Catastrophe bonds transfer disaster risks to capital markets, offering investors high-yield opportunities while insurers reduce exposure to large-scale events. Traditional insurance relies on pooled premiums and risk-sharing among policyholders to cover losses from natural disasters and other hazards. Explore deeper insights into how these financial tools protect against catastrophic risks and their impact on the insurance industry.

Why it is important

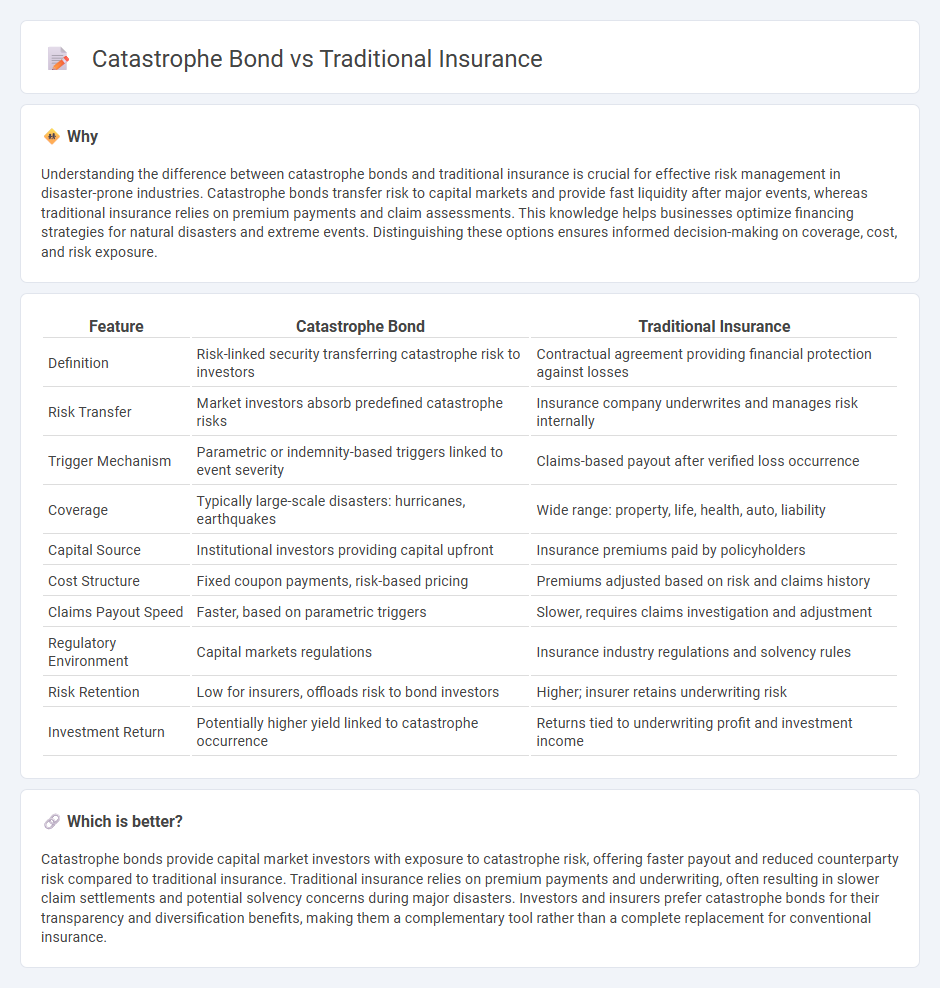

Understanding the difference between catastrophe bonds and traditional insurance is crucial for effective risk management in disaster-prone industries. Catastrophe bonds transfer risk to capital markets and provide fast liquidity after major events, whereas traditional insurance relies on premium payments and claim assessments. This knowledge helps businesses optimize financing strategies for natural disasters and extreme events. Distinguishing these options ensures informed decision-making on coverage, cost, and risk exposure.

Comparison Table

| Feature | Catastrophe Bond | Traditional Insurance |

|---|---|---|

| Definition | Risk-linked security transferring catastrophe risk to investors | Contractual agreement providing financial protection against losses |

| Risk Transfer | Market investors absorb predefined catastrophe risks | Insurance company underwrites and manages risk internally |

| Trigger Mechanism | Parametric or indemnity-based triggers linked to event severity | Claims-based payout after verified loss occurrence |

| Coverage | Typically large-scale disasters: hurricanes, earthquakes | Wide range: property, life, health, auto, liability |

| Capital Source | Institutional investors providing capital upfront | Insurance premiums paid by policyholders |

| Cost Structure | Fixed coupon payments, risk-based pricing | Premiums adjusted based on risk and claims history |

| Claims Payout Speed | Faster, based on parametric triggers | Slower, requires claims investigation and adjustment |

| Regulatory Environment | Capital markets regulations | Insurance industry regulations and solvency rules |

| Risk Retention | Low for insurers, offloads risk to bond investors | Higher; insurer retains underwriting risk |

| Investment Return | Potentially higher yield linked to catastrophe occurrence | Returns tied to underwriting profit and investment income |

Which is better?

Catastrophe bonds provide capital market investors with exposure to catastrophe risk, offering faster payout and reduced counterparty risk compared to traditional insurance. Traditional insurance relies on premium payments and underwriting, often resulting in slower claim settlements and potential solvency concerns during major disasters. Investors and insurers prefer catastrophe bonds for their transparency and diversification benefits, making them a complementary tool rather than a complete replacement for conventional insurance.

Connection

Catastrophe bonds and traditional insurance both serve as risk management tools for mitigating losses from natural disasters. While traditional insurance pools premiums to cover claims, catastrophe bonds transfer specific disaster risks to capital markets by paying investors high yields linked to event triggers. Combining catastrophe bonds with traditional insurance enhances overall financial resilience by diversifying funding sources and reducing insurer exposure to extreme catastrophe losses.

Key Terms

Risk Transfer

Traditional insurance transfers risk by pooling premiums from many policyholders to cover losses from insured events, relying on insurer capital and reinsurance for claims payment. Catastrophe bonds shift risk directly to capital market investors by issuing securities that pay out upon predefined disaster triggers, thus providing insurers with rapid access to alternative funds after catastrophes. Explore how these risk transfer mechanisms impact financial stability and resilience in disaster management.

Payout Trigger

Traditional insurance payout triggers are typically event-based, relying on the occurrence of specified risks such as natural disasters or accidents, which must be verified through loss assessments. Catastrophe bonds utilize parametric triggers tied to measurable data like seismic intensity or hurricane wind speeds, enabling faster payouts without detailed loss evaluations. Explore the differences in payout triggers to understand how each impacts risk management and financial recovery strategies.

Capital Source

Traditional insurance relies primarily on premiums paid by policyholders as a consistent capital source to underwrite risks, enabling timely claim settlements through accumulated reserves. Catastrophe bonds, issued by insurers or reinsurers in capital markets, attract investors by transferring specific disaster-related risks, providing a large influx of capital upfront that is only lost if a predefined catastrophe event occurs. Explore the intricacies of capital sourcing between these two frameworks to optimize risk management strategies.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional life insurance plans provide long-standing financial protection and benefits, such as term insurance, endowment plans, and retirement plans, offering life coverage, fixed incomes, tax benefits, and bonuses.

Traditional Indemnity Insurance Plans - Virginia Health Information - Traditional health insurance reimburses patients based on provider bills and usual, customary, and reasonable (UCR) fees, allowing freedom to choose any medical provider without network restrictions.

Comparing Costs: Subscription Health Plans vs. Traditional Insurance - Traditional insurance involves paying premiums, deductibles, and coinsurance for comprehensive coverage, often resulting in higher out-of-pocket costs but providing access to a wide range of medical services, including hospitalization and specialty care.

dowidth.com

dowidth.com