Flood insurance integration involves specialized risk assessment models that account for hydrological data and geographic flood zones, ensuring tailored coverage for water-related damages. Auto insurance integration focuses on telematics and driver behavior analytics to optimize premiums and enhance claims processing efficiency. Explore the differences and benefits of each insurance integration to make informed coverage decisions.

Why it is important

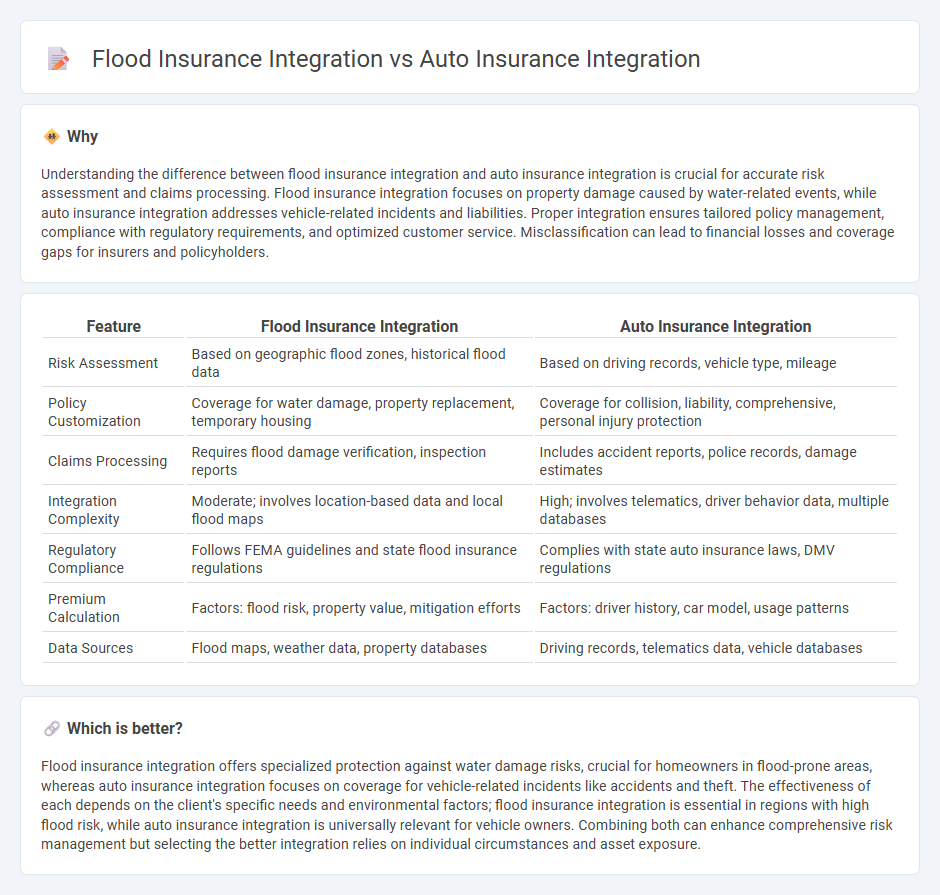

Understanding the difference between flood insurance integration and auto insurance integration is crucial for accurate risk assessment and claims processing. Flood insurance integration focuses on property damage caused by water-related events, while auto insurance integration addresses vehicle-related incidents and liabilities. Proper integration ensures tailored policy management, compliance with regulatory requirements, and optimized customer service. Misclassification can lead to financial losses and coverage gaps for insurers and policyholders.

Comparison Table

| Feature | Flood Insurance Integration | Auto Insurance Integration |

|---|---|---|

| Risk Assessment | Based on geographic flood zones, historical flood data | Based on driving records, vehicle type, mileage |

| Policy Customization | Coverage for water damage, property replacement, temporary housing | Coverage for collision, liability, comprehensive, personal injury protection |

| Claims Processing | Requires flood damage verification, inspection reports | Includes accident reports, police records, damage estimates |

| Integration Complexity | Moderate; involves location-based data and local flood maps | High; involves telematics, driver behavior data, multiple databases |

| Regulatory Compliance | Follows FEMA guidelines and state flood insurance regulations | Complies with state auto insurance laws, DMV regulations |

| Premium Calculation | Factors: flood risk, property value, mitigation efforts | Factors: driver history, car model, usage patterns |

| Data Sources | Flood maps, weather data, property databases | Driving records, telematics data, vehicle databases |

Which is better?

Flood insurance integration offers specialized protection against water damage risks, crucial for homeowners in flood-prone areas, whereas auto insurance integration focuses on coverage for vehicle-related incidents like accidents and theft. The effectiveness of each depends on the client's specific needs and environmental factors; flood insurance integration is essential in regions with high flood risk, while auto insurance integration is universally relevant for vehicle owners. Combining both can enhance comprehensive risk management but selecting the better integration relies on individual circumstances and asset exposure.

Connection

Flood insurance integration and auto insurance integration are connected through comprehensive risk management and bundled policy offerings that streamline claims processing and customer service. Both integrations utilize advanced data analytics and geographic information systems (GIS) to assess environmental and vehicular risks accurately, enhancing underwriting precision. This synergy enables insurers to provide holistic coverage options, reduce administrative costs, and improve customer retention by addressing interconnected risk factors efficiently.

Key Terms

Policy Management Systems

Auto insurance integration in Policy Management Systems centers on seamless claim processing, risk assessment using telematics data, and real-time premium adjustments to enhance customer experience and operational efficiency. Flood insurance integration involves incorporating FEMA flood zone maps, automated compliance checks with NFIP regulations, and dynamic risk modeling to accurately price policies and manage catastrophic risk exposure. Explore the latest advancements in Policy Management Systems to optimize both auto and flood insurance integration strategies.

Claims Processing Automation

Auto insurance integration streamlines claims processing by leveraging telematics and AI-driven damage assessment tools, reducing settlement times and improving accuracy. Flood insurance integration emphasizes real-time weather data and geographic information systems (GIS) to expedite claims verification and risk evaluation. Explore how advanced automation reshapes claims management in both auto and flood insurance sectors.

Data Interoperability

Auto insurance integration leverages standardized data formats like ACORD to streamline claims processing, risk assessment, and policy management across platforms. Flood insurance integration often involves complex geospatial and environmental datasets requiring specialized interoperability standards such as FEMA's Risk Rating 2.0 and NFIP data protocols. Explore the key differences in data interoperability to enhance your insurance integration strategies.

Source and External Links

Auto Insurance Integration | Progressive Partner Onboarding - Progressive's embedded API lets businesses automatically generate and display auto insurance quotes within their own platforms by integrating customer and vehicle data, with the option for users to complete the purchase directly through Progressive's pre-filled online process.

Driving Forward: Navigating Embedded Insurance for the Mobility Sector - Embedded auto insurance is being directly built into mobility services such as car subscriptions and EV sales, offering customers immediate, dynamic coverage that adjusts based on usage and is managed seamlessly through a single platform.

Insurance API Integration Guide - A Detailed Overview - Insurance API integration streamlines policy creation by automatically transferring customer and vehicle data between systems, reducing manual entry, improving accuracy, and enhancing the overall customer experience.

dowidth.com

dowidth.com