Gig worker insurance provides flexible coverage tailored to independent contractors and freelance professionals, focusing on short-term liability and income protection. Expatriate insurance offers comprehensive global health and travel benefits designed for individuals living and working abroad, including emergency evacuation and repatriation services. Discover the key differences and advantages to choose the best insurance solution for your unique lifestyle.

Why it is important

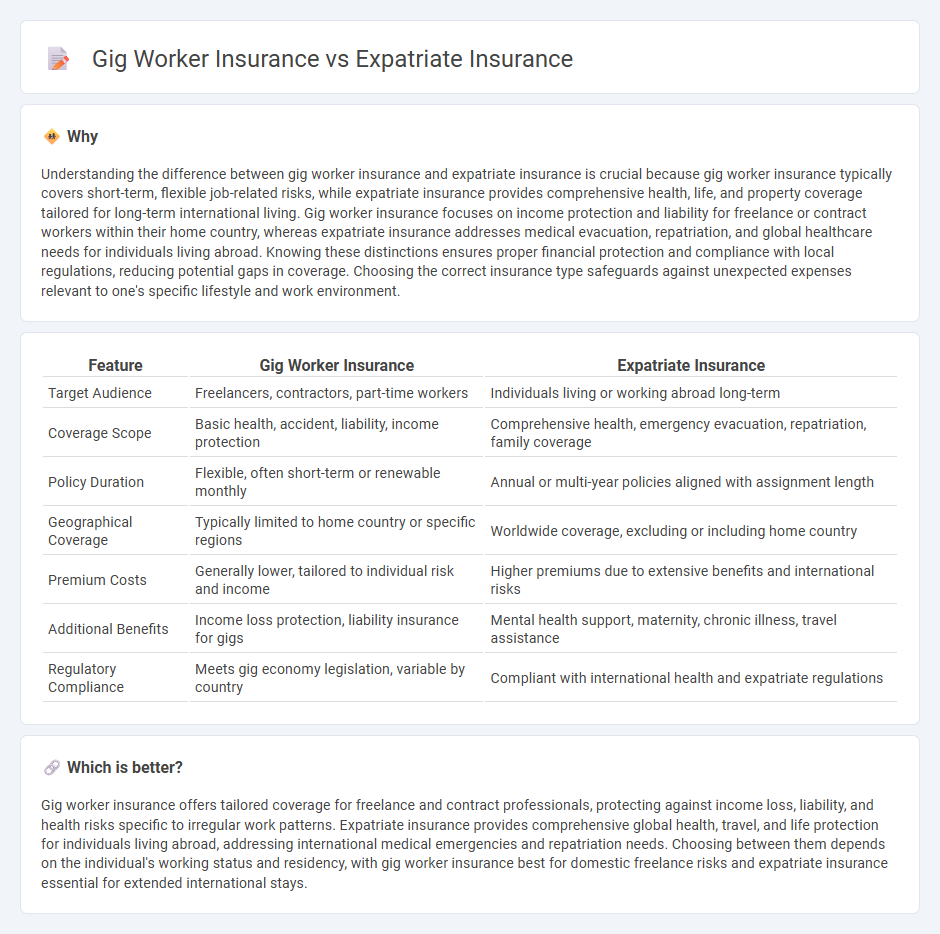

Understanding the difference between gig worker insurance and expatriate insurance is crucial because gig worker insurance typically covers short-term, flexible job-related risks, while expatriate insurance provides comprehensive health, life, and property coverage tailored for long-term international living. Gig worker insurance focuses on income protection and liability for freelance or contract workers within their home country, whereas expatriate insurance addresses medical evacuation, repatriation, and global healthcare needs for individuals living abroad. Knowing these distinctions ensures proper financial protection and compliance with local regulations, reducing potential gaps in coverage. Choosing the correct insurance type safeguards against unexpected expenses relevant to one's specific lifestyle and work environment.

Comparison Table

| Feature | Gig Worker Insurance | Expatriate Insurance |

|---|---|---|

| Target Audience | Freelancers, contractors, part-time workers | Individuals living or working abroad long-term |

| Coverage Scope | Basic health, accident, liability, income protection | Comprehensive health, emergency evacuation, repatriation, family coverage |

| Policy Duration | Flexible, often short-term or renewable monthly | Annual or multi-year policies aligned with assignment length |

| Geographical Coverage | Typically limited to home country or specific regions | Worldwide coverage, excluding or including home country |

| Premium Costs | Generally lower, tailored to individual risk and income | Higher premiums due to extensive benefits and international risks |

| Additional Benefits | Income loss protection, liability insurance for gigs | Mental health support, maternity, chronic illness, travel assistance |

| Regulatory Compliance | Meets gig economy legislation, variable by country | Compliant with international health and expatriate regulations |

Which is better?

Gig worker insurance offers tailored coverage for freelance and contract professionals, protecting against income loss, liability, and health risks specific to irregular work patterns. Expatriate insurance provides comprehensive global health, travel, and life protection for individuals living abroad, addressing international medical emergencies and repatriation needs. Choosing between them depends on the individual's working status and residency, with gig worker insurance best for domestic freelance risks and expatriate insurance essential for extended international stays.

Connection

Gig worker insurance and expatriate insurance both address the coverage needs of individuals with non-traditional work and living arrangements, often lacking standard employer-provided benefits. These insurance types provide tailored health, liability, and income protection suited for mobile, independent professionals facing unique risks across different regions or countries. Understanding their overlap helps optimize comprehensive risk management for global gig workers navigating international employment landscapes.

Key Terms

Expatriate Insurance:

Expatriate insurance provides comprehensive health coverage tailored to individuals living and working abroad, often including medical evacuation, repatriation, and local healthcare services. It addresses specific risks faced by expatriates, such as access to international medical facilities and multi-country support. Explore how expatriate insurance ensures peace of mind and protection tailored to your global lifestyle.

International Health Coverage

Expatriate insurance provides comprehensive international health coverage tailored for individuals living abroad long-term, including access to private hospitals and emergency evacuation services. Gig worker insurance typically offers flexible, short-term health plans that accommodate variable incomes and may include limited international coverage depending on the provider. Explore detailed comparisons to determine the best international health insurance solution for your lifestyle.

Repatriation Benefits

Expatriate insurance typically offers extensive repatriation benefits, covering the cost of returning the insured to their home country in case of medical emergencies or death, which is crucial for long-term international assignments. Gig worker insurance, on the other hand, may provide limited or no repatriation coverage, as it often focuses on short-term or local contracts with less comprehensive benefits. Explore detailed comparisons to understand how repatriation coverage impacts your insurance needs.

Source and External Links

Expatriate insurance - Wikipedia - Expatriate insurance policies cover financial and other risks for people living and working outside their home country, including health, property, automobile, and life insurance, often with provisions for high-risk areas like war and terrorism.

Expat Insurance: Health, Life and Travel Plans for Expatriates - Expatriate insurance offers comprehensive coverage including health, life, disability, and income protection, with plans tailored for medical care abroad and customizable based on expats' needs.

Expat Insurance for Individuals, Corporates & Families - This provider offers dedicated international health and travel insurance products designed specifically for expats, supporting individuals, families, and corporates worldwide with 24/7 access to private medical care.

dowidth.com

dowidth.com