Cyber risk underwriting focuses on assessing and managing potential losses from cyber threats such as data breaches, ransomware, and network disruptions, employing specialized models that analyze vulnerability and exposure in digital environments. Errors and omissions (E&O) underwriting evaluates the risks related to professional liability, covering claims arising from negligence, mistakes, or failure to perform professional duties, often requiring in-depth review of clients' past claims history and industry-specific risks. Explore the critical distinctions and strategies in these underwriting fields to optimize protection against evolving liabilities.

Why it is important

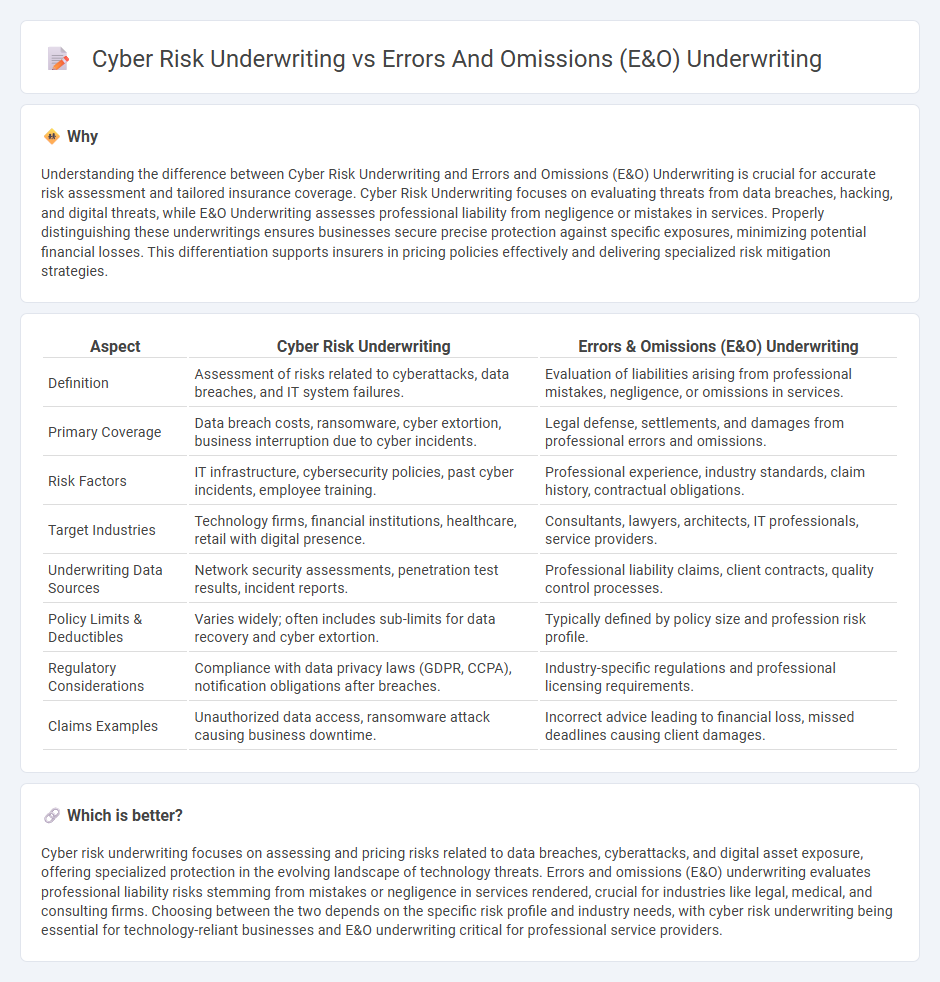

Understanding the difference between Cyber Risk Underwriting and Errors and Omissions (E&O) Underwriting is crucial for accurate risk assessment and tailored insurance coverage. Cyber Risk Underwriting focuses on evaluating threats from data breaches, hacking, and digital threats, while E&O Underwriting assesses professional liability from negligence or mistakes in services. Properly distinguishing these underwritings ensures businesses secure precise protection against specific exposures, minimizing potential financial losses. This differentiation supports insurers in pricing policies effectively and delivering specialized risk mitigation strategies.

Comparison Table

| Aspect | Cyber Risk Underwriting | Errors & Omissions (E&O) Underwriting |

|---|---|---|

| Definition | Assessment of risks related to cyberattacks, data breaches, and IT system failures. | Evaluation of liabilities arising from professional mistakes, negligence, or omissions in services. |

| Primary Coverage | Data breach costs, ransomware, cyber extortion, business interruption due to cyber incidents. | Legal defense, settlements, and damages from professional errors and omissions. |

| Risk Factors | IT infrastructure, cybersecurity policies, past cyber incidents, employee training. | Professional experience, industry standards, claim history, contractual obligations. |

| Target Industries | Technology firms, financial institutions, healthcare, retail with digital presence. | Consultants, lawyers, architects, IT professionals, service providers. |

| Underwriting Data Sources | Network security assessments, penetration test results, incident reports. | Professional liability claims, client contracts, quality control processes. |

| Policy Limits & Deductibles | Varies widely; often includes sub-limits for data recovery and cyber extortion. | Typically defined by policy size and profession risk profile. |

| Regulatory Considerations | Compliance with data privacy laws (GDPR, CCPA), notification obligations after breaches. | Industry-specific regulations and professional licensing requirements. |

| Claims Examples | Unauthorized data access, ransomware attack causing business downtime. | Incorrect advice leading to financial loss, missed deadlines causing client damages. |

Which is better?

Cyber risk underwriting focuses on assessing and pricing risks related to data breaches, cyberattacks, and digital asset exposure, offering specialized protection in the evolving landscape of technology threats. Errors and omissions (E&O) underwriting evaluates professional liability risks stemming from mistakes or negligence in services rendered, crucial for industries like legal, medical, and consulting firms. Choosing between the two depends on the specific risk profile and industry needs, with cyber risk underwriting being essential for technology-reliant businesses and E&O underwriting critical for professional service providers.

Connection

Cyber risk underwriting and Errors and Omissions (E&O) underwriting intersect through their focus on assessing liability exposure related to technology, data breaches, and professional services errors. Both underwriting processes evaluate risk factors involving data security failures, system breaches, and the financial impact of third-party claims arising from cyber incidents or professional negligence. Insurers often integrate cyber risk assessments within E&O policies to enhance coverage for technology-driven claims, reflecting the convergence of operational and cyber liability.

Key Terms

Professional Liability

Errors and omissions (E&O) underwriting primarily assesses risks related to professional services and advice, focusing on claims arising from negligence or inadequate work. Cyber risk underwriting emphasizes protection against data breaches, cyberattacks, and technology failures impacting client systems and data security. Explore the distinctions and intricacies of professional liability coverage in both underwriting fields to enhance risk management strategies.

Data Breach

Errors and omissions (E&O) underwriting primarily addresses professional liability risks related to negligent acts or omissions, while cyber risk underwriting focuses on threats like data breaches that compromise sensitive information. Data breach coverage in cyber underwriting involves assessing vulnerabilities in network security, potential exposure of personally identifiable information (PII), and regulatory compliance risks under frameworks like GDPR and CCPA. Explore detailed comparisons to understand how underwriting criteria differ between E&O and cyber risk policies for comprehensive protection.

Third-Party Claims

Errors and omissions (E&O) underwriting primarily assesses liability exposure arising from professional services failures, emphasizing claims related to negligence, mistakes, or inadequate work impacting clients. Cyber risk underwriting focuses on third-party claims linked to data breaches, privacy violations, and system intrusions that compromise sensitive information and cause financial loss or reputational damage. Discover more about the distinct risk assessments and coverage strategies in E&O and cyber insurance underwriting.

Source and External Links

Errors and Omissions Insurance (E&O) for Small Businesses | Hiscox - E&O insurance protects professionals and businesses from claims of negligence or inadequate work by covering legal costs and settlements related to such claims in providing specialized services.

What Is Errors and Omissions Coverage (E&O)? - Travelers Insurance - E&O coverage is professional liability insurance that covers legal defense and settlement costs arising from allegations of inadequate work or negligent actions in professional services.

Errors and Omissions Insurance (E&O) - Progressive Commercial - E&O insurance shields businesses from customer claims of negligence or substandard work by covering legal fees and settlements, including claims arising from incorrect advice, failure to deliver services, or missed deadlines.

dowidth.com

dowidth.com