NFT insurance protects digital assets on blockchain platforms by covering risks such as theft, hacking, or loss of value, while decentralized insurance operates through smart contracts on peer-to-peer networks without intermediaries, offering transparency and reduced costs. Both types leverage blockchain technology but cater to different aspects of risk management in the evolving digital economy. Explore the distinct features and benefits of NFT insurance versus decentralized insurance to make informed coverage decisions.

Why it is important

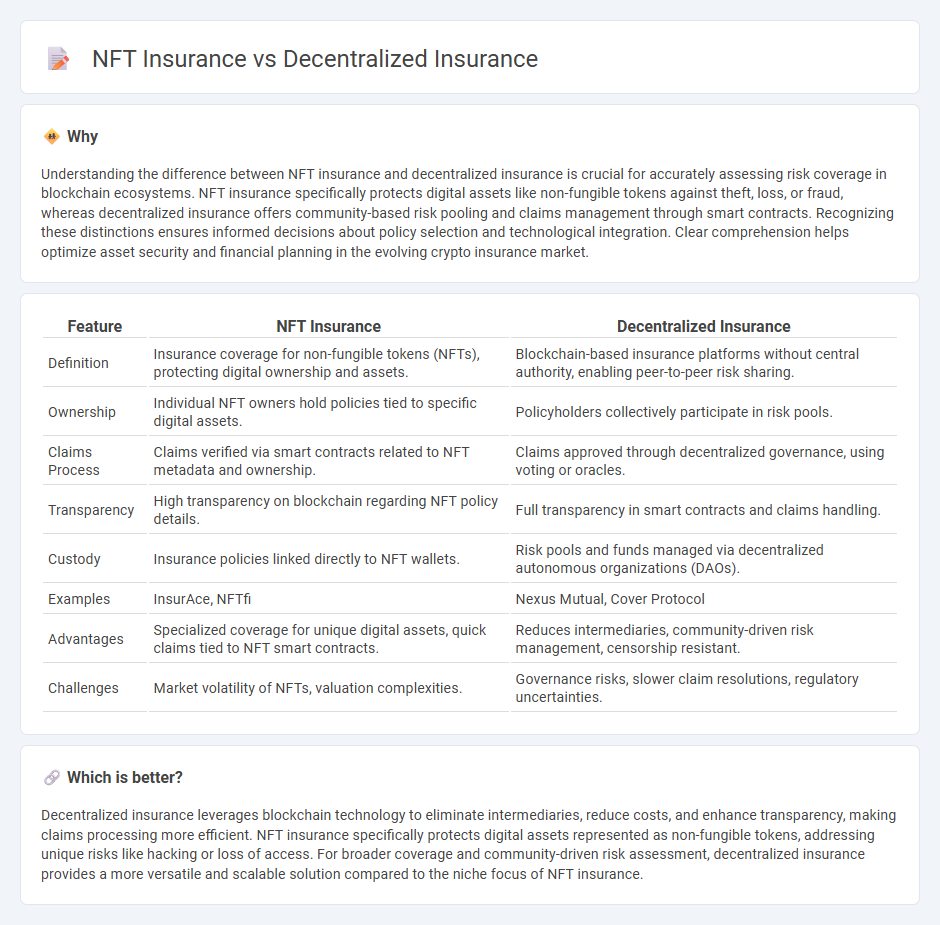

Understanding the difference between NFT insurance and decentralized insurance is crucial for accurately assessing risk coverage in blockchain ecosystems. NFT insurance specifically protects digital assets like non-fungible tokens against theft, loss, or fraud, whereas decentralized insurance offers community-based risk pooling and claims management through smart contracts. Recognizing these distinctions ensures informed decisions about policy selection and technological integration. Clear comprehension helps optimize asset security and financial planning in the evolving crypto insurance market.

Comparison Table

| Feature | NFT Insurance | Decentralized Insurance |

|---|---|---|

| Definition | Insurance coverage for non-fungible tokens (NFTs), protecting digital ownership and assets. | Blockchain-based insurance platforms without central authority, enabling peer-to-peer risk sharing. |

| Ownership | Individual NFT owners hold policies tied to specific digital assets. | Policyholders collectively participate in risk pools. |

| Claims Process | Claims verified via smart contracts related to NFT metadata and ownership. | Claims approved through decentralized governance, using voting or oracles. |

| Transparency | High transparency on blockchain regarding NFT policy details. | Full transparency in smart contracts and claims handling. |

| Custody | Insurance policies linked directly to NFT wallets. | Risk pools and funds managed via decentralized autonomous organizations (DAOs). |

| Examples | InsurAce, NFTfi | Nexus Mutual, Cover Protocol |

| Advantages | Specialized coverage for unique digital assets, quick claims tied to NFT smart contracts. | Reduces intermediaries, community-driven risk management, censorship resistant. |

| Challenges | Market volatility of NFTs, valuation complexities. | Governance risks, slower claim resolutions, regulatory uncertainties. |

Which is better?

Decentralized insurance leverages blockchain technology to eliminate intermediaries, reduce costs, and enhance transparency, making claims processing more efficient. NFT insurance specifically protects digital assets represented as non-fungible tokens, addressing unique risks like hacking or loss of access. For broader coverage and community-driven risk assessment, decentralized insurance provides a more versatile and scalable solution compared to the niche focus of NFT insurance.

Connection

NFT insurance and decentralized insurance are interconnected through blockchain technology, enabling secure, transparent, and automated coverage for digital assets. NFT insurance protects non-fungible tokens against risks like hacking, fraud, and loss, while decentralized insurance leverages smart contracts to eliminate intermediaries and enhance trust among participants. Both systems promote risk-sharing and efficient claims processing within the decentralized finance (DeFi) ecosystem.

Key Terms

Smart Contracts

Decentralized insurance leverages blockchain technology to create transparent, trustless policies managed by smart contracts that automatically execute claims based on predefined conditions. NFT insurance utilizes unique, non-fungible tokens to represent specific insurance policies or insured assets, offering personalized coverage and enhanced security through immutable record-keeping on the blockchain. Explore the innovative applications and benefits of smart contracts in both decentralized and NFT insurance models to understand their transformative potential in the insurance industry.

Risk Pooling

Decentralized insurance leverages risk pooling by aggregating premiums from a broad user base to cover claims transparently on blockchain networks, enhancing trust and reducing fraud. NFT insurance, however, underwrites unique digital assets through individualized smart contracts, offering tailored coverage instead of collective risk sharing. Explore how each model innovates risk management in the evolving insurance ecosystem for deeper insights.

Tokenization

Decentralized insurance leverages blockchain technology to democratize risk-sharing by enabling peer-to-peer policies without intermediaries, while NFT insurance uniquely tokenizes specific digital assets, providing transparent, verifiable coverage through non-fungible tokens. Tokenization in decentralized insurance converts policy rights and claims into digital tokens, enhancing liquidity and traceability, whereas NFT insurance directly ties coverage to individual digital collectibles, ensuring precise protection and transferability in the evolving digital economy. Explore the intricacies of tokenization's impact on insurance models to understand how these innovations reshape risk management and asset security.

Source and External Links

DeFi Insurance: The Next Generation of Insurance | Hedera - DeFi insurance uses blockchain technology and smart contracts to automate payouts for specific risks, such as natural disasters or flight delays, without the need for intermediaries.

What Is Decentralized Insurance? - DeFipedia - Decentralized insurance provides financial coverage for predefined losses using blockchain technology, covering risks in both the crypto and real-world environments.

DeFi in Insurance: Revolutionary Guide to Decentralized Coverage - DeFi insurance platforms leverage blockchain to offer transparent, efficient, and accessible coverage options, reducing costs and improving risk management across various sectors.

dowidth.com

dowidth.com