Peer-to-peer insurance leverages decentralized groups pooling resources to cover risks collectively, often resulting in lower premiums and increased transparency. Social insurance, typically government-run, provides mandatory coverage for widespread societal risks such as unemployment, health, and retirement, funded through taxes or contributions. Explore the key differences and benefits between these models to understand which suits your insurance needs best.

Why it is important

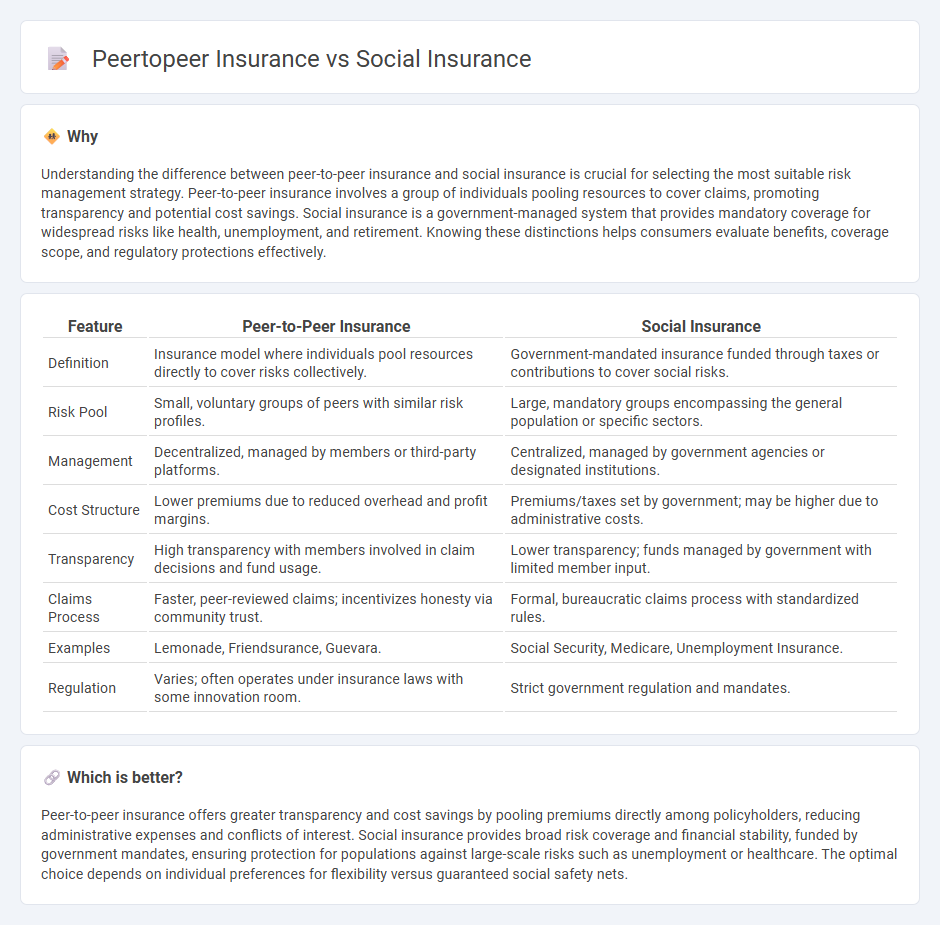

Understanding the difference between peer-to-peer insurance and social insurance is crucial for selecting the most suitable risk management strategy. Peer-to-peer insurance involves a group of individuals pooling resources to cover claims, promoting transparency and potential cost savings. Social insurance is a government-managed system that provides mandatory coverage for widespread risks like health, unemployment, and retirement. Knowing these distinctions helps consumers evaluate benefits, coverage scope, and regulatory protections effectively.

Comparison Table

| Feature | Peer-to-Peer Insurance | Social Insurance |

|---|---|---|

| Definition | Insurance model where individuals pool resources directly to cover risks collectively. | Government-mandated insurance funded through taxes or contributions to cover social risks. |

| Risk Pool | Small, voluntary groups of peers with similar risk profiles. | Large, mandatory groups encompassing the general population or specific sectors. |

| Management | Decentralized, managed by members or third-party platforms. | Centralized, managed by government agencies or designated institutions. |

| Cost Structure | Lower premiums due to reduced overhead and profit margins. | Premiums/taxes set by government; may be higher due to administrative costs. |

| Transparency | High transparency with members involved in claim decisions and fund usage. | Lower transparency; funds managed by government with limited member input. |

| Claims Process | Faster, peer-reviewed claims; incentivizes honesty via community trust. | Formal, bureaucratic claims process with standardized rules. |

| Examples | Lemonade, Friendsurance, Guevara. | Social Security, Medicare, Unemployment Insurance. |

| Regulation | Varies; often operates under insurance laws with some innovation room. | Strict government regulation and mandates. |

Which is better?

Peer-to-peer insurance offers greater transparency and cost savings by pooling premiums directly among policyholders, reducing administrative expenses and conflicts of interest. Social insurance provides broad risk coverage and financial stability, funded by government mandates, ensuring protection for populations against large-scale risks such as unemployment or healthcare. The optimal choice depends on individual preferences for flexibility versus guaranteed social safety nets.

Connection

Peer-to-peer insurance and social insurance both rely on collective risk-sharing among groups to enhance coverage affordability and accessibility. Peer-to-peer insurance leverages decentralized networks, allowing participants to pool premiums and share claims directly without traditional insurers. Social insurance operates through government-mandated programs funded by contributions from workers and employers, ensuring financial protection against risks like unemployment, disability, and healthcare.

Key Terms

Risk Pooling

Social insurance relies on large risk pools funded by governments to provide broad coverage for various social risks like unemployment, health, and disability, ensuring financial protection across entire populations. Peer-to-peer insurance creates smaller, community-based risk pools where members share risks directly, often leading to increased transparency and potential cost savings. Explore how these differing approaches to risk pooling impact coverage, costs, and user experience.

Contribution Model

Social insurance relies on mandatory contributions pooled by the government, ensuring risk is shared across a broad population base to provide universal coverage. Peer-to-peer insurance operates through voluntary group contributions among participants, promoting transparency and potential cost savings by reducing administrative fees. Explore deeper insights into how these distinct contribution models impact coverage efficiency and member benefits.

Benefit Distribution

Social insurance programs redistribute risk through government-managed funds, providing guaranteed benefits based on contributions and statutory eligibility criteria. Peer-to-peer insurance pools premiums within smaller groups, enabling more transparent and potentially faster benefit distribution, as excess funds may be refunded to participants rather than retained as profit. Explore the differences in benefit distribution to understand which model aligns with your financial security needs.

Source and External Links

Social Security History - Social insurance provides partial replacement of work income during times of unemployment, retirement, death, or disability, serving as "income insurance" to secure economic stability for individuals facing these risks, with major U.S. programs including Social Security, unemployment insurance, workers' compensation, and state short-term illness benefits.

Social insurance - Citizens Information - Social insurance contributions in Ireland entitle contributors to a range of benefits such as jobseeker's benefit, illness benefit, maternity and paternity benefits, state pensions, and various other social welfare payments, dependent on contribution types and qualifying conditions.

Social insurance - Wikipedia - Social insurance is a social welfare system providing insurance against economic risks based on contributions from individuals, covering programs like public health insurance, social security, unemployment insurance, and workers' compensation, with a mix of government and private involvement and varying degrees of redistribution.

dowidth.com

dowidth.com