Gig worker insurance offers tailored coverage for freelancers and independent contractors, addressing gaps such as income protection and liability risks unique to self-employment. Student health insurance focuses on affordable medical coverage, emphasizing preventive care and mental health services essential for the academic environment. Explore detailed comparisons to choose the best insurance solution for your lifestyle and needs.

Why it is important

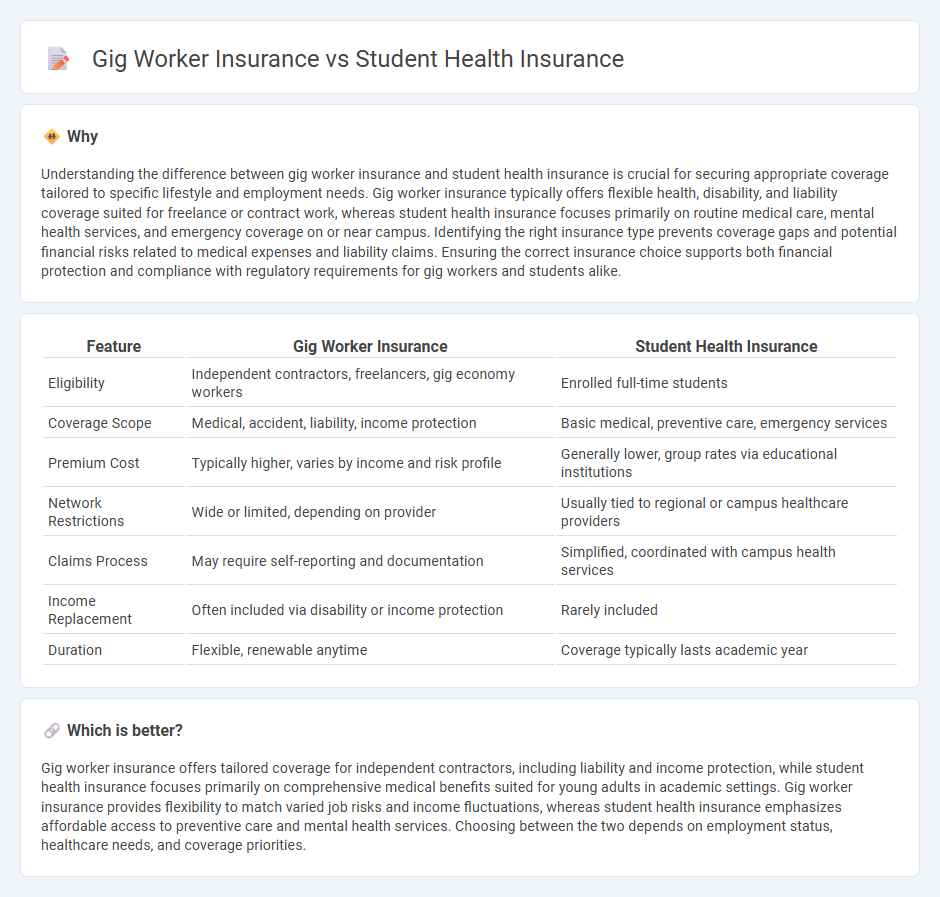

Understanding the difference between gig worker insurance and student health insurance is crucial for securing appropriate coverage tailored to specific lifestyle and employment needs. Gig worker insurance typically offers flexible health, disability, and liability coverage suited for freelance or contract work, whereas student health insurance focuses primarily on routine medical care, mental health services, and emergency coverage on or near campus. Identifying the right insurance type prevents coverage gaps and potential financial risks related to medical expenses and liability claims. Ensuring the correct insurance choice supports both financial protection and compliance with regulatory requirements for gig workers and students alike.

Comparison Table

| Feature | Gig Worker Insurance | Student Health Insurance |

|---|---|---|

| Eligibility | Independent contractors, freelancers, gig economy workers | Enrolled full-time students |

| Coverage Scope | Medical, accident, liability, income protection | Basic medical, preventive care, emergency services |

| Premium Cost | Typically higher, varies by income and risk profile | Generally lower, group rates via educational institutions |

| Network Restrictions | Wide or limited, depending on provider | Usually tied to regional or campus healthcare providers |

| Claims Process | May require self-reporting and documentation | Simplified, coordinated with campus health services |

| Income Replacement | Often included via disability or income protection | Rarely included |

| Duration | Flexible, renewable anytime | Coverage typically lasts academic year |

Which is better?

Gig worker insurance offers tailored coverage for independent contractors, including liability and income protection, while student health insurance focuses primarily on comprehensive medical benefits suited for young adults in academic settings. Gig worker insurance provides flexibility to match varied job risks and income fluctuations, whereas student health insurance emphasizes affordable access to preventive care and mental health services. Choosing between the two depends on employment status, healthcare needs, and coverage priorities.

Connection

Gig worker insurance and student health insurance both address gaps in traditional employment-based coverage by offering flexible, affordable health plans tailored to non-standard work and academic schedules. These insurance options prioritize accessibility and financial protection for individuals with irregular incomes or limited access to employer-sponsored benefits, emphasizing the importance of adaptable coverage models. By focusing on customization and portability, both policies help mitigate health-related financial risks for gig economy participants and students alike.

Key Terms

**Student Health Insurance:**

Student health insurance plans offer affordable coverage tailored to young adults, often providing access to campus health services and mental health support. These plans typically cover preventive care, prescription drugs, and emergency services with lower premiums than standard individual policies. Explore more benefits and options to make an informed decision about student health insurance coverage.

Student Health Plan

Student Health Plans typically offer comprehensive coverage tailored to the unique needs of enrolled students, including mental health services, preventive care, and affordable premiums. In contrast, gig worker insurance often emphasizes flexible, customizable policies to accommodate irregular income and diverse job risks but may lack some specialized student benefits. Explore the key differences and benefits of student health plans to determine the best insurance option for your unique situation.

School Network Coverage

Student health insurance plans often prioritize school network coverage, providing access to in-network doctors and campus health services specifically tailored to student needs. Gig worker insurance typically offers more flexible provider networks that accommodate various work locations but might lack extensive partnerships with academic institutions. Explore the differences in network coverage to choose the best health insurance suited for your lifestyle.

Source and External Links

DU Student Health Insurance Plan (SHIP) - This plan provides comprehensive coverage for students at the University of Denver with benefits like low co-payments and a nationwide network of providers.

College Student Health Insurance - Offers lower-cost plans with comprehensive benefits designed specifically for college students, providing access to national networks of healthcare providers.

Anthem Gold Student Health Insurance Plan (SHIP) - Provides a full year of medical, mental health, and prescription coverage for CU Boulder students.

dowidth.com

dowidth.com