Pet insurance platforms focus on coverage for veterinary expenses, including accidents, illnesses, and preventive care, catering to the unique needs of pet owners. Dental insurance platforms specialize in plans that cover routine checkups, cleanings, and restorative dental procedures, addressing oral health costs for individuals. Explore the differences and benefits of each platform to find the best insurance solution for your needs.

Why it is important

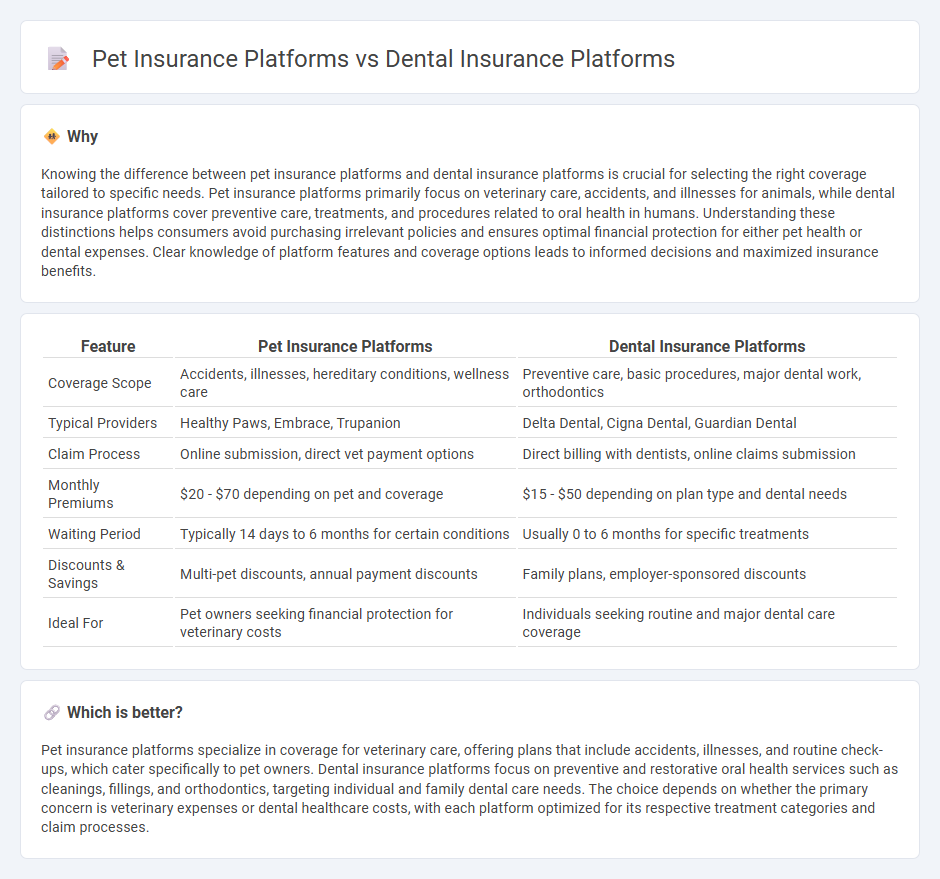

Knowing the difference between pet insurance platforms and dental insurance platforms is crucial for selecting the right coverage tailored to specific needs. Pet insurance platforms primarily focus on veterinary care, accidents, and illnesses for animals, while dental insurance platforms cover preventive care, treatments, and procedures related to oral health in humans. Understanding these distinctions helps consumers avoid purchasing irrelevant policies and ensures optimal financial protection for either pet health or dental expenses. Clear knowledge of platform features and coverage options leads to informed decisions and maximized insurance benefits.

Comparison Table

| Feature | Pet Insurance Platforms | Dental Insurance Platforms |

|---|---|---|

| Coverage Scope | Accidents, illnesses, hereditary conditions, wellness care | Preventive care, basic procedures, major dental work, orthodontics |

| Typical Providers | Healthy Paws, Embrace, Trupanion | Delta Dental, Cigna Dental, Guardian Dental |

| Claim Process | Online submission, direct vet payment options | Direct billing with dentists, online claims submission |

| Monthly Premiums | $20 - $70 depending on pet and coverage | $15 - $50 depending on plan type and dental needs |

| Waiting Period | Typically 14 days to 6 months for certain conditions | Usually 0 to 6 months for specific treatments |

| Discounts & Savings | Multi-pet discounts, annual payment discounts | Family plans, employer-sponsored discounts |

| Ideal For | Pet owners seeking financial protection for veterinary costs | Individuals seeking routine and major dental care coverage |

Which is better?

Pet insurance platforms specialize in coverage for veterinary care, offering plans that include accidents, illnesses, and routine check-ups, which cater specifically to pet owners. Dental insurance platforms focus on preventive and restorative oral health services such as cleanings, fillings, and orthodontics, targeting individual and family dental care needs. The choice depends on whether the primary concern is veterinary expenses or dental healthcare costs, with each platform optimized for its respective treatment categories and claim processes.

Connection

Pet insurance platforms and dental insurance platforms share a common goal of reducing out-of-pocket healthcare costs by providing tailored coverage for specific needs. Both platforms utilize advanced data analytics and digital claim processing to enhance customer experience and streamline policy management. Integration of health data and insurance technology enables cross-platform benefits, such as bundled plans and related wellness programs, that improve overall risk assessment and customer retention.

Key Terms

Dental Insurance Platforms:

Dental insurance platforms streamline access to comprehensive dental care plans, offering users tailored coverage options for routine check-ups, orthodontics, and dental surgeries with transparent pricing and provider networks. These platforms integrate advanced features like AI-driven claim processing, tele-dentistry consultations, and personalized wellness reminders, enhancing user experience and cost efficiency. Explore how dental insurance platforms revolutionize oral health management and provide optimal financial protection.

Provider Network

Dental insurance platforms typically boast extensive provider networks with thousands of participating dentists nationwide, ensuring wide accessibility and coverage for routine cleanings, orthodontics, and major dental procedures. Pet insurance platforms often feature more limited but specialized veterinary networks, emphasizing partnerships with emergency clinics and specialty hospitals to address diverse animal health needs. Explore the differences in provider network structures to choose the best insurance platform for your dental or pet care requirements.

Annual Maximum Benefit

Dental insurance platforms typically offer Annual Maximum Benefits ranging from $1,000 to $2,000, designed to cover routine cleanings, fillings, and minor procedures. Pet insurance platforms usually have variable annual limits depending on the plan, with some offering unlimited coverage for chronic conditions while others cap payouts annually around $5,000 to $10,000. Explore detailed comparisons to understand how Annual Maximum Benefits impact your coverage needs.

Source and External Links

Bento - Bento is a patented, modern dental benefit platform offering flexible, customized dental plans with transparent pricing, instant claim adjudication, and a focus on delivering a superior, connected member experience for employers, insurers, and other organizations.

DentalXChange - DentalXChange is a comprehensive dental revenue cycle management (RCM) platform that streamlines eligibility verification, claims submission, and payment processing for dental providers, payers, and partners across a large nationwide network.

DentalHQ - DentalHQ enables dental practices to create and manage customizable membership plans, automate plan administration, and offer affordable, monthly payment options to both insured and uninsured patients, with features like guaranteed payments and community outreach tools.

dowidth.com

dowidth.com