLife offers critical illness insurance that provides lump-sum payments regardless of medical coverage to alleviate financial burdens during recovery, with benefits like no waiting period, coverage portability, and simple enrollment without health questions.

dowidth.com

dowidth.com