Cyber risk underwriting evaluates potential threats related to data breaches, ransomware, and digital asset vulnerabilities, focusing on evolving technology landscapes and regulatory compliance. Life underwriting assesses an individual's health, lifestyle, and longevity factors to determine policy eligibility and premium rates, relying heavily on medical history and biometric data. Discover more about how these distinct underwriting methodologies shape insurance products and risk management strategies.

Why it is important

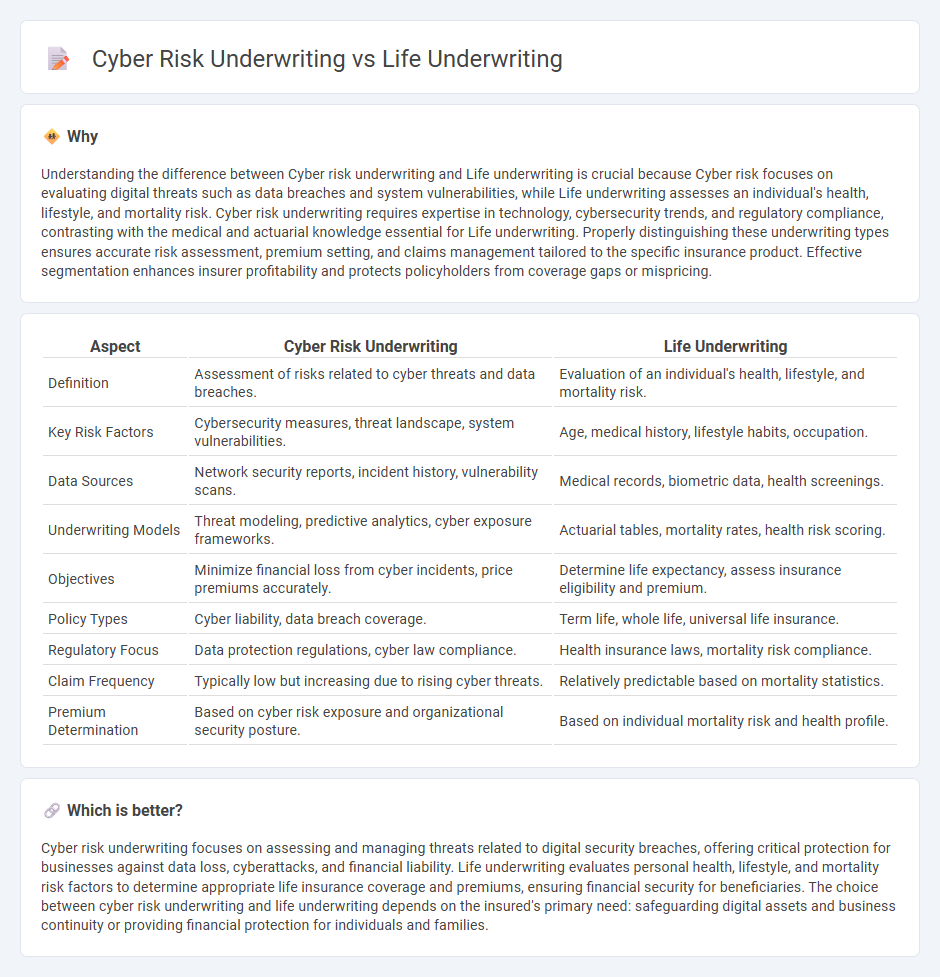

Understanding the difference between Cyber risk underwriting and Life underwriting is crucial because Cyber risk focuses on evaluating digital threats such as data breaches and system vulnerabilities, while Life underwriting assesses an individual's health, lifestyle, and mortality risk. Cyber risk underwriting requires expertise in technology, cybersecurity trends, and regulatory compliance, contrasting with the medical and actuarial knowledge essential for Life underwriting. Properly distinguishing these underwriting types ensures accurate risk assessment, premium setting, and claims management tailored to the specific insurance product. Effective segmentation enhances insurer profitability and protects policyholders from coverage gaps or mispricing.

Comparison Table

| Aspect | Cyber Risk Underwriting | Life Underwriting |

|---|---|---|

| Definition | Assessment of risks related to cyber threats and data breaches. | Evaluation of an individual's health, lifestyle, and mortality risk. |

| Key Risk Factors | Cybersecurity measures, threat landscape, system vulnerabilities. | Age, medical history, lifestyle habits, occupation. |

| Data Sources | Network security reports, incident history, vulnerability scans. | Medical records, biometric data, health screenings. |

| Underwriting Models | Threat modeling, predictive analytics, cyber exposure frameworks. | Actuarial tables, mortality rates, health risk scoring. |

| Objectives | Minimize financial loss from cyber incidents, price premiums accurately. | Determine life expectancy, assess insurance eligibility and premium. |

| Policy Types | Cyber liability, data breach coverage. | Term life, whole life, universal life insurance. |

| Regulatory Focus | Data protection regulations, cyber law compliance. | Health insurance laws, mortality risk compliance. |

| Claim Frequency | Typically low but increasing due to rising cyber threats. | Relatively predictable based on mortality statistics. |

| Premium Determination | Based on cyber risk exposure and organizational security posture. | Based on individual mortality risk and health profile. |

Which is better?

Cyber risk underwriting focuses on assessing and managing threats related to digital security breaches, offering critical protection for businesses against data loss, cyberattacks, and financial liability. Life underwriting evaluates personal health, lifestyle, and mortality risk factors to determine appropriate life insurance coverage and premiums, ensuring financial security for beneficiaries. The choice between cyber risk underwriting and life underwriting depends on the insured's primary need: safeguarding digital assets and business continuity or providing financial protection for individuals and families.

Connection

Cyber risk underwriting and life underwriting intersect through the assessment of digital vulnerabilities that can impact an individual's life security, such as identity theft and health data breaches. Both underwriting processes use data analytics to evaluate risks that affect personal safety and financial stability, integrating cyber threat intelligence with health and lifestyle information. This connection allows insurers to offer more comprehensive protection tailored to the evolving risks of the digital age.

Key Terms

**Life Underwriting:**

Life underwriting evaluates the risk factors related to an individual's health, lifestyle, and genetic predispositions to determine insurance eligibility and premiums. It relies on medical history, age, occupation, and habits such as smoking to predict mortality and morbidity outcomes accurately. Explore more about life underwriting techniques and its impact on insurance policies to gain deeper insights.

Mortality Rate

Life underwriting primarily evaluates mortality rates based on age, health conditions, lifestyle, and family medical history to determine risk and premium rates. Cyber risk underwriting assesses threats related to data breaches, ransomware, and operational disruptions but does not directly correlate with traditional mortality metrics. Explore detailed comparisons between life and cyber risk underwriting to understand their distinct approaches.

Medical Examination

Life underwriting centers on evaluating an applicant's health through detailed medical examinations, including blood tests, ECGs, and physical assessments to gauge mortality risk. Cyber risk underwriting, by contrast, does not involve medical examinations but relies on assessing an organization's cybersecurity posture, vulnerabilities, and incident history to determine risk exposure. Explore our insights to understand the nuanced differences between life and cyber risk underwriting processes.

Source and External Links

What is Life Insurance Underwriting? - Life insurance underwriting is a detailed process assessing an applicant's eligibility and determining appropriate premiums based on medical and financial factors.

What Is Underwriting and How Does It Work? - Underwriting helps life insurance companies manage risk exposure by ensuring policies are appropriately priced and matched to the applicant's risk profile.

What is underwriting - Underwriting assesses life insurance applications by evaluating medical screenings, lifestyle, and other factors to establish fair premiums based on risk.

dowidth.com

dowidth.com