Pay per mile insurance offers a cost-effective alternative to traditional car insurance by charging drivers based on the exact number of miles they drive, rather than a fixed premium. Traditional car insurance premiums are calculated using factors like age, driving history, and coverage level, often resulting in higher costs for infrequent drivers. Explore the differences between pay per mile and traditional insurance to determine the best option for your driving habits.

Why it is important

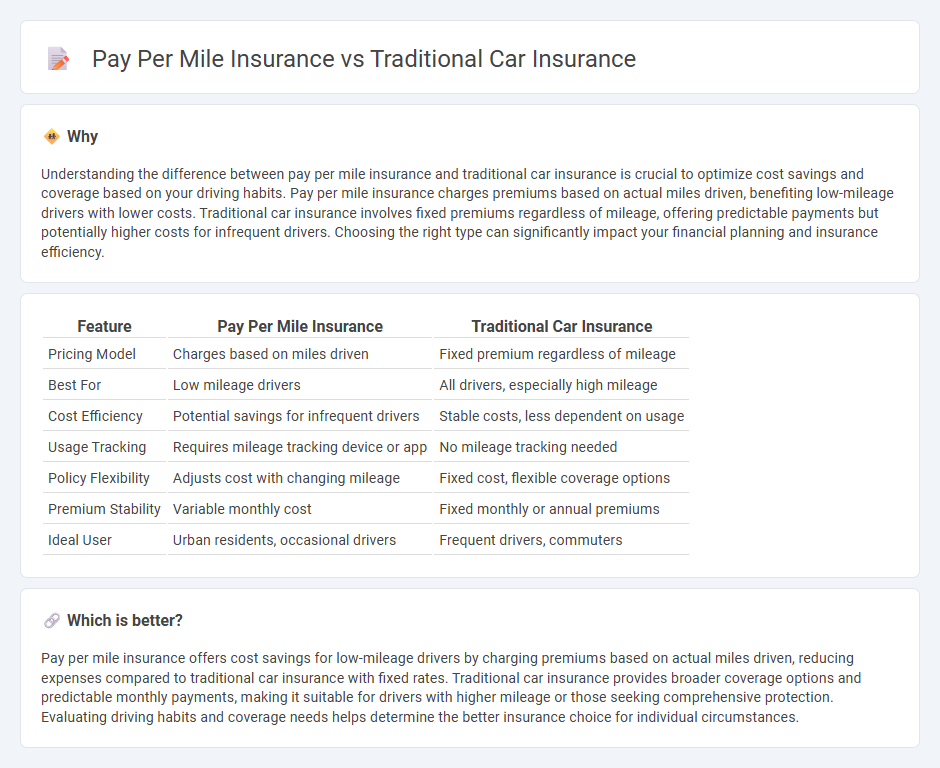

Understanding the difference between pay per mile insurance and traditional car insurance is crucial to optimize cost savings and coverage based on your driving habits. Pay per mile insurance charges premiums based on actual miles driven, benefiting low-mileage drivers with lower costs. Traditional car insurance involves fixed premiums regardless of mileage, offering predictable payments but potentially higher costs for infrequent drivers. Choosing the right type can significantly impact your financial planning and insurance efficiency.

Comparison Table

| Feature | Pay Per Mile Insurance | Traditional Car Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Fixed premium regardless of mileage |

| Best For | Low mileage drivers | All drivers, especially high mileage |

| Cost Efficiency | Potential savings for infrequent drivers | Stable costs, less dependent on usage |

| Usage Tracking | Requires mileage tracking device or app | No mileage tracking needed |

| Policy Flexibility | Adjusts cost with changing mileage | Fixed cost, flexible coverage options |

| Premium Stability | Variable monthly cost | Fixed monthly or annual premiums |

| Ideal User | Urban residents, occasional drivers | Frequent drivers, commuters |

Which is better?

Pay per mile insurance offers cost savings for low-mileage drivers by charging premiums based on actual miles driven, reducing expenses compared to traditional car insurance with fixed rates. Traditional car insurance provides broader coverage options and predictable monthly payments, making it suitable for drivers with higher mileage or those seeking comprehensive protection. Evaluating driving habits and coverage needs helps determine the better insurance choice for individual circumstances.

Connection

Pay per mile insurance and traditional car insurance both provide coverage for vehicle-related risks but differ primarily in cost structure and billing methods. Pay per mile insurance bases premiums on the actual miles driven, offering a more personalized and potentially cost-effective option for low-mileage drivers, while traditional car insurance typically charges a fixed premium based on risk factors such as age, driving history, and location. Both types aim to manage financial risk associated with driving, but pay per mile insurance introduces a usage-based model that enhances flexibility and fairness in premium calculation.

Key Terms

Premium

Traditional car insurance typically involves a fixed premium based on factors like age, location, and driving history, often resulting in higher costs for low-mileage drivers. Pay per mile insurance calculates premiums directly from the number of miles driven, offering a cost-effective option for infrequent drivers by reducing unnecessary expenses. Explore detailed comparisons to determine which insurance model best fits your driving habits and budget.

Mileage Tracking

Traditional car insurance typically uses estimated annual mileage reported at policy inception, which can lead to less accurate premiums. Pay per mile insurance relies on precise mileage tracking through telematics devices or smartphone apps, ensuring users pay specifically for the miles driven. Discover how mileage tracking technology can impact your insurance costs and coverage options.

Coverage Limits

Traditional car insurance typically offers fixed coverage limits that remain constant regardless of miles driven, providing comprehensive protection for bodily injury, property damage, and liability. Pay-per-mile insurance bases premiums on actual mileage, often allowing flexible coverage limits tailored to driving habits, potentially lowering costs for low-mileage drivers while maintaining essential protection. Explore the benefits and coverage options of both insurance types to determine the best fit for your driving needs.

Source and External Links

What Is Classic Car Insurance & How Does It Work? - Progressive - Traditional car insurance for classic cars offers agreed value coverage tailored to collectible or antique vehicles, typically including liability, comprehensive, and collision coverages suited for occasional pleasure use, shows, and tours.

Collector & Classic Car Insurance - GEICO - Classic car insurance policies provide liability, uninsured motorist, and medical coverages similar to regular auto insurance but focus on agreed value protection for collision and comprehensive coverages, often including optional spare parts coverage.

Classic & Collector Car Insurance - Nationwide - Nationwide's classic car insurance features guaranteed value coverage, lower premiums than standard policies, flexible usage for club functions and pleasure driving, and the option to choose repair shops experienced in classic vehicle repairs.

dowidth.com

dowidth.com