Short term rental insurance specifically covers risks associated with rental properties leased for brief periods, including guest-related damages and liability claims. Commercial property insurance protects physical business assets like buildings, equipment, and inventory from risks such as fire, theft, and natural disasters. Explore the key differences and coverage details to determine which insurance suits your rental or commercial property needs.

Why it is important

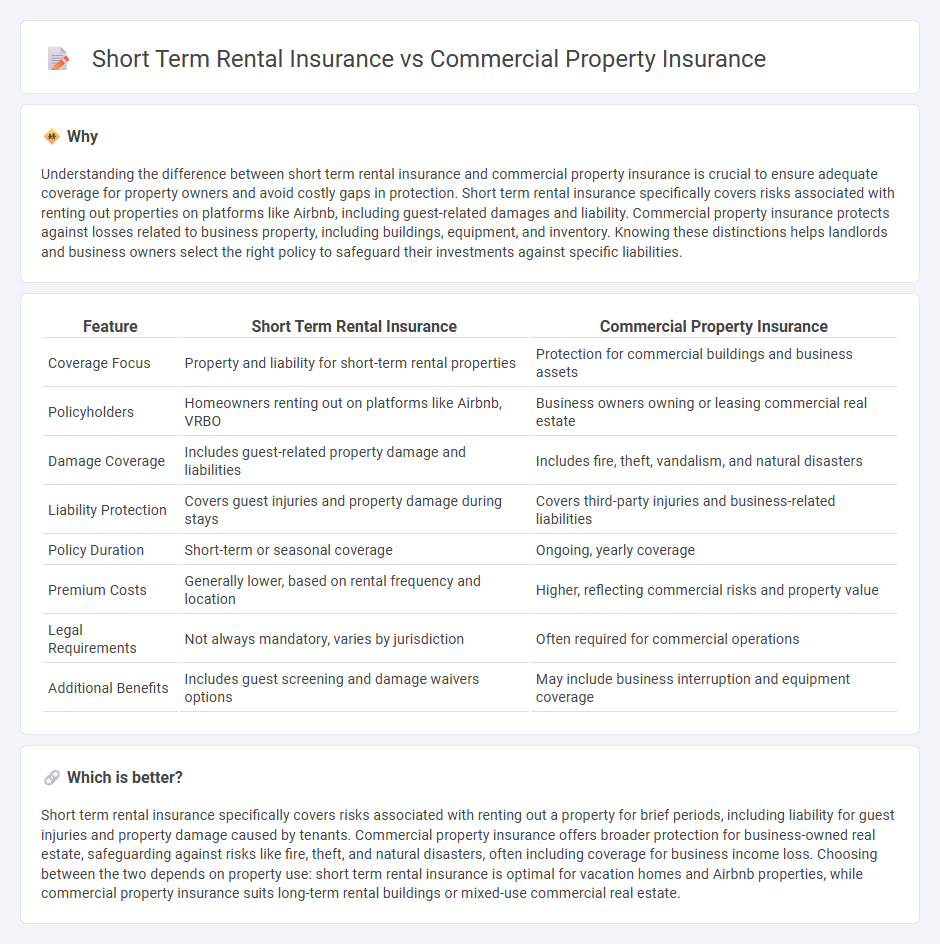

Understanding the difference between short term rental insurance and commercial property insurance is crucial to ensure adequate coverage for property owners and avoid costly gaps in protection. Short term rental insurance specifically covers risks associated with renting out properties on platforms like Airbnb, including guest-related damages and liability. Commercial property insurance protects against losses related to business property, including buildings, equipment, and inventory. Knowing these distinctions helps landlords and business owners select the right policy to safeguard their investments against specific liabilities.

Comparison Table

| Feature | Short Term Rental Insurance | Commercial Property Insurance |

|---|---|---|

| Coverage Focus | Property and liability for short-term rental properties | Protection for commercial buildings and business assets |

| Policyholders | Homeowners renting out on platforms like Airbnb, VRBO | Business owners owning or leasing commercial real estate |

| Damage Coverage | Includes guest-related property damage and liabilities | Includes fire, theft, vandalism, and natural disasters |

| Liability Protection | Covers guest injuries and property damage during stays | Covers third-party injuries and business-related liabilities |

| Policy Duration | Short-term or seasonal coverage | Ongoing, yearly coverage |

| Premium Costs | Generally lower, based on rental frequency and location | Higher, reflecting commercial risks and property value |

| Legal Requirements | Not always mandatory, varies by jurisdiction | Often required for commercial operations |

| Additional Benefits | Includes guest screening and damage waivers options | May include business interruption and equipment coverage |

Which is better?

Short term rental insurance specifically covers risks associated with renting out a property for brief periods, including liability for guest injuries and property damage caused by tenants. Commercial property insurance offers broader protection for business-owned real estate, safeguarding against risks like fire, theft, and natural disasters, often including coverage for business income loss. Choosing between the two depends on property use: short term rental insurance is optimal for vacation homes and Airbnb properties, while commercial property insurance suits long-term rental buildings or mixed-use commercial real estate.

Connection

Short term rental insurance and commercial property insurance both provide essential coverage for property owners, addressing risks related to property damage, liability, and loss of income. While short term rental insurance specifically protects rental properties used for temporary stays against guest-related damages and liabilities, commercial property insurance covers a broader range of business-owned properties, including those used for rental purposes. Property owners managing short term rentals often require both types of insurance to ensure comprehensive protection against varied risks associated with rental activities and business operations.

Key Terms

**Commercial Property Insurance:**

Commercial property insurance protects buildings and contents used for business purposes, covering risks like fire, theft, and natural disasters. It typically includes liability coverage for accidents occurring on the commercial premises, crucial for retail stores, offices, and warehouses. Explore comprehensive commercial property insurance plans to safeguard your business assets effectively.

Business Interruption Coverage

Commercial property insurance typically covers damages to the physical building and its contents, including Business Interruption Coverage that compensates for income loss during periods when the property is unusable due to insured perils. Short term rental insurance, tailored for Airbnb or vacation rental hosts, often includes Business Interruption Coverage but may have specific clauses related to guest occupancy and rental periods, potentially limiting coverage scope. Explore detailed differences to ensure your rental business maintains financial stability during unexpected disruptions.

Replacement Cost Value

Commercial property insurance typically covers replacement cost value (RCV), ensuring the policyholder receives funds to rebuild or repair the property without depreciation deductions after a covered loss. Short term rental insurance may offer varying levels of RCV coverage, often influenced by the policy terms and rental duration, sometimes paying actual cash value (ACV) instead, which factors in depreciation. Explore detailed comparisons to understand which insurance type best safeguards your investment with optimal replacement cost value coverage.

Source and External Links

What Is Commercial Property Insurance? - Nationwide - Commercial property insurance protects a company's physical assets such as buildings, contents, and exterior fixtures from risks including fire, explosions, storms, theft, and vandalism, with costs depending on factors like location, construction, and occupancy.

Commercial Property Insurance - Progressive - This insurance covers business physical assets including buildings, personal property like inventory and equipment, and can include business interruption coverage for lost revenue due to property damage.

Commercial Property Insurance - Travelers - It protects against unexpected events such as fires, windstorms, theft, and vandalism, covering buildings, office equipment, furniture, and inventory, and can help businesses recover quickly by providing financial assistance and loss prevention services.

dowidth.com

dowidth.com