Behavioral policy pricing uses data on individual actions and lifestyle choices to tailor insurance premiums, promoting healthier habits and risk reduction. Genetic underwriting assesses genetic information to predict disease risk and customize insurance coverage, raising ethical and privacy concerns. Explore the impact of these innovative methods on the future of insurance underwriting and pricing.

Why it is important

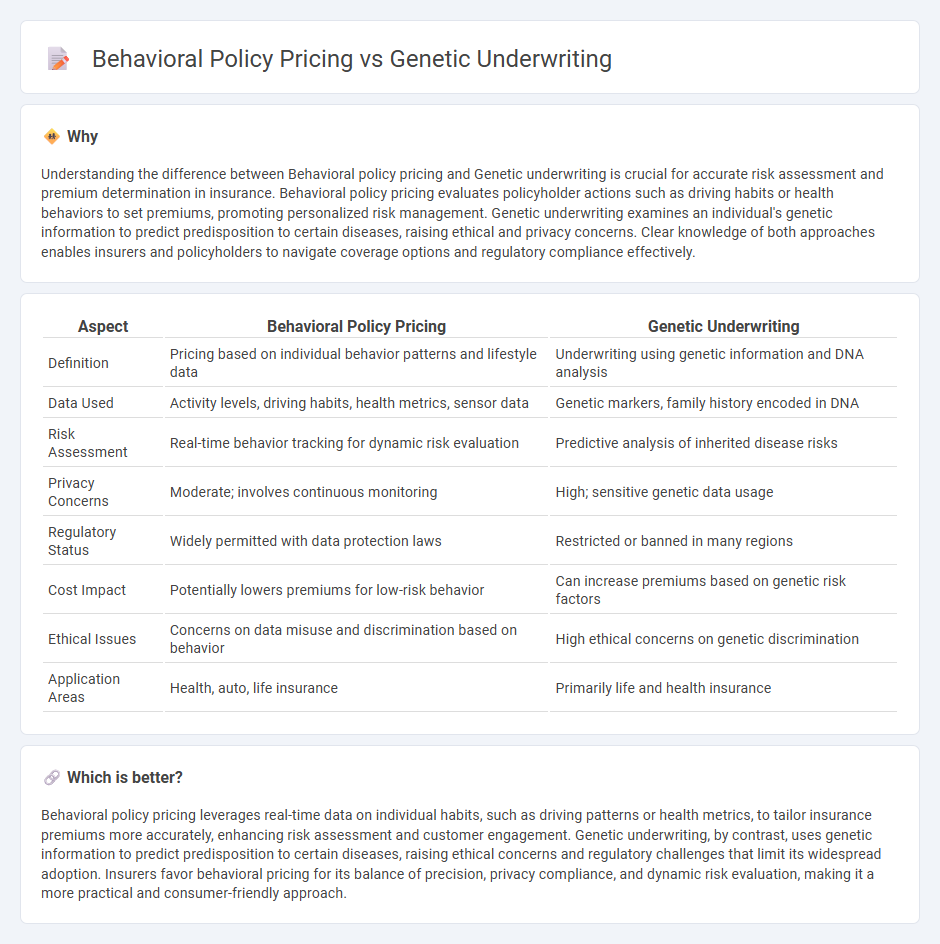

Understanding the difference between Behavioral policy pricing and Genetic underwriting is crucial for accurate risk assessment and premium determination in insurance. Behavioral policy pricing evaluates policyholder actions such as driving habits or health behaviors to set premiums, promoting personalized risk management. Genetic underwriting examines an individual's genetic information to predict predisposition to certain diseases, raising ethical and privacy concerns. Clear knowledge of both approaches enables insurers and policyholders to navigate coverage options and regulatory compliance effectively.

Comparison Table

| Aspect | Behavioral Policy Pricing | Genetic Underwriting |

|---|---|---|

| Definition | Pricing based on individual behavior patterns and lifestyle data | Underwriting using genetic information and DNA analysis |

| Data Used | Activity levels, driving habits, health metrics, sensor data | Genetic markers, family history encoded in DNA |

| Risk Assessment | Real-time behavior tracking for dynamic risk evaluation | Predictive analysis of inherited disease risks |

| Privacy Concerns | Moderate; involves continuous monitoring | High; sensitive genetic data usage |

| Regulatory Status | Widely permitted with data protection laws | Restricted or banned in many regions |

| Cost Impact | Potentially lowers premiums for low-risk behavior | Can increase premiums based on genetic risk factors |

| Ethical Issues | Concerns on data misuse and discrimination based on behavior | High ethical concerns on genetic discrimination |

| Application Areas | Health, auto, life insurance | Primarily life and health insurance |

Which is better?

Behavioral policy pricing leverages real-time data on individual habits, such as driving patterns or health metrics, to tailor insurance premiums more accurately, enhancing risk assessment and customer engagement. Genetic underwriting, by contrast, uses genetic information to predict predisposition to certain diseases, raising ethical concerns and regulatory challenges that limit its widespread adoption. Insurers favor behavioral pricing for its balance of precision, privacy compliance, and dynamic risk evaluation, making it a more practical and consumer-friendly approach.

Connection

Behavioral policy pricing utilizes data on individual behaviors, such as driving habits or health activities, to tailor insurance premiums more accurately. Genetic underwriting incorporates genetic information to assess risk factors that may influence policy pricing. Both methods enhance risk assessment precision, enabling insurers to offer personalized premiums based on behavioral patterns and genetic predispositions.

Key Terms

Adverse Selection

Genetic underwriting assesses individual risk profiles by analyzing genetic data to predict susceptibility to diseases, which can minimize adverse selection by accurately pricing high-risk applicants. Behavioral policy pricing uses lifestyle and behavior information, such as smoking or exercise habits, to tailor premiums, aiming to reduce the asymmetry of information between insurers and policyholders. Discover how these approaches shape the future of insurance risk management and pricing strategies.

Predictive Analytics

Genetic underwriting leverages DNA data to assess risk by identifying predispositions to hereditary diseases, whereas behavioral policy pricing uses lifestyle and habits, such as smoking or exercise, for risk evaluation through predictive analytics. Predictive analytics in both approaches relies on vast datasets and algorithms to enhance accuracy in mortality and morbidity predictions, ultimately shaping personalized insurance premiums. Explore the evolving impact of predictive analytics on risk assessment and pricing strategies in insurance to understand future trends.

Anti-Discrimination Regulation

Genetic underwriting assesses insurance risk based on an individual's genetic information, raising concerns under anti-discrimination regulations such as the Genetic Information Nondiscrimination Act (GINA) in the United States, which prohibits misuse of genetic data in insurance and employment decisions. Behavioral policy pricing relies on analyzing lifestyle choices like smoking or exercise habits, often collected through wearable devices or questionnaires, and faces fewer regulatory constraints but still must comply with privacy laws. Explore the evolving legal frameworks and ethical considerations shaping the future of insurance pricing models.

Source and External Links

Insurance underwriting in the genetic era - This paper reviews genetic advances and their impact on various insurance types, emphasizing the role of genetic information in risk classification.

Genetic Testing in Insurance: Challenges and Opportunities - This article discusses the challenges and opportunities of genetic testing in insurance underwriting, noting laws and regulations that limit the use of genetic information.

Genetic Testing in Underwriting: Implications for Life Insurance Markets - This paper analyzes the implications of genetic testing on life insurance underwriting, considering potential consequences such as adverse selection if genetic data is not allowed for underwriting.

dowidth.com

dowidth.com