Earthquake microinsurance provides affordable coverage for low-income households against seismic risks, offering payouts based on predefined earthquake intensity levels. Flood microinsurance targets communities vulnerable to seasonal flooding, delivering quick financial support to help rebuild homes and livelihoods after flood events. Explore the differences and benefits of each type to protect vulnerable populations more effectively.

Why it is important

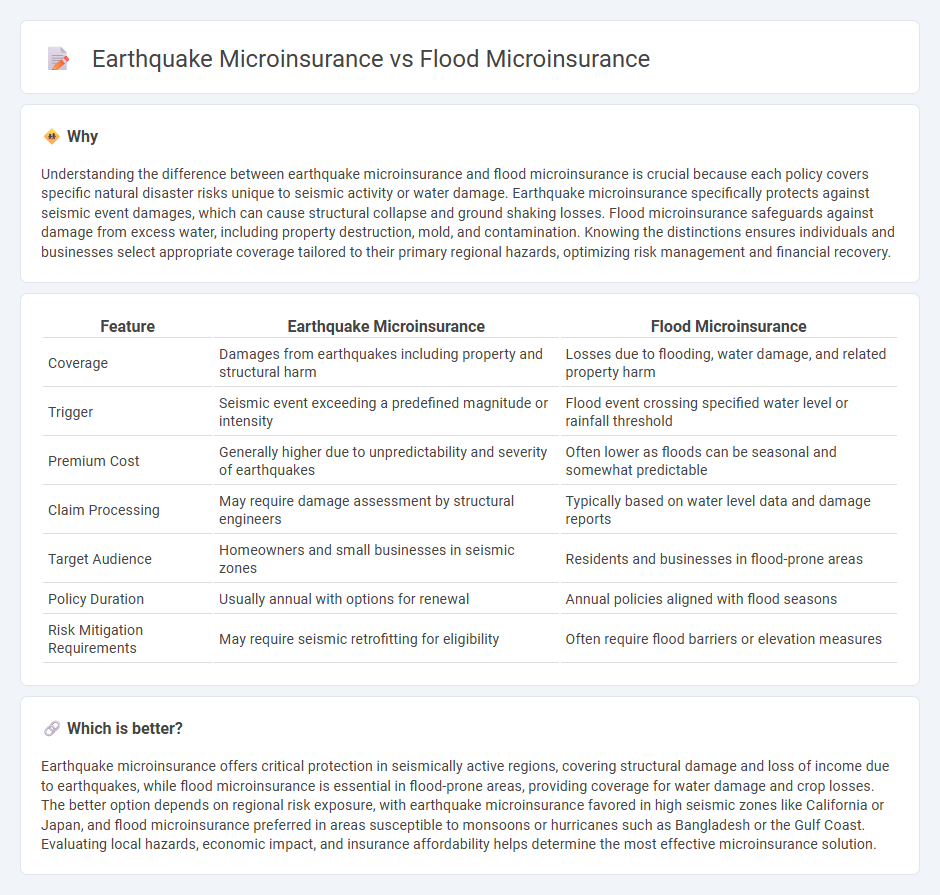

Understanding the difference between earthquake microinsurance and flood microinsurance is crucial because each policy covers specific natural disaster risks unique to seismic activity or water damage. Earthquake microinsurance specifically protects against seismic event damages, which can cause structural collapse and ground shaking losses. Flood microinsurance safeguards against damage from excess water, including property destruction, mold, and contamination. Knowing the distinctions ensures individuals and businesses select appropriate coverage tailored to their primary regional hazards, optimizing risk management and financial recovery.

Comparison Table

| Feature | Earthquake Microinsurance | Flood Microinsurance |

|---|---|---|

| Coverage | Damages from earthquakes including property and structural harm | Losses due to flooding, water damage, and related property harm |

| Trigger | Seismic event exceeding a predefined magnitude or intensity | Flood event crossing specified water level or rainfall threshold |

| Premium Cost | Generally higher due to unpredictability and severity of earthquakes | Often lower as floods can be seasonal and somewhat predictable |

| Claim Processing | May require damage assessment by structural engineers | Typically based on water level data and damage reports |

| Target Audience | Homeowners and small businesses in seismic zones | Residents and businesses in flood-prone areas |

| Policy Duration | Usually annual with options for renewal | Annual policies aligned with flood seasons |

| Risk Mitigation Requirements | May require seismic retrofitting for eligibility | Often require flood barriers or elevation measures |

Which is better?

Earthquake microinsurance offers critical protection in seismically active regions, covering structural damage and loss of income due to earthquakes, while flood microinsurance is essential in flood-prone areas, providing coverage for water damage and crop losses. The better option depends on regional risk exposure, with earthquake microinsurance favored in high seismic zones like California or Japan, and flood microinsurance preferred in areas susceptible to monsoons or hurricanes such as Bangladesh or the Gulf Coast. Evaluating local hazards, economic impact, and insurance affordability helps determine the most effective microinsurance solution.

Connection

Earthquake microinsurance and flood microinsurance both address financial risks from natural disasters, providing affordable coverage to vulnerable populations in high-risk areas. These microinsurance products often utilize similar distribution channels, including mobile platforms and local agents, to improve accessibility for low-income households. Together, they form a comprehensive risk management solution that enhances community resilience against climate-induced hazards.

Key Terms

**Flood Microinsurance:**

Flood microinsurance provides financial protection against losses caused by flooding, especially in vulnerable low-income communities prone to heavy rainfall and river overflow. Coverage typically includes property damage, crop loss, and temporary displacement, helping policyholders recover quickly without falling into debt. Discover how flood microinsurance can safeguard livelihoods and enhance resilience in flood-prone areas.

Inundation

Flood microinsurance specifically addresses risks associated with inundation caused by heavy rainfall, river overflow, or coastal storms, providing compensation for water damage to homes and assets. Earthquake microinsurance covers losses from ground shaking and structural damage but typically does not protect against flooding that occurs as a secondary effect of seismic events. Explore detailed coverage options and policy benefits to determine which microinsurance solution best suits your risk profile.

Parametric triggers

Flood microinsurance and earthquake microinsurance both utilize parametric triggers to expedite claim settlements based on predefined thresholds, such as rainfall levels for floods or seismic magnitude for earthquakes. These objective parameters enable rapid payouts without the need for extensive damage assessments, enhancing financial resilience in vulnerable communities. Explore the specifics of parametric triggers to optimize coverage for diverse natural disasters.

Source and External Links

Can Parametric Microinsurance Improve the Financial Resilience of ... - Parametric microinsurance offers affordable flood protection to lower-income households who typically cannot afford standard flood insurance, providing quick payouts based on flood severity rather than actual loss assessments, which aids timely financial recovery after floods.

ARC Ltd and Floodbase Partner to Develop Parametric Flood ... - ARC Ltd and Floodbase are developing scalable parametric flood microinsurance products for smallholder farmers in Africa that pay out swiftly when flood severity exceeds set thresholds, based on extensive flood data, helping vulnerable populations recover faster.

Introducing a Micro-Flood Insurance Market in Bangladesh - Studies in Bangladesh indicate that despite low demand due to limited incomes, commercially viable micro flood insurance markets can exist, especially with partner-agent organizational models that reduce administrative costs and facilitate long-term sustainability.

dowidth.com

dowidth.com