Short term rental insurance covers property damage, liability, and loss of rental income specifically for homeowners renting their space temporarily, while business interruption insurance protects businesses from lost income due to unforeseen disruptions like natural disasters or equipment failures. Understanding the differences in coverage scope and claim processes is crucial for selecting the right protection based on operational risks. Explore more to determine which insurance option best safeguards your financial interests.

Why it is important

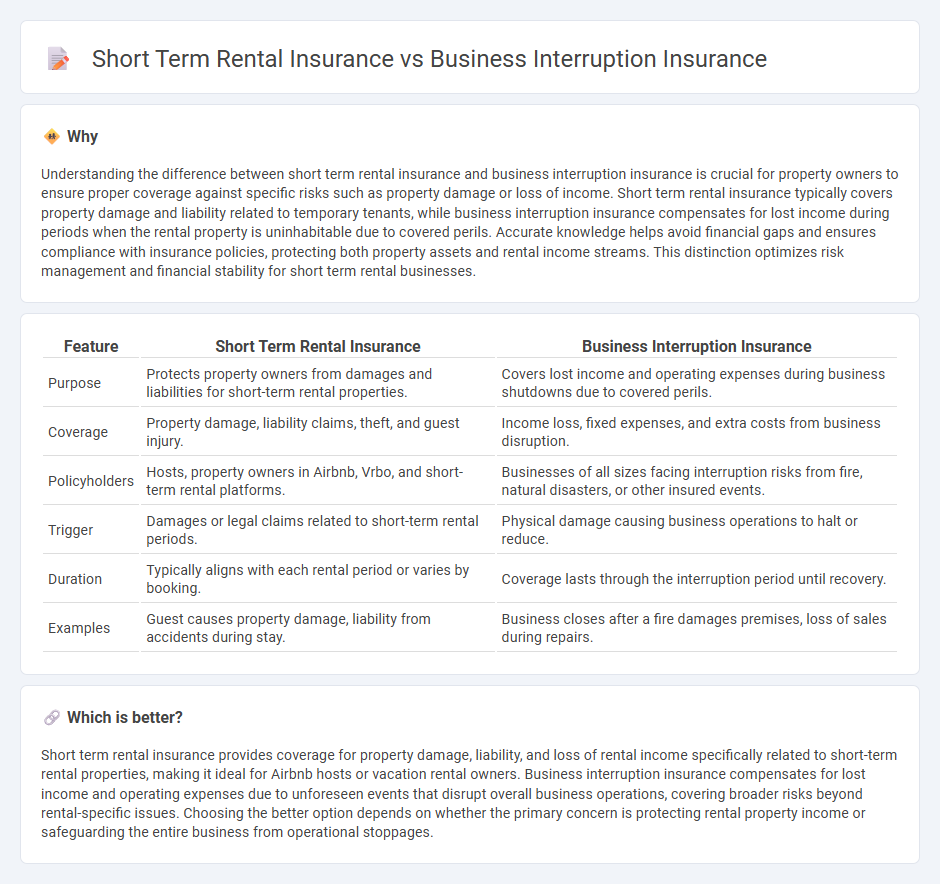

Understanding the difference between short term rental insurance and business interruption insurance is crucial for property owners to ensure proper coverage against specific risks such as property damage or loss of income. Short term rental insurance typically covers property damage and liability related to temporary tenants, while business interruption insurance compensates for lost income during periods when the rental property is uninhabitable due to covered perils. Accurate knowledge helps avoid financial gaps and ensures compliance with insurance policies, protecting both property assets and rental income streams. This distinction optimizes risk management and financial stability for short term rental businesses.

Comparison Table

| Feature | Short Term Rental Insurance | Business Interruption Insurance |

|---|---|---|

| Purpose | Protects property owners from damages and liabilities for short-term rental properties. | Covers lost income and operating expenses during business shutdowns due to covered perils. |

| Coverage | Property damage, liability claims, theft, and guest injury. | Income loss, fixed expenses, and extra costs from business disruption. |

| Policyholders | Hosts, property owners in Airbnb, Vrbo, and short-term rental platforms. | Businesses of all sizes facing interruption risks from fire, natural disasters, or other insured events. |

| Trigger | Damages or legal claims related to short-term rental periods. | Physical damage causing business operations to halt or reduce. |

| Duration | Typically aligns with each rental period or varies by booking. | Coverage lasts through the interruption period until recovery. |

| Examples | Guest causes property damage, liability from accidents during stay. | Business closes after a fire damages premises, loss of sales during repairs. |

Which is better?

Short term rental insurance provides coverage for property damage, liability, and loss of rental income specifically related to short-term rental properties, making it ideal for Airbnb hosts or vacation rental owners. Business interruption insurance compensates for lost income and operating expenses due to unforeseen events that disrupt overall business operations, covering broader risks beyond rental-specific issues. Choosing the better option depends on whether the primary concern is protecting rental property income or safeguarding the entire business from operational stoppages.

Connection

Short term rental insurance provides coverage for property damage and liability risks specific to short term rental properties, ensuring financial protection during rental periods. Business interruption insurance complements this by covering lost income and operating expenses if a covered event, such as property damage or natural disaster, disrupts rental operations. Together, they offer comprehensive risk management by protecting both the physical asset and the income stream associated with short term rentals.

Key Terms

**Business Interruption Insurance:**

Business interruption insurance provides essential coverage for income loss and operational expenses when a business is temporarily halted due to a covered event like fire, natural disasters, or equipment breakdown. Unlike short term rental insurance, which primarily protects property damage and liability for rental activities, business interruption insurance safeguards ongoing revenue streams and fixed costs such as rent and payroll. Explore how business interruption insurance can secure your financial stability during unforeseen disruptions.

Lost Income

Business interruption insurance covers lost income due to unexpected disruptions like fire or natural disasters affecting your short-term rental property's operations. Short term rental insurance typically protects against property damage and liability but may not fully compensate for income loss during vacancy periods. Explore detailed coverage options to safeguard rental income effectively.

Extra Expenses

Business interruption insurance typically covers extra expenses incurred to keep operations running during unexpected disruptions, including costs like temporary relocation or equipment rental. Short term rental insurance primarily focuses on property-related risks but may include limited coverage for extra expenses such as emergency repairs to maintain rental income continuity. Explore detailed policy comparisons to understand how each insurance type protects against extra expenses in rental businesses.

Source and External Links

How Much Does Business Interruption Insurance Cost? - Business interruption insurance covers lost income and expenses while a business is closed due to covered events like fire, vandalism, or wind damage, and is often bundled with business property insurance.

Secure Your Future: Business Interruption Insurance Explained - This coverage reimburses lost revenue and ongoing expenses (like payroll and rent) during a temporary closure caused by a covered loss, and can also pay for costs to relocate and operate from a temporary location if necessary.

Business Interruption & Business Owner Policy - Business interruption insurance helps small businesses recover from income losses due to disruptions, with optional extensions for supply chain issues (contingent business interruption) and delays in returning to normal operations after repairs (extended business interruption).

dowidth.com

dowidth.com