Peer-to-peer insurance revolutionizes traditional models by enabling groups of individuals to pool resources and share risks directly, reducing reliance on centralized insurers and lowering costs. Parametric insurance offers a data-driven approach, triggering automatic payouts based on predefined metrics like weather events or natural disasters instead of assessing claim damage. Explore the distinct advantages and applications of these innovative insurance models to determine which best suits your needs.

Why it is important

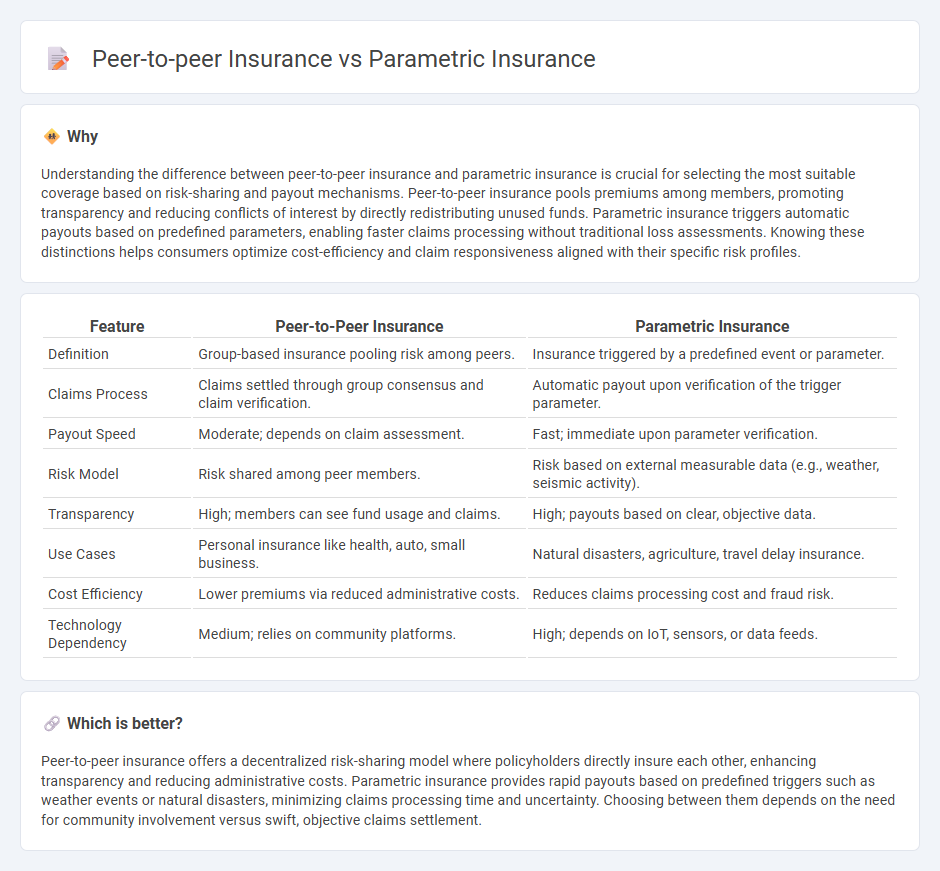

Understanding the difference between peer-to-peer insurance and parametric insurance is crucial for selecting the most suitable coverage based on risk-sharing and payout mechanisms. Peer-to-peer insurance pools premiums among members, promoting transparency and reducing conflicts of interest by directly redistributing unused funds. Parametric insurance triggers automatic payouts based on predefined parameters, enabling faster claims processing without traditional loss assessments. Knowing these distinctions helps consumers optimize cost-efficiency and claim responsiveness aligned with their specific risk profiles.

Comparison Table

| Feature | Peer-to-Peer Insurance | Parametric Insurance |

|---|---|---|

| Definition | Group-based insurance pooling risk among peers. | Insurance triggered by a predefined event or parameter. |

| Claims Process | Claims settled through group consensus and claim verification. | Automatic payout upon verification of the trigger parameter. |

| Payout Speed | Moderate; depends on claim assessment. | Fast; immediate upon parameter verification. |

| Risk Model | Risk shared among peer members. | Risk based on external measurable data (e.g., weather, seismic activity). |

| Transparency | High; members can see fund usage and claims. | High; payouts based on clear, objective data. |

| Use Cases | Personal insurance like health, auto, small business. | Natural disasters, agriculture, travel delay insurance. |

| Cost Efficiency | Lower premiums via reduced administrative costs. | Reduces claims processing cost and fraud risk. |

| Technology Dependency | Medium; relies on community platforms. | High; depends on IoT, sensors, or data feeds. |

Which is better?

Peer-to-peer insurance offers a decentralized risk-sharing model where policyholders directly insure each other, enhancing transparency and reducing administrative costs. Parametric insurance provides rapid payouts based on predefined triggers such as weather events or natural disasters, minimizing claims processing time and uncertainty. Choosing between them depends on the need for community involvement versus swift, objective claims settlement.

Connection

Peer-to-peer insurance and parametric insurance both leverage technology to disrupt traditional risk management models by enhancing transparency and efficiency. Peer-to-peer insurance pools premiums from a group of individuals to cover collective risks, while parametric insurance pays predefined settlements based on triggering events rather than loss assessment. Integrating parametric triggers within peer-to-peer insurance frameworks accelerates claim processing and reduces administrative costs, creating a more streamlined and customer-centric insurance experience.

Key Terms

Trigger event

Parametric insurance activates coverage based on predefined trigger events such as a specific magnitude of an earthquake or a certain amount of rainfall, ensuring rapid and objective claim payouts without the need for traditional loss assessments. Peer-to-peer insurance relies on collective risk sharing among a group of individuals, with payout triggers often dependent on the occurrence of insured events agreed upon by the group, promoting transparency and community involvement. Explore the differences in trigger events and how they impact claims processes to understand which insurance model aligns best with your needs.

Risk pool

Parametric insurance relies on predefined parameters such as weather data or natural disaster measurements to trigger automatic payouts from a centralized risk pool managed by insurers. Peer-to-peer insurance pools contributions from a community of members who share similar risk profiles, distributing claims within the group before any insurer engagement. Explore the mechanisms behind these risk pools to understand which model best suits your coverage needs.

Claims process

Parametric insurance streamlines the claims process by triggering automatic payouts based on predefined parameters such as weather data or seismic activity, eliminating the need for claim adjustments or loss assessments. Peer-to-peer insurance involves community members pooling funds to cover claims within the group, typically resulting in a faster resolution due to reduced bureaucracy but may require consensus or verification steps among peers. Explore how these innovative insurance models accelerate claims processing and improve customer experience.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance pays out based on the occurrence and intensity of a predefined event (like an earthquake or hurricane), as measured by an objective parameter, rather than the actual loss incurred--when the trigger is reached, the insured receives a predetermined payout.

Parametric Insurance Solutions - Amwins - Parametric policies use clear, pre-agreed triggers (such as wind speed or earthquake magnitude) and payout functions, enabling fast claims settlement without traditional loss assessment, so insureds get rapid liquidity after a qualifying event.

Parametric insurance - Wikipedia - Unlike traditional indemnity insurance, which reimburses actual losses after assessment, parametric insurance provides specified payouts when a measurable event exceeds a set threshold, leading to quicker payouts but potential basis risk if the payout does not match the actual damage.

dowidth.com

dowidth.com