Cyber risk insurance protects businesses against losses from data breaches, cyberattacks, and other digital threats, while errors and omissions (E&O) insurance covers professional liability due to negligence, mistakes, or failure to perform services. Companies handling sensitive information or offering professional services often require both policies to mitigate distinct but overlapping risks. Explore the key differences and benefits of cyber risk insurance versus E&O insurance to safeguard your business effectively.

Why it is important

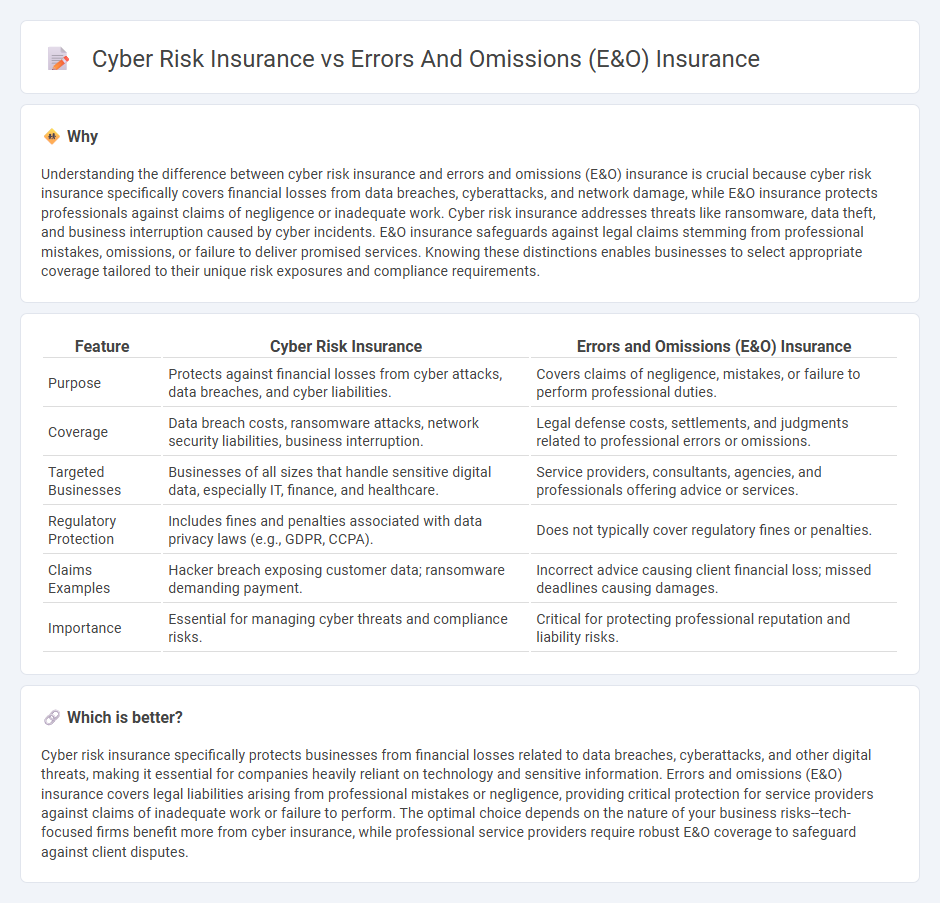

Understanding the difference between cyber risk insurance and errors and omissions (E&O) insurance is crucial because cyber risk insurance specifically covers financial losses from data breaches, cyberattacks, and network damage, while E&O insurance protects professionals against claims of negligence or inadequate work. Cyber risk insurance addresses threats like ransomware, data theft, and business interruption caused by cyber incidents. E&O insurance safeguards against legal claims stemming from professional mistakes, omissions, or failure to deliver promised services. Knowing these distinctions enables businesses to select appropriate coverage tailored to their unique risk exposures and compliance requirements.

Comparison Table

| Feature | Cyber Risk Insurance | Errors and Omissions (E&O) Insurance |

|---|---|---|

| Purpose | Protects against financial losses from cyber attacks, data breaches, and cyber liabilities. | Covers claims of negligence, mistakes, or failure to perform professional duties. |

| Coverage | Data breach costs, ransomware attacks, network security liabilities, business interruption. | Legal defense costs, settlements, and judgments related to professional errors or omissions. |

| Targeted Businesses | Businesses of all sizes that handle sensitive digital data, especially IT, finance, and healthcare. | Service providers, consultants, agencies, and professionals offering advice or services. |

| Regulatory Protection | Includes fines and penalties associated with data privacy laws (e.g., GDPR, CCPA). | Does not typically cover regulatory fines or penalties. |

| Claims Examples | Hacker breach exposing customer data; ransomware demanding payment. | Incorrect advice causing client financial loss; missed deadlines causing damages. |

| Importance | Essential for managing cyber threats and compliance risks. | Critical for protecting professional reputation and liability risks. |

Which is better?

Cyber risk insurance specifically protects businesses from financial losses related to data breaches, cyberattacks, and other digital threats, making it essential for companies heavily reliant on technology and sensitive information. Errors and omissions (E&O) insurance covers legal liabilities arising from professional mistakes or negligence, providing critical protection for service providers against claims of inadequate work or failure to perform. The optimal choice depends on the nature of your business risks--tech-focused firms benefit more from cyber insurance, while professional service providers require robust E&O coverage to safeguard against client disputes.

Connection

Cyber risk insurance and errors and omissions (E&O) insurance are interconnected as both cover financial losses arising from professional services and technology-related incidents. Cyber risk insurance protects businesses against data breaches, ransomware attacks, and other cyber threats, while E&O insurance addresses claims of negligence, mistakes, or failure to perform professional duties. Together, these policies provide comprehensive risk management for companies facing complex liabilities in the digital economy.

Key Terms

Professional Liability

Errors and omissions (E&O) insurance provides coverage for professionals against claims of negligence, mistakes, or inadequate work that result in financial loss for clients, while cyber risk insurance specifically addresses liabilities and damages related to data breaches, cyberattacks, and other cyber incidents. Both types fall under the broader category of professional liability insurance, but E&O focuses on traditional service errors, whereas cyber risk insurance targets digital threats and data protection gaps. Explore detailed policy differences and coverage specifics to determine the optimal protection for your professional risks.

Data Breach

Errors and omissions (E&O) insurance primarily covers professional negligence and mistakes that result in financial loss to clients, whereas cyber risk insurance specifically addresses the financial and reputational damage caused by data breaches and cyberattacks. Data breach coverage under cyber risk insurance includes incident response, notification costs, legal fees, and regulatory fines directly related to compromised sensitive information. Explore detailed coverage options and policy features to protect your business comprehensively against data breach risks.

Negligence

Errors and Omissions (E&O) insurance primarily covers claims related to professional negligence, including mistakes or failure to perform services that cause financial harm to clients. Cyber risk insurance, on the other hand, addresses losses stemming from cyber incidents such as data breaches, ransomware attacks, and cyber extortion, focusing less on negligence and more on third-party cyber threats. To understand the nuances and ensure comprehensive protection, explore detailed comparisons of these insurance types.

Source and External Links

Errors and Omissions Insurance (E&O) for Small Businesses | Hiscox - E&O insurance protects businesses against clients' claims of negligence, inadequate work, or mistakes in professional services, covering legal costs and settlements, but does not replace general liability or property insurance.

Errors and Omissions Insurance (E&O) - Progressive Commercial - E&O insurance covers legal fees and settlements from claims of professional mistakes, missed deadlines, or failure to deliver services, but does not cover customer injury, property damage, or employment-related claims.

Errors and Omissions (E&O) Insurance | The Hartford - E&O insurance helps businesses defend against lawsuits for negligence, errors, omissions, misrepresentation, or inaccurate advice, paying for legal fees, court costs, administrative expenses, and any required settlements or judgments.

dowidth.com

dowidth.com