Insurtech sandboxes offer a controlled regulatory environment where innovative insurance technologies and business models can be tested safely, accelerating market entry and compliance evaluation. Peer-to-peer insurance leverages community pooling of risks, enabling participants to share premiums and claims directly, often resulting in lower costs and increased transparency. Discover how these transformative approaches are reshaping the future of insurance.

Why it is important

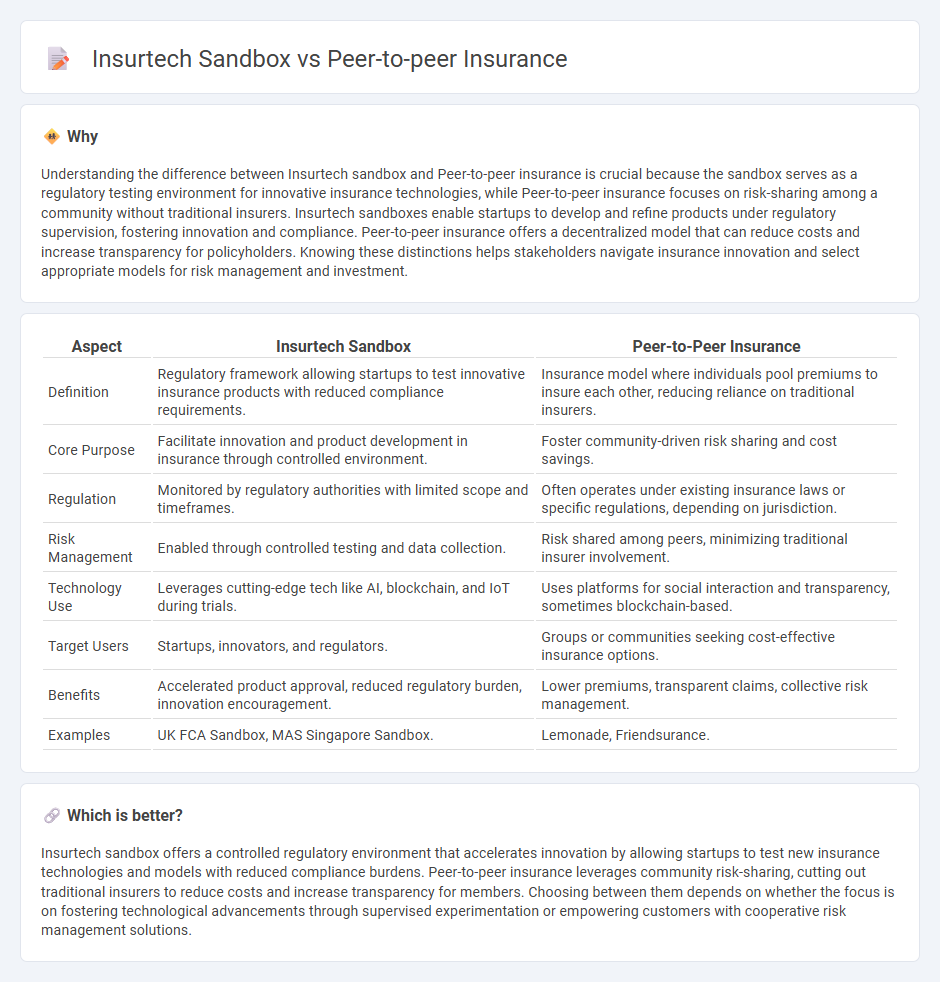

Understanding the difference between Insurtech sandbox and Peer-to-peer insurance is crucial because the sandbox serves as a regulatory testing environment for innovative insurance technologies, while Peer-to-peer insurance focuses on risk-sharing among a community without traditional insurers. Insurtech sandboxes enable startups to develop and refine products under regulatory supervision, fostering innovation and compliance. Peer-to-peer insurance offers a decentralized model that can reduce costs and increase transparency for policyholders. Knowing these distinctions helps stakeholders navigate insurance innovation and select appropriate models for risk management and investment.

Comparison Table

| Aspect | Insurtech Sandbox | Peer-to-Peer Insurance |

|---|---|---|

| Definition | Regulatory framework allowing startups to test innovative insurance products with reduced compliance requirements. | Insurance model where individuals pool premiums to insure each other, reducing reliance on traditional insurers. |

| Core Purpose | Facilitate innovation and product development in insurance through controlled environment. | Foster community-driven risk sharing and cost savings. |

| Regulation | Monitored by regulatory authorities with limited scope and timeframes. | Often operates under existing insurance laws or specific regulations, depending on jurisdiction. |

| Risk Management | Enabled through controlled testing and data collection. | Risk shared among peers, minimizing traditional insurer involvement. |

| Technology Use | Leverages cutting-edge tech like AI, blockchain, and IoT during trials. | Uses platforms for social interaction and transparency, sometimes blockchain-based. |

| Target Users | Startups, innovators, and regulators. | Groups or communities seeking cost-effective insurance options. |

| Benefits | Accelerated product approval, reduced regulatory burden, innovation encouragement. | Lower premiums, transparent claims, collective risk management. |

| Examples | UK FCA Sandbox, MAS Singapore Sandbox. | Lemonade, Friendsurance. |

Which is better?

Insurtech sandbox offers a controlled regulatory environment that accelerates innovation by allowing startups to test new insurance technologies and models with reduced compliance burdens. Peer-to-peer insurance leverages community risk-sharing, cutting out traditional insurers to reduce costs and increase transparency for members. Choosing between them depends on whether the focus is on fostering technological advancements through supervised experimentation or empowering customers with cooperative risk management solutions.

Connection

Insurtech sandboxes facilitate innovation by allowing peer-to-peer insurance models to be tested in a controlled regulatory environment, accelerating product development and market entry. Peer-to-peer insurance leverages blockchain and smart contracts to increase transparency and reduce administrative costs, which are effectively trialed within insurtech sandboxes. These sandboxes support collaboration between startups and regulators, driving the adoption of decentralized risk-sharing frameworks inherent to peer-to-peer insurance.

Key Terms

Risk Pooling

Peer-to-peer insurance leverages risk pooling by grouping participants to share claims costs directly, reducing reliance on traditional insurers and enhancing transparency. Insurtech sandboxes enable innovative risk pooling models through regulatory experimentation, fostering the development of tech-driven solutions that optimize claims management and pricing. Explore how these approaches transform risk sharing and redefine insurance ecosystems.

Regulatory Framework

Peer-to-peer insurance operates within established regulatory frameworks designed to ensure member protection and financial stability, often requiring adherence to strict licensing and capital requirements. The Insurtech sandbox provides a controlled regulatory environment allowing innovators to test new insurance models, including peer-to-peer solutions, with relaxed compliance to foster innovation while maintaining consumer safeguards. Explore how evolving regulations shape the future of peer-to-peer insurance and Insurtech innovation.

Digital Platform

Peer-to-peer insurance leverages decentralized digital platforms to connect policyholders directly, reducing reliance on traditional insurers and enhancing transparency through shared risk pools. Insurtech sandboxes provide a controlled digital environment for testing innovative insurance technologies, enabling rapid development and regulatory compliance within a secure framework. Explore the evolving role of digital platforms in transforming insurance landscapes to learn more.

Source and External Links

How Peer-to-Peer Insurance Works - Peer-to-peer insurance is a new model that combines technology and the sharing economy to offer mutual protection by pooling funds among participants.

Peer-To-Peer Car Rental Insurance - This insurance model applies to car-sharing services, where owners keep their own insurance but may opt for additional protection plans during rentals.

Navigate Insurance Peer-to-Peer Reviews - This article provides tips for navigating peer-to-peer reviews in insurance, which involve discussions between providers and insurance medical directors.

dowidth.com

dowidth.com