Buy now insurance offers immediate, one-time coverage ideal for short-term needs, providing convenience and flexibility without long-term commitment. Subscription insurance delivers continuous protection through monthly payments, often including added benefits like automatic renewals and customizable plans designed for consistent coverage. Explore the differences and choose the best option tailored to your insurance needs.

Why it is important

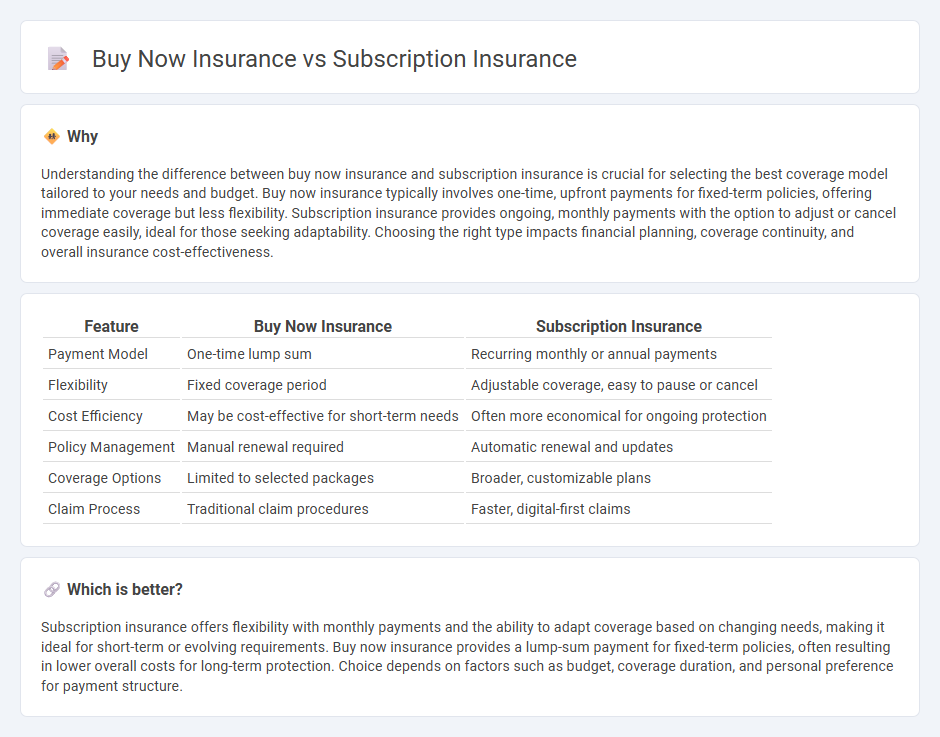

Understanding the difference between buy now insurance and subscription insurance is crucial for selecting the best coverage model tailored to your needs and budget. Buy now insurance typically involves one-time, upfront payments for fixed-term policies, offering immediate coverage but less flexibility. Subscription insurance provides ongoing, monthly payments with the option to adjust or cancel coverage easily, ideal for those seeking adaptability. Choosing the right type impacts financial planning, coverage continuity, and overall insurance cost-effectiveness.

Comparison Table

| Feature | Buy Now Insurance | Subscription Insurance |

|---|---|---|

| Payment Model | One-time lump sum | Recurring monthly or annual payments |

| Flexibility | Fixed coverage period | Adjustable coverage, easy to pause or cancel |

| Cost Efficiency | May be cost-effective for short-term needs | Often more economical for ongoing protection |

| Policy Management | Manual renewal required | Automatic renewal and updates |

| Coverage Options | Limited to selected packages | Broader, customizable plans |

| Claim Process | Traditional claim procedures | Faster, digital-first claims |

Which is better?

Subscription insurance offers flexibility with monthly payments and the ability to adapt coverage based on changing needs, making it ideal for short-term or evolving requirements. Buy now insurance provides a lump-sum payment for fixed-term policies, often resulting in lower overall costs for long-term protection. Choice depends on factors such as budget, coverage duration, and personal preference for payment structure.

Connection

Buy now insurance and subscription insurance connect through their emphasis on flexibility and convenience in coverage. Buy now insurance allows immediate purchase of specific policies online, while subscription insurance offers ongoing, pay-as-you-go protection with adjustable terms. Both models leverage digital platforms to streamline user experience and adapt to evolving customer needs in the insurance market.

Key Terms

Risk Pooling

Subscription insurance leverages risk pooling by aggregating premiums from a broad subscriber base, enhancing risk diversification and reducing individual cost volatility. Buy now insurance typically covers a single event or item without continuous contribution, limiting the pooling effect and often resulting in higher premiums for sporadic risks. Explore how risk pooling impacts coverage efficiency and pricing models to make informed insurance decisions.

Policyholder Participation

Subscription insurance enhances policyholder participation by offering continuous coverage and flexible premium payments tailored to individual needs. Buy now insurance provides immediate, one-time coverage with less ongoing interaction from the policyholder. Explore the benefits and drawbacks of each model to determine which best suits your participation preferences.

Premium Structure

Subscription insurance offers a flexible premium structure with recurring payments based on usage or time, allowing policyholders to adjust coverage as needed. Buy now insurance requires a one-time premium payment upfront, providing full coverage for a fixed term without changes. Explore the significant differences in premium structures to determine which insurance model suits your financial planning best.

Source and External Links

What is a Subscription Policy? - Definition from Insuranceopedia - A subscription policy is an insurance policy shared by multiple insurers who collectively assume portions of the risk and premiums, allowing them to manage exposure according to their capacity and business goals.

Subscription Policy - Insurance Training Center - In a subscription policy, insurers share the risk through a lead insurer who manages the policy, with each insurer responsible for an agreed percentage of coverage and claims, useful when full coverage exceeds single insurer capacity.

Comparing Costs: Subscription Health Plans vs. Traditional Insurance - Subscription insurance plans, such as health subscription plans, operate on a membership model with fixed monthly fees covering services without claims or deductibles, offering greater cost transparency, flexibility, and direct provider access compared to traditional insurance.

dowidth.com

dowidth.com