Insurtech sandboxes provide a controlled regulatory environment where innovators test new insurance technologies and business models, accelerating product development while ensuring compliance. On-demand insurance offers flexible, customer-centric coverage activated instantly for specific needs or time frames, reflecting a shift towards personalized risk management. Explore how these innovations are transforming the insurance landscape and driving efficiency.

Why it is important

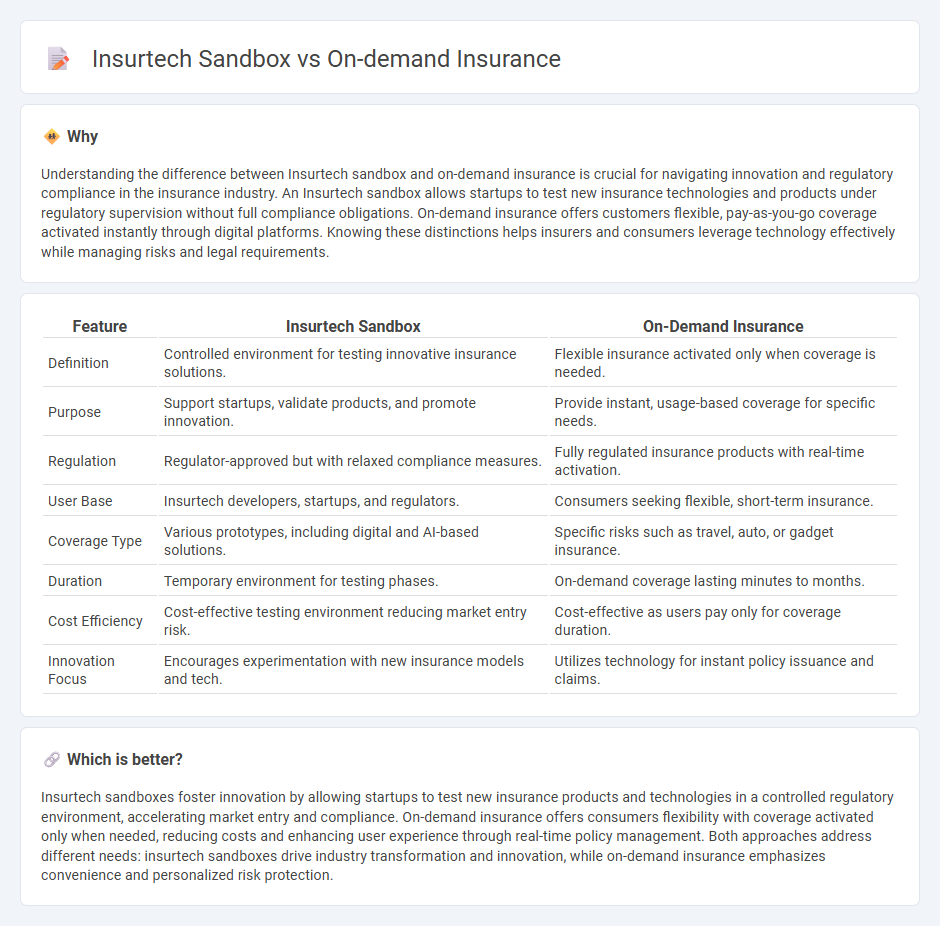

Understanding the difference between Insurtech sandbox and on-demand insurance is crucial for navigating innovation and regulatory compliance in the insurance industry. An Insurtech sandbox allows startups to test new insurance technologies and products under regulatory supervision without full compliance obligations. On-demand insurance offers customers flexible, pay-as-you-go coverage activated instantly through digital platforms. Knowing these distinctions helps insurers and consumers leverage technology effectively while managing risks and legal requirements.

Comparison Table

| Feature | Insurtech Sandbox | On-Demand Insurance |

|---|---|---|

| Definition | Controlled environment for testing innovative insurance solutions. | Flexible insurance activated only when coverage is needed. |

| Purpose | Support startups, validate products, and promote innovation. | Provide instant, usage-based coverage for specific needs. |

| Regulation | Regulator-approved but with relaxed compliance measures. | Fully regulated insurance products with real-time activation. |

| User Base | Insurtech developers, startups, and regulators. | Consumers seeking flexible, short-term insurance. |

| Coverage Type | Various prototypes, including digital and AI-based solutions. | Specific risks such as travel, auto, or gadget insurance. |

| Duration | Temporary environment for testing phases. | On-demand coverage lasting minutes to months. |

| Cost Efficiency | Cost-effective testing environment reducing market entry risk. | Cost-effective as users pay only for coverage duration. |

| Innovation Focus | Encourages experimentation with new insurance models and tech. | Utilizes technology for instant policy issuance and claims. |

Which is better?

Insurtech sandboxes foster innovation by allowing startups to test new insurance products and technologies in a controlled regulatory environment, accelerating market entry and compliance. On-demand insurance offers consumers flexibility with coverage activated only when needed, reducing costs and enhancing user experience through real-time policy management. Both approaches address different needs: insurtech sandboxes drive industry transformation and innovation, while on-demand insurance emphasizes convenience and personalized risk protection.

Connection

Insurtech sandboxes facilitate innovation by providing regulatory environments where companies can test on-demand insurance products without full compliance burdens. This accelerates the deployment of flexible, usage-based insurance solutions that meet evolving consumer demands in real-time. By enabling controlled experimentation, sandboxes support the growth and refinement of on-demand insurance models within the insurance technology ecosystem.

Key Terms

Customization

On-demand insurance offers personalized coverage tailored to an individual's specific needs and time frames, leveraging flexible policies and real-time adjustments. Insurtech sandboxes provide a controlled environment for innovators to experiment with customizable insurance solutions, accelerating development and regulatory approval of tailored products. Explore how these approaches enhance customization in insurance by learning more about their distinct advantages and applications.

Regulatory testing

On-demand insurance leverages flexible, usage-based coverage models requiring agile regulatory compliance frameworks. Insurtech sandboxes provide controlled environments where regulators and innovators test new insurance products, ensuring adherence to legal standards while fostering innovation. Explore how regulatory testing in sandboxes accelerates market readiness and safeguards consumer protection in evolving insurance landscapes.

Technology integration

On-demand insurance leverages real-time data processing and IoT devices to provide instant, customizable coverage that adapts to user behavior and needs. Insurtech sandboxes enable startups to test innovative technology integrations such as AI-driven underwriting and blockchain claims management in a controlled regulatory environment. Explore how these technologies reshape the insurance landscape and drive competitive advantages.

Source and External Links

The ins and outs of on-demand insurance: a growing trend in coverage flexibility - On-demand insurance allows consumers to purchase coverage as needed, typically through digital platforms, offering flexibility for assets not constantly in use, such as travel, rental cars, or event-specific needs.

What Is On-Demand Insurance? - On-demand insurance refers to policies that can be bought online without a broker, featuring fast, streamlined applications and approvals, though coverage is often limited to specific items like electronics.

On-demand Insurance Market Size & Share Report, 2030 - The global on-demand insurance market is growing rapidly, driven by digital platforms, transparent policies, and personalized coverage options enabled by technologies like AI and machine learning.

dowidth.com

dowidth.com