Pet insurance platforms specialize in providing tailored coverage options for loss, illness, or injury related to pets, facilitating claims and policy management through user-friendly digital interfaces. Workers' compensation insurance platforms focus on compliance, workplace injury claims, and employee benefit coordination, integrating tools for risk assessment and regulatory reporting. Explore the key differences and benefits of these insurance platforms to choose the best fit for your needs.

Why it is important

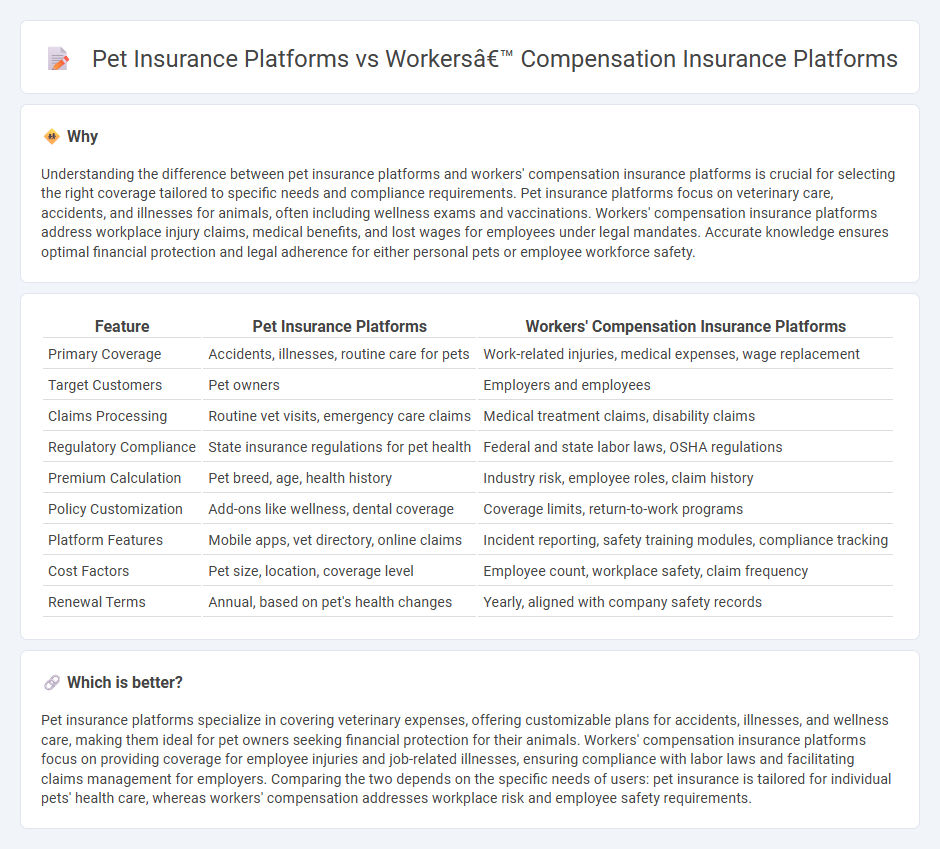

Understanding the difference between pet insurance platforms and workers' compensation insurance platforms is crucial for selecting the right coverage tailored to specific needs and compliance requirements. Pet insurance platforms focus on veterinary care, accidents, and illnesses for animals, often including wellness exams and vaccinations. Workers' compensation insurance platforms address workplace injury claims, medical benefits, and lost wages for employees under legal mandates. Accurate knowledge ensures optimal financial protection and legal adherence for either personal pets or employee workforce safety.

Comparison Table

| Feature | Pet Insurance Platforms | Workers' Compensation Insurance Platforms |

|---|---|---|

| Primary Coverage | Accidents, illnesses, routine care for pets | Work-related injuries, medical expenses, wage replacement |

| Target Customers | Pet owners | Employers and employees |

| Claims Processing | Routine vet visits, emergency care claims | Medical treatment claims, disability claims |

| Regulatory Compliance | State insurance regulations for pet health | Federal and state labor laws, OSHA regulations |

| Premium Calculation | Pet breed, age, health history | Industry risk, employee roles, claim history |

| Policy Customization | Add-ons like wellness, dental coverage | Coverage limits, return-to-work programs |

| Platform Features | Mobile apps, vet directory, online claims | Incident reporting, safety training modules, compliance tracking |

| Cost Factors | Pet size, location, coverage level | Employee count, workplace safety, claim frequency |

| Renewal Terms | Annual, based on pet's health changes | Yearly, aligned with company safety records |

Which is better?

Pet insurance platforms specialize in covering veterinary expenses, offering customizable plans for accidents, illnesses, and wellness care, making them ideal for pet owners seeking financial protection for their animals. Workers' compensation insurance platforms focus on providing coverage for employee injuries and job-related illnesses, ensuring compliance with labor laws and facilitating claims management for employers. Comparing the two depends on the specific needs of users: pet insurance is tailored for individual pets' health care, whereas workers' compensation addresses workplace risk and employee safety requirements.

Connection

Pet insurance platforms and workers' compensation insurance platforms share technological frameworks such as AI-driven claims processing, risk assessment algorithms, and data analytics tools that streamline policy management and claims handling. Both platforms utilize cloud-based systems to enhance accessibility, improve customer experience, and ensure regulatory compliance through real-time data monitoring and reporting. Integration of these digital innovations supports efficient underwriting and fraud detection across diverse insurance products.

Key Terms

Workers’ Compensation Insurance Platforms:

Workers' compensation insurance platforms streamline claims processing, risk management, and compliance tracking for employers, improving operational efficiency and reducing administrative costs. These platforms often incorporate advanced analytics and automated workflows to enhance injury reporting and benefit coordination with regulatory requirements. Explore how leading workers' compensation insurance platforms transform workplace safety and claims management for businesses.

Claims Management

Workers' compensation insurance platforms streamline claims management by automating injury reporting, tracking medical treatments, and managing wage replacement efficiently to reduce claim processing time. Pet insurance platforms focus on simplifying claims for veterinary treatments and reimbursements, utilizing user-friendly mobile apps for quick submission and approval but with less complexity compared to workers' comp systems. Explore detailed comparisons of claims management features to understand which platform best suits your insurance needs.

Employer Compliance

Workers' compensation insurance platforms streamline employer compliance by automating injury reporting, managing claims processes, and ensuring adherence to state-specific regulations. In contrast, pet insurance platforms prioritize consumer-facing policy management and claims submission without direct employer compliance features. Explore in-depth comparisons to understand which platform best supports your regulatory and operational needs.

Source and External Links

Pay-As-You-Go Workers' Compensation by Paycor - A platform that automates workers' compensation insurance payments based on payroll, eliminating large down payments and year-end surprises, while helping with budgeting and compliance monitoring.

Workers' Compensation Insurance Software by Sapiens - An AI-based, open, and integrated insurance platform designed for workers' compensation that accelerates innovation, supports insurers and administrators, and adapts to changing market conditions.

Guidewire Workers' Compensation Solution - A comprehensive, purpose-built platform simplifying claims and policy management with enhanced case handling, medical management, reserve payments, and analytics to improve operational efficiency and outcomes.

dowidth.com

dowidth.com