Buy now insurance offers immediate, comprehensive coverage for individuals seeking full-scale protection, often involving higher premiums and extensive policy terms. Microinsurance targets low-income populations with affordable, limited coverage tailored to specific risks like health, crop, or life insurance, enhancing financial inclusion. Discover how both insurance models address diverse needs by exploring their unique features and benefits.

Why it is important

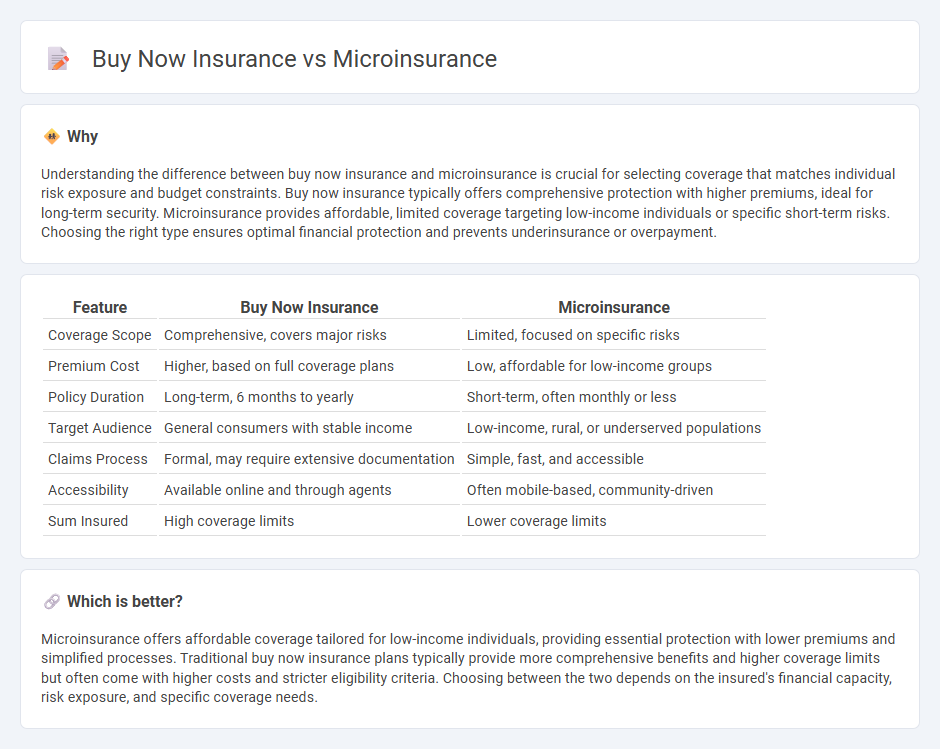

Understanding the difference between buy now insurance and microinsurance is crucial for selecting coverage that matches individual risk exposure and budget constraints. Buy now insurance typically offers comprehensive protection with higher premiums, ideal for long-term security. Microinsurance provides affordable, limited coverage targeting low-income individuals or specific short-term risks. Choosing the right type ensures optimal financial protection and prevents underinsurance or overpayment.

Comparison Table

| Feature | Buy Now Insurance | Microinsurance |

|---|---|---|

| Coverage Scope | Comprehensive, covers major risks | Limited, focused on specific risks |

| Premium Cost | Higher, based on full coverage plans | Low, affordable for low-income groups |

| Policy Duration | Long-term, 6 months to yearly | Short-term, often monthly or less |

| Target Audience | General consumers with stable income | Low-income, rural, or underserved populations |

| Claims Process | Formal, may require extensive documentation | Simple, fast, and accessible |

| Accessibility | Available online and through agents | Often mobile-based, community-driven |

| Sum Insured | High coverage limits | Lower coverage limits |

Which is better?

Microinsurance offers affordable coverage tailored for low-income individuals, providing essential protection with lower premiums and simplified processes. Traditional buy now insurance plans typically provide more comprehensive benefits and higher coverage limits but often come with higher costs and stricter eligibility criteria. Choosing between the two depends on the insured's financial capacity, risk exposure, and specific coverage needs.

Connection

Buy now insurance integrates seamlessly with microinsurance by enabling immediate, on-demand coverage through digital platforms tailored for low-income consumers. This connection enhances accessibility and affordability, leveraging real-time data analytics and mobile technology to deliver personalized microinsurance products. Such synergy transforms risk management by providing flexible, user-centric protection aligned with microinsurance principles.

Key Terms

Coverage Scope

Microinsurance offers limited coverage tailored to low-income individuals, focusing on essential risks such as health, crop failure, and property damage. Buy now insurance provides more comprehensive protection, often including broader risks and customizable policy options suitable for various asset types and durations. Discover how each insurance model fits specific needs and financial situations.

Premium Payment

Microinsurance offers affordable premium payments designed for low-income individuals, often with flexible payment schedules tailored to irregular income streams. Buy now insurance typically requires a lump-sum premium payment at the time of purchase, providing immediate coverage but less flexibility in payment frequency. Explore deeper insights into premium payment options to determine the best insurance solution for your financial needs.

Accessibility

Microinsurance offers affordable, low-premium coverage tailored to low-income populations, enhancing accessibility for individuals often excluded from traditional insurance markets. Buy now insurance provides instant, on-demand protection through digital platforms, making it convenient and accessible for tech-savvy consumers who need immediate coverage. Explore more about how these insurance models improve coverage accessibility for diverse customer needs.

Source and External Links

Microinsurance - Wikipedia - Microinsurance provides low-income people (living on $1-$4/day) with protection through affordable insurance products featuring low premiums and coverage caps, designed to cover risks like health, personal accident, or property on individual or group basis, delivered via various channels including microfinance institutions and large insurers.

Background on: microinsurance and emerging markets | III - Microinsurance targets underserved populations in developing countries by offering low-cost, high-volume insurance products often distributed with small loans or through microfinance organizations, helping protect against risks like health issues or crop/livestock loss and improving standards of living.

Microinsurance | Insurance - Microinsurance is carefully designed insurance appropriate for low-income individuals, focusing on affordability, suitable coverage, and accessible delivery, to protect vulnerable people from risks such as illness, death, and disasters, with a global reach impacting billions.

dowidth.com

dowidth.com