Crop insurance protects farmers against losses caused by natural disasters, pests, or adverse weather conditions that impact agricultural yield. Credit insurance safeguards businesses from non-payment risks by covering outstanding invoices and receivables from customers. Explore the differences and benefits of each insurance type to determine the best protection for your financial security.

Why it is important

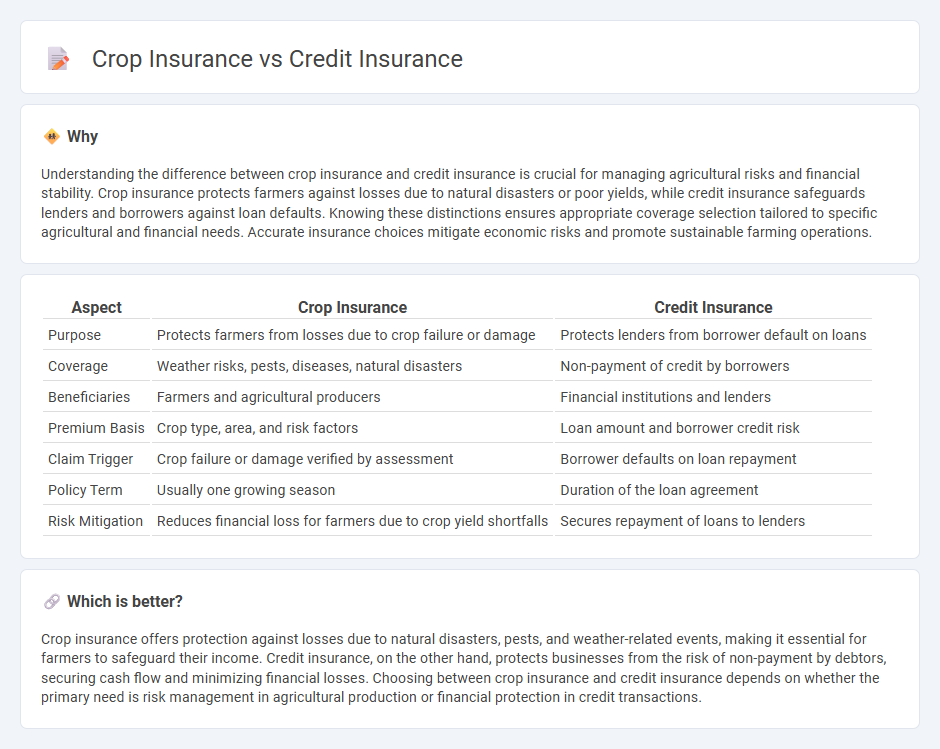

Understanding the difference between crop insurance and credit insurance is crucial for managing agricultural risks and financial stability. Crop insurance protects farmers against losses due to natural disasters or poor yields, while credit insurance safeguards lenders and borrowers against loan defaults. Knowing these distinctions ensures appropriate coverage selection tailored to specific agricultural and financial needs. Accurate insurance choices mitigate economic risks and promote sustainable farming operations.

Comparison Table

| Aspect | Crop Insurance | Credit Insurance |

|---|---|---|

| Purpose | Protects farmers from losses due to crop failure or damage | Protects lenders from borrower default on loans |

| Coverage | Weather risks, pests, diseases, natural disasters | Non-payment of credit by borrowers |

| Beneficiaries | Farmers and agricultural producers | Financial institutions and lenders |

| Premium Basis | Crop type, area, and risk factors | Loan amount and borrower credit risk |

| Claim Trigger | Crop failure or damage verified by assessment | Borrower defaults on loan repayment |

| Policy Term | Usually one growing season | Duration of the loan agreement |

| Risk Mitigation | Reduces financial loss for farmers due to crop yield shortfalls | Secures repayment of loans to lenders |

Which is better?

Crop insurance offers protection against losses due to natural disasters, pests, and weather-related events, making it essential for farmers to safeguard their income. Credit insurance, on the other hand, protects businesses from the risk of non-payment by debtors, securing cash flow and minimizing financial losses. Choosing between crop insurance and credit insurance depends on whether the primary need is risk management in agricultural production or financial protection in credit transactions.

Connection

Crop insurance and credit insurance are interconnected as both mitigate financial risks faced by farmers and agricultural lenders. Crop insurance protects farmers against losses due to natural disasters or adverse weather, ensuring crop revenue stability. Credit insurance safeguards lenders by covering loan defaults linked to agricultural production failures, creating a financial safety net within the agricultural credit ecosystem.

Key Terms

**Credit Insurance:**

Credit insurance protects businesses and lenders from losses due to borrower default, ensuring financial stability and reducing credit risk exposure. It covers trade receivables and loan repayments, providing a safety net that enhances cash flow management and supports business growth. Explore more about how credit insurance safeguards your financial transactions and mitigates risk effectively.

Default Risk

Credit insurance mitigates default risk by protecting lenders or creditors against losses from borrower non-payment, often linked to business or consumer loans. Crop insurance reduces financial risk for farmers by covering losses due to crop failure caused by natural disasters, reducing the likelihood of loan default arising from poor harvests. Explore detailed comparisons and benefits of each insurance type to understand their role in managing default risk effectively.

Policyholder

Credit insurance protects policyholders by covering losses from borrower defaults, ensuring financial stability for lenders and businesses. Crop insurance offers farmers policyholder protection against losses due to adverse weather, pests, or natural disasters, securing agricultural income. Explore more to understand how these insurance types safeguard different policyholders uniquely.

Source and External Links

credit insurance | Wex | US Law | LII / Legal Information Institute - Credit insurance is a policy purchased by a borrower to protect the lender from loss due to the borrower's insolvency, disability, death, or unemployment, and payment benefits go directly to the lender.

What Is Credit Insurance? - NerdWallet - Credit insurance is optional coverage that helps pay off loans if you die, become disabled, involuntarily unemployed, or your collateral property is damaged or stolen.

Credit insurance | Office of the Insurance Commissioner - Credit insurance protects lenders by making payments on your behalf in cases of death, disability, or job loss, but the cost may be high and you should understand the terms before purchasing.

dowidth.com

dowidth.com