On-demand insurance offers flexible, pay-as-you-go coverage tailored to specific needs and time frames, contrasting with traditional insurance's fixed plans and long-term commitments. This innovative model leverages digital platforms for instant access and real-time policy management, enhancing user convenience and cost efficiency. Explore the differences and benefits of each to determine the best fit for your coverage needs.

Why it is important

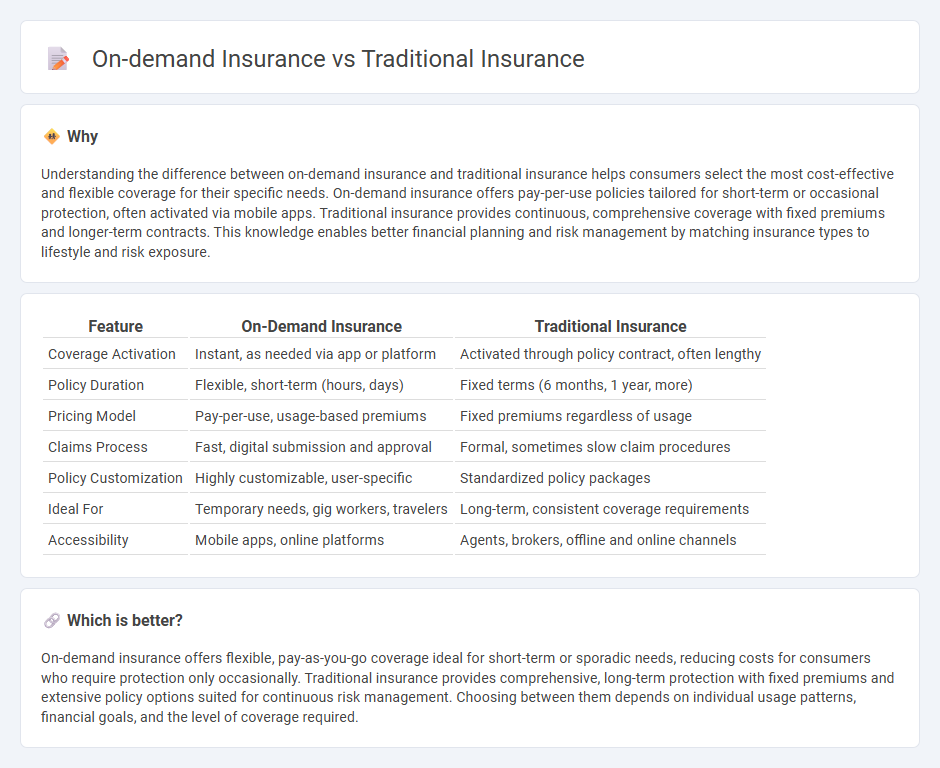

Understanding the difference between on-demand insurance and traditional insurance helps consumers select the most cost-effective and flexible coverage for their specific needs. On-demand insurance offers pay-per-use policies tailored for short-term or occasional protection, often activated via mobile apps. Traditional insurance provides continuous, comprehensive coverage with fixed premiums and longer-term contracts. This knowledge enables better financial planning and risk management by matching insurance types to lifestyle and risk exposure.

Comparison Table

| Feature | On-Demand Insurance | Traditional Insurance |

|---|---|---|

| Coverage Activation | Instant, as needed via app or platform | Activated through policy contract, often lengthy |

| Policy Duration | Flexible, short-term (hours, days) | Fixed terms (6 months, 1 year, more) |

| Pricing Model | Pay-per-use, usage-based premiums | Fixed premiums regardless of usage |

| Claims Process | Fast, digital submission and approval | Formal, sometimes slow claim procedures |

| Policy Customization | Highly customizable, user-specific | Standardized policy packages |

| Ideal For | Temporary needs, gig workers, travelers | Long-term, consistent coverage requirements |

| Accessibility | Mobile apps, online platforms | Agents, brokers, offline and online channels |

Which is better?

On-demand insurance offers flexible, pay-as-you-go coverage ideal for short-term or sporadic needs, reducing costs for consumers who require protection only occasionally. Traditional insurance provides comprehensive, long-term protection with fixed premiums and extensive policy options suited for continuous risk management. Choosing between them depends on individual usage patterns, financial goals, and the level of coverage required.

Connection

On-demand insurance leverages digital platforms to provide flexible, pay-as-you-go coverage, complementing traditional insurance models by addressing the demand for customized, short-term protection. Traditional insurance offers comprehensive, long-term policies typically under fixed terms and premiums, creating a stable foundation for risk management. Together, they expand the insurance ecosystem by serving diverse consumer needs, enhancing accessibility, and driving innovation in underwriting and claims processing.

Key Terms

Policy Duration

Traditional insurance policies typically require long-term commitments, often spanning six months to a year, which can limit flexibility for consumers. On-demand insurance offers the advantage of customizable, short-term policies that activate only when needed, enabling users to insure assets for hours or days rather than extended periods. Explore the benefits and suitability of each option to determine the best fit for your insurance needs.

Premium Structure

Traditional insurance premium structures are typically fixed and based on long-term risk assessments, often requiring annual or semi-annual payments regardless of usage frequency. On-demand insurance offers flexible premiums calculated in real-time, allowing users to pay only for coverage during specific periods or events, effectively reducing unnecessary costs. Explore the nuances of premium structures to understand which insurance model aligns best with your financial and coverage needs.

Underwriting Process

Traditional insurance underwriting involves comprehensive risk assessment using historical data, credit scores, and detailed personal information to determine premiums and coverage limits. On-demand insurance streamlines underwriting by leveraging real-time data, automation, and mobile technology, enabling instant policy issuance tailored to specific events or durations. Explore how these innovations in underwriting processes can optimize your insurance experience.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional insurance plans refer mainly to long-established life insurance types, including pure life protection plans like term and whole life insurance, and mixed plans that combine life coverage with investment returns such as endowment and annuity plans, offering death benefits, maturity benefits, and bonuses.

Traditional Indemnity Insurance Plans - Virginia Health Information - Traditional health insurance, often called indemnity or fee-for-service plans, reimburse policyholders based on usual, customary, and reasonable fees for medical services, offering broad provider choice without network restrictions but requiring claim filing and deductible/copay payments.

Indiana Medicaid: Members: Traditional Medicaid - IN.gov - Traditional Medicaid (fee-for-service) provides comprehensive health care coverage for eligible low-income individuals, reimbursing providers directly for services rendered without managed care restrictions, requiring use of Medicaid-approved providers.

dowidth.com

dowidth.com