Microinsurance targets low-income individuals by offering affordable, tailored coverage for risks like health, agriculture, and property. Social insurance typically involves government-mandated programs providing broad protection such as pensions, unemployment benefits, and healthcare to ensure social welfare. Explore more to understand the differences and benefits of each insurance type.

Why it is important

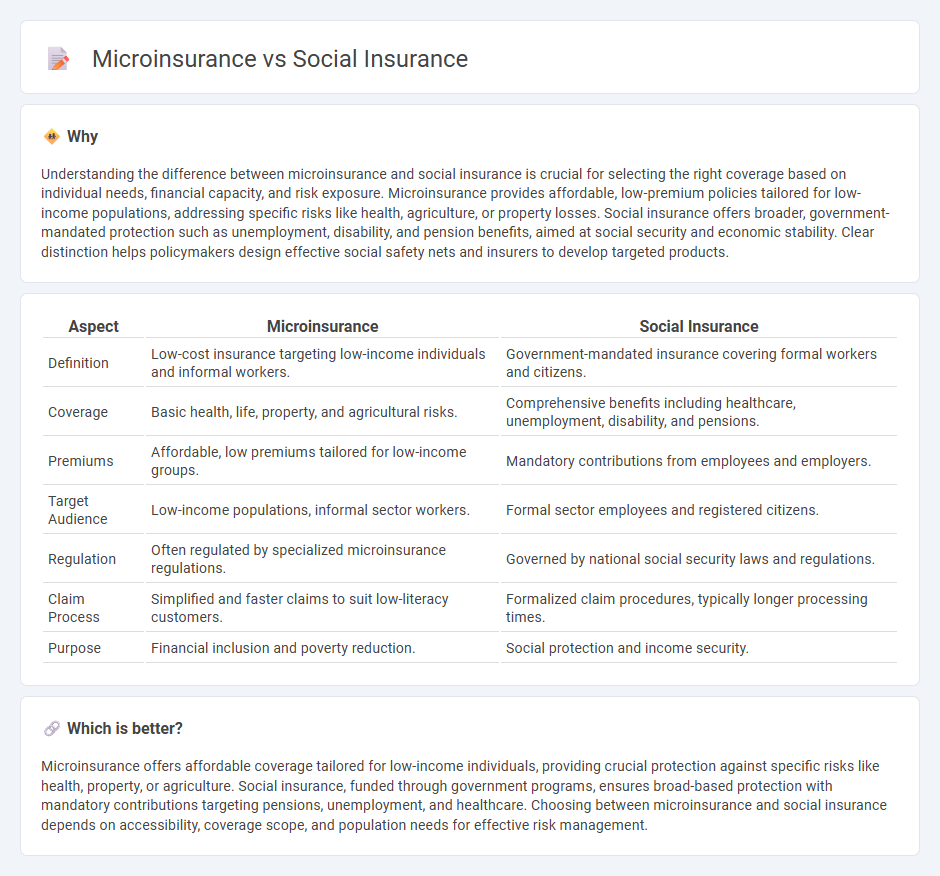

Understanding the difference between microinsurance and social insurance is crucial for selecting the right coverage based on individual needs, financial capacity, and risk exposure. Microinsurance provides affordable, low-premium policies tailored for low-income populations, addressing specific risks like health, agriculture, or property losses. Social insurance offers broader, government-mandated protection such as unemployment, disability, and pension benefits, aimed at social security and economic stability. Clear distinction helps policymakers design effective social safety nets and insurers to develop targeted products.

Comparison Table

| Aspect | Microinsurance | Social Insurance |

|---|---|---|

| Definition | Low-cost insurance targeting low-income individuals and informal workers. | Government-mandated insurance covering formal workers and citizens. |

| Coverage | Basic health, life, property, and agricultural risks. | Comprehensive benefits including healthcare, unemployment, disability, and pensions. |

| Premiums | Affordable, low premiums tailored for low-income groups. | Mandatory contributions from employees and employers. |

| Target Audience | Low-income populations, informal sector workers. | Formal sector employees and registered citizens. |

| Regulation | Often regulated by specialized microinsurance regulations. | Governed by national social security laws and regulations. |

| Claim Process | Simplified and faster claims to suit low-literacy customers. | Formalized claim procedures, typically longer processing times. |

| Purpose | Financial inclusion and poverty reduction. | Social protection and income security. |

Which is better?

Microinsurance offers affordable coverage tailored for low-income individuals, providing crucial protection against specific risks like health, property, or agriculture. Social insurance, funded through government programs, ensures broad-based protection with mandatory contributions targeting pensions, unemployment, and healthcare. Choosing between microinsurance and social insurance depends on accessibility, coverage scope, and population needs for effective risk management.

Connection

Microinsurance and social insurance both aim to provide financial protection to vulnerable populations by mitigating risks related to health, income loss, and other emergencies. Microinsurance targets low-income individuals and informal sector workers with affordable, accessible policies, while social insurance typically operates through government programs offering broader coverage and social safety nets. The connection lies in their complementary roles, where microinsurance supplements social insurance coverage gaps, enhancing overall social protection frameworks.

Key Terms

Risk pooling

Social insurance typically involves large-scale risk pooling funded by mandatory contributions from workers and employers, providing comprehensive coverage for health, unemployment, and pensions. Microinsurance targets low-income populations with smaller, affordable premiums and more tailored risk pools that address specific risks like crop failure or health emergencies. Explore how effective risk pooling in these systems can enhance financial security and resilience for diverse communities.

Coverage scope

Social insurance typically offers extensive coverage, including health, unemployment, pension, and disability benefits, designed for large populations under government schemes. Microinsurance targets low-income individuals, providing affordable, limited coverage centered on specific risks such as health emergencies, crop failure, or small property damage. Explore the nuances of these insurance models to understand which suits different socioeconomic needs.

Target population

Social insurance primarily targets formal sector employees and their dependents, offering widespread coverage through mandatory contributions linked to employment. Microinsurance focuses on low-income individuals in informal sectors who typically lack access to conventional insurance, providing affordable, tailored financial protection. Explore the distinctions further to understand the impact on vulnerable populations and insurance accessibility.

Source and External Links

Social Security Programs in the United States - Social Insurance - Social insurance in the U.S. provides income replacement due to retirement, disability, or death, covering about 96% of jobs and financed by payroll taxes through OASDI, the largest income-maintenance program.

Social insurance - Wikipedia - Social insurance is a form of social welfare that protects against economic risks by pooling contributions from individuals, with programs including Social Security, unemployment insurance, and Medicare, differing from public assistance by basing claims partly on contributions.

Social insurance | Eligibility, Types & Coverage | Britannica Money - Social insurance programs are compulsory, self-financing public programs providing protection against economic risks like old age and sickness, with benefits not strictly tied to contributions and designed to serve social purposes without means testing.

dowidth.com

dowidth.com